Iridium (IRDM) Wins $94M Contract From Space Systems Command

Iridium Communications IRDM recently signed a five-year contract with the United States Space Force's Space Systems Command's Commercial Space Office. The multi-faceted contract is for Enhanced Mobile Satellite Services (EMSS) functionalities and security sustainment services (ECS3), supporting vital U.S. government applications.

The deal is valued at nearly $94 million with a potential total value of $103 million, highlighted IRDM. The increase in potential total deal value is dependent on future surge requirements.

Through its EMSS program, Iridium aims to provide seamless global access to secure and standard narrowband voice, broadcast and push-to-talk, and adopt additional services to all U.S. Department of Defense (DoD) and DoD-approved subscribers. The company ensures that the EMSS Service Center, which connects to the IRDM network, becomes a crucial component in facilitating essential communication applications for government entities.

Building on its longstanding relationship with the DoD’s EMSS Program Office, the company has been instrumental in enhancing the security and sustainability of critical communication infrastructure for over two decades, added IRDM.

Iridium signed the deal after the successful completion of the previous contract, GMSSA, in 2019 for 4.5 years ($54 million). With a seven-year airtime services contract worth $738.5 million secured from the Defense Information Systems Agency in 2019, IRDM has reinforced its role in supporting the U.S. government's critical communications infrastructure through at least 2026.

The ECS3 contract is poised to play a pivotal role in supporting the EMSS program through 2029.

McLean, VA-based IRDM is a leading provider of mobile voice and data satellite communications network with an augmented global footprint. It partners with private, government and non-governmental organizations in the United States and beyond, catering to a robust array of industries from aviation, emergency services, mining, forestry, maritime, oil and gas to transportation and utilities.

Iridium’s rich portfolio of innovative solutions is well-received among the targeted customers.

In April 2024, it inked a five-year commercial contract with L3Harris Technologies, wherein Iridium Satellite Time and Location service will be leveraged in more than 36 L3Harris-operated communications network backbone nodes and Federal Aviation Administration facilities across the United States.

In the last reported quarter, IRDM’s earnings per share of 16 cents met the Zacks Consensus Estimate. The bottom line surged 100% year over year, owing to continued momentum in total commercial services. Also, the change in its expected satellite useful lifetimes has led to a decline in depreciation expenses compared with the prior year.

However, quarterly revenues dipped 0.7% year over year to $203.9 million due to soft equipment revenues. The top line surpassed the Zacks Consensus Estimate by 3.6%.

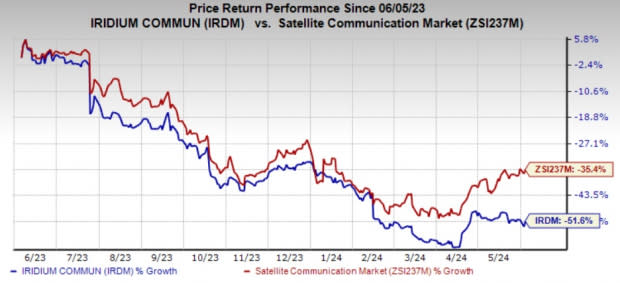

The stock plunged 51.6% in the past year compared with the sub-industry’s decline of 35.4%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Iridium currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks from the broader industry have been discussed below.

Arista Networks, Inc. ANET, sporting a Zacks Rank #1 (Strong Buy) at present, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven and data-centric approach to help customers build their cloud architecture and enhance their cloud experience. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arista has a long-term earnings growth expectation of 15.7% and delivered an earnings surprise of 15.4%, on average, in the trailing four quarters.

Motorola Solutions, Inc. MSI, carrying a Zacks Rank #2 (Buy) at present, delivered an earnings surprise of 7.5%, on average, in the trailing four quarters. It has a long-term earnings growth expectation of 9.5%.

Motorola provides services and solutions to government segments and public safety programs, along with large enterprises and wireless infrastructure service providers. It develops and services both analog and digital two-way radio, voice and data communications products and systems for private networks, wireless broadband systems and end-to-end enterprise mobility solutions to a wide range of enterprise markets.

NVIDIA Corporation NVDA, sporting a Zacks Rank #1 at present, is another key pick in the broader industry. It is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit, or GPU. Over the years, NVDA’s focus has evolved from PC graphics to AI-based solutions that now support high-performance computing, gaming and virtual reality platforms.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Iridium Communications Inc (IRDM) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance