Investors in Teaminvest Private Group (ASX:TIP) from three years ago are still down 33%, even after 15% gain this past week

This month, we saw the Teaminvest Private Group Limited (ASX:TIP) up an impressive 47%. But that cannot eclipse the less-than-impressive returns over the last three years. In fact, the share price is down 33% in the last three years, falling well short of the market return.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

Check out our latest analysis for Teaminvest Private Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Teaminvest Private Group moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

The modest 0.9% dividend yield is unlikely to be guiding the market view of the stock. With revenue flat over three years, it seems unlikely that the share price is reflecting the top line. We're not entirely sure why the share price is dropped, but it does seem likely investors have become less optimistic about the business.

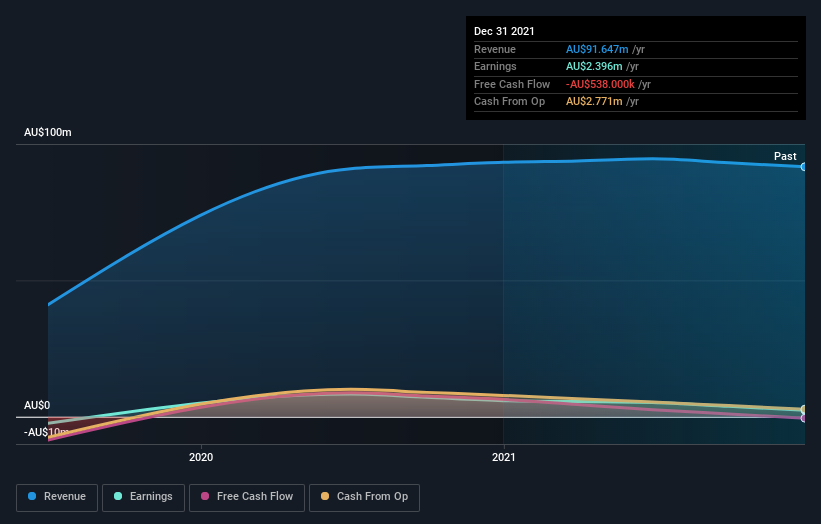

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free interactive report on Teaminvest Private Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Teaminvest Private Group shareholders are down 11% for the year (even including dividends), falling short of the market return. The market shed around 2.7%, no doubt weighing on the stock price. However, the loss over the last year isn't as bad as the 10% per annum loss investors have suffered over the last three years. We'd need clear signs of growth in the underlying business before we could muster much enthusiasm for this one. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 3 warning signs we've spotted with Teaminvest Private Group .

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance