Ionis (IONS) Q1 Loss Narrower Than Expected, Sales Miss

Ionis Pharmaceuticals IONS reported a loss of 98 cents per share for first-quarter 2024, which was narrower than the Zacks Consensus Estimate of a loss of $1.10 per share.

The bottom line includes compensation expenses related to equity awards. Excluding these special items, adjusted loss per share was 77 cents against a loss of 68 cents per share in the year-ago quarter.

Total revenues were $119 million in the first quarter, missing the Zacks Consensus Estimate of $131.5 million. Revenues declined 1.2% year over year.

Quarter in Detail

Ionis licensed Spinraza to Biogen BIIB, which is responsible for commercializing it. Spinraza is approved for treating spinal muscular atrophy, or SMA, worldwide. Ionis receives royalties from Biogen on Spinraza’s sales. Ionis and Biogen also market Qalsody (tofersen) for amyotrophic lateral sclerosis (ALS) with superoxide dismutase 1 (SOD1) mutations. Qalsody was approved in April 2023.

Ionis and AstraZeneca’s AZN Wainua (eplontersen) was approved by the FDA in December 2023 for treating patients with hereditary transthyretin-mediated amyloid polyneuropathy, commonly called hATTR-PN or ATTRv-PN. AstraZeneca and Ionis co-market Wainua for ATTRv-PN in the United States, while AstraZeneca has exclusive rights to commercialize Wainua in outside U.S. markets.

With the launch of Wainua in the United States, Ionis receives royalties from AstraZeneca, which is included in commercial revenues from the first quarter of 2024. Applications seeking approval of Wainua for ATTRv-PN are under review in the EU and Canada.

Commercial revenues were $59 million in the first quarter, down 13.2% year over year. Commercial revenues missed the Zacks Consensus Estimate of $65 million.

Commercial revenues from Spinraza royalties were $38 million, down 24% year over. Spinraza sales were hurt by the unfavorable timing of shipments in several outside U.S. markets. Spinraza royalties missed the Zacks Consensus Estimate of $48.7 million.

In the first quarter, Wainua royalty revenues were $1 million. Wainua generated sales of $5 million in the first partial quarter of the launch recorded by AstraZeneca. Other commercial revenues were $20 million compared with $18 million in the year-ago quarter.

Other commercial revenues include revenues from Tegsedi and Waylivra distribution fees and license and royalty revenues. License and royalty revenues also include royalties from Qalsody U.S. product sales.

R&D revenues declined 4.8% year over year to $60.0 million. Collaborative agreement revenues were $49 million in the quarter compared with $39 million in the year-ago quarter. Joint development revenues for Wainua from partner AstraZeneca were $11 million in the quarter compared with $24 million in the year-ago quarter.

Adjusted operating costs rose 9.2% year over year to $238 million in the quarter, mainly due to higher SG&A costs for go-to-market activities for Wainua, olezarsen and donidalorsen. R&D costs also increased in the quarter due to the timing of late-stage pipeline development activities.

2024 Guidance

Ionis maintained its financial guidance for 2024. The company expects total revenues to be more than $575 million in 2024. Revenues in subsequent quarters of 2024 are expected to be modestly higher compared to the first quarter based on anticipated regulatory milestones, license fees and R&D funding from partners.

Adjusted operating loss is expected to be less than $475 million. Adjusted operating expenses are expected to increase in the mid-single-digit range year over year in 2024.

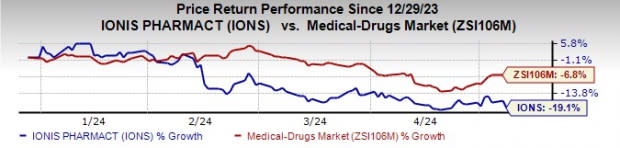

Year to date, Ionis’ shares have declined 19.1% compared with the industry’s decrease of 6.8%.

Image Source: Zacks Investment Research

Pipeline Update

Ionis has phase III studies ongoing for nine medicines (internal as well as partnered) across 11 indications.

Some of these candidates are pelacarsen for cardiovascular disease due to elevated Lp(a) levels, olezarsen for familial chylomicronemia syndrome (FCS), a rare disease and severe hypertriglyceridemia (sHTG), ulefnersen for ALS, with mutations in the fused in sarcoma gene, or FUS (FUS-ALS); donidalorsen for the prophylactic treatment of hereditary angioedema (HAE), bepirovirsen for chronic hepatitis B, IONIS-FB-LRx for IgA Nephropathy and zilganersen for Alexander’s disease.

Novartis NVS and GSK are its partners for pelacarsen and bepirovirsen, respectively. Novartis/Ionis plan to report data from pelacarsen studies and file regulatory applications for approval in 2025.

AstraZeneca and Ionis are also developing Wainua for another form of amyloidosis called cardiomyopathy caused by hereditary TTR amyloidosis (ATTR-CM), which has a larger market than ATTRv-PN. Data from the phase III CARDIO-TTRANSform study in ATTR-CM is expected in the first half of 2025.

Ionis filed a new drug application (“NDA”) seeking approval for its wholly-owned pipeline candidate, olezarsen, for the treatment of FCS in the United States in the first quarter based on results from the BALANCE study. Ionis also plans to file a regulatory application in the EU later this year. If approved, olezarsen will be Ionis’ first medicine that will be launched independently. Ionis has also completed enrollment in two of the three phase III studies for sHTG. Data from sHTG studies on olezarsen are expected in 2025.

Some of its other wholly-owned pipeline candidates are ulefnersen and donidalorsen, which are also in late-stage development. While ulefnersen is being developed for FUS-ALS, donidalorsen has been developed for HAE.

In January 2024, Ionis reported top-line results from the phase III OASIS-HAE study on donidalorsen in HAE patients. The study achieved its primary endpoint of a statistically significant reduction in the rate of HAE attacks in patients treated with the drug once every four weeks and eight weeks. Based on these results, Ionis is preparing to file an NDA for donidalorsen with the FDA. Additionally, Ionis’ partner, Otsuka, is preparing to file for marketing approval in Europe.

In March 2024, Ionis reported positive data from a mid-stage study on its candidate ION224 being developed for treating metabolic dysfunction associated steatohepatitis or MASH, also called NASH. The study met its primary and key secondary endpoints. The data, for the first time, demonstrated that targeting the DGAT2 gene to reduce hepatic fat production can improve NASH histological endpoints, including improving fibrosis.

Zacks Rank

Ionis currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ionis Pharmaceuticals, Inc. Price and Consensus

Ionis Pharmaceuticals, Inc. price-consensus-chart | Ionis Pharmaceuticals, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Novartis AG (NVS) : Free Stock Analysis Report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Ionis Pharmaceuticals, Inc. (IONS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance