Investors push Fiverr International (NYSE:FVRR) 3.3% lower this week, company's increasing losses might be to blame

It hasn't been the best quarter for Fiverr International Ltd. (NYSE:FVRR) shareholders, since the share price has fallen 23% in that time. But at least the stock is up over the last year. But to be blunt its return of 21% fall short of what you could have got from an index fund (around 35%).

Although Fiverr International has shed US$239m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

Check out our latest analysis for Fiverr International

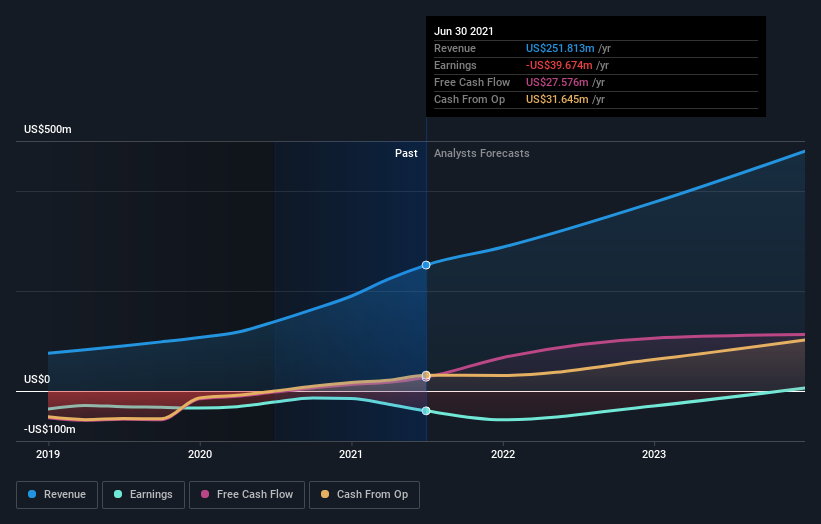

Because Fiverr International made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Fiverr International saw its revenue grow by 82%. That's a head and shoulders above most loss-making companies. To be blunt the 21% is underwhelming given the strong revenue growth. It could be that the market is missing what growth investor Matt Joass calls 'the hidden power of inflection points'. It's possible that the market is worried about the losses, or simply that the growth was already priced in. Or, this could be worth adding to your watchlist.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So it makes a lot of sense to check out what analysts think Fiverr International will earn in the future (free profit forecasts).

A Different Perspective

Fiverr International shareholders have gained 21% for the year. The bad news is that's no better than the average market return, which was roughly 35%. The stock trailed the market by 27% in that time, testament to the power of passive investing. It might be that investors are more concerned about the business lately due to some fundamental change (or else the share price simply got ahead of itself, previously). It's always interesting to track share price performance over the longer term. But to understand Fiverr International better, we need to consider many other factors. For example, we've discovered 3 warning signs for Fiverr International that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance