Property investors flock to Sydney once again

Property investors are increasingly setting their sights back on Sydney as property prices fall, making the city more palatable to home buyers.

According to a new survey by Property Investment Professionals of Australia (PIPA), the appeal of the Harbour City has nearly doubled since last year.

In 2018, only 9 per cent of investors thought Sydney had the best investment prospects, but that figure has risen to 14 per cent this year.

Related story: Housing market sprints ahead as buyers urged to get in now

Related story: Did our parents actually have it easier buying property? Expert weighs in

Related story: 600,000 Aussie households in rental stress as Rent Assistance falls behind

STRAND Property Group director Michael Ossitt said he had observed an uptick in market activity over the last few months.

“There have been more and more buyers and investors active in Sydney ever since the federal election as well as the relaxation in credit policies and drastic reduction in interest rates."

CoreLogic figures put Sydney’s median dwelling price at a much more affordable $805,424, opening the door for more investors and home buyers.

Reduced loan serviceability requirements and all-time low interest rates have also seen lenders approve more borrowers.

The Northern Beaches in particular has seen “particularly strong demand” from families and investors who want to make their move now that prices have fallen from their peak a few years ago, Ossitt said.

The number of potential buyers visiting open homes has risen as well as the number of those flocking auctions.

“All of these results, as well as a rise in auction clearance rates and asking prices, seems to suggest that Sydney’s market is heading into another upswing.

“It is still early days, of course, but strategic investors are making their move now.”

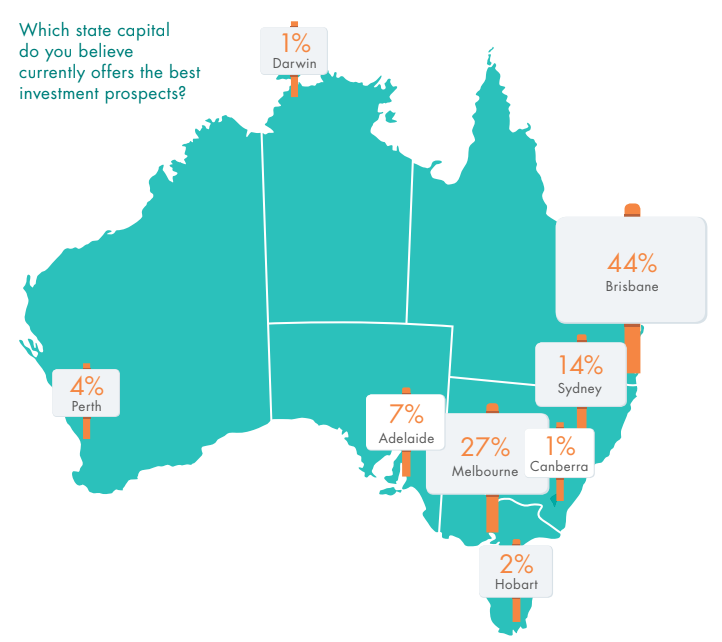

Brisbane remains the most popular choice for property investors, followed by Melbourne.

Darwin remains the least popular option for property investors, with only 0.3 per cent of investors favouring the Northern Territory capital as offering the best investment prospects, and Canberra sits in second-last place at 1 per cent.

Where should I invest in Sydney?

Speaking to Yahoo Finance, Ossitt said savvy investors wanting to snap up a good deal in Sydney probably wouldn’t find ‘bargains’ but should look in “quality areas” at “quality properties”.

“Based on the retraction from 2017 prices, investors have a great opportunity to still get a discount from then to now,” he said.

“I’d be looking at suburbs close to major lifestyle drivers.

“Even if the investor can’t afford to get into, say, Manly, suburbs around such as Fairlight, Balgowlah, Queenscliff, and Manly Vale make for great areas with low supply of new dwellings.”

For Metropole Property Strategists and Yahoo Finance property expert Michael Yardney, Cremorne and Cammeray in Sydney’s Lower North Shore are seeing strong demand yet are below 2017 peak values.

Other suburbs he earmarked were Marrickville and Dulwich Hill in the inner west, as well as Randwick, Kensington, Maroubra, Bondi and Coogee in Sydney’s east.

Realestate.com.au chief economist Nerida Conisbee tipped Seven Hills, Bateau Bay, Emu Plains, Raby and Port Kembla as offering property investors willing to explore outside of central Sydney the most bang for their buck.

Apartment buyers should look to Dee Why, Lane Cove, Newtown, Petersham, and Marsfield, she added.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance