Investors Who Bought Ramsay Health Care (ASX:RHC) Shares A Year Ago Are Now Up 11%

We believe investing is smart because history shows that stock markets go higher in the long term. But if when you choose to buy stocks, some of them will be below average performers. For example, the Ramsay Health Care Limited (ASX:RHC), share price is up over the last year, but its gain of 11% trails the market return. Having said that, the longer term returns aren't so impressive, with stock gaining just 7.9% in three years.

Check out our latest analysis for Ramsay Health Care

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last twelve months, Ramsay Health Care actually shrank its EPS by 56%.

Given the share price gain, we doubt the market is measuring progress with EPS. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

We doubt the modest 1.4% dividend yield is doing much to support the share price. Ramsay Health Care's revenue actually dropped 4.4% over last year. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

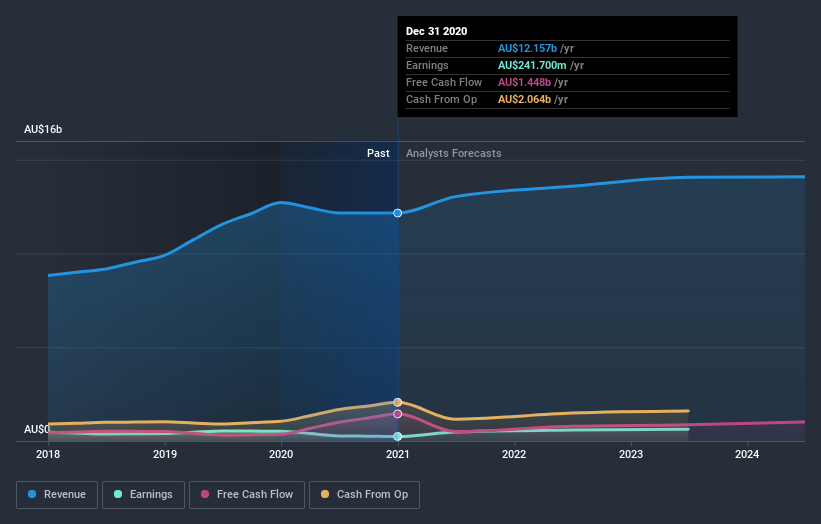

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling Ramsay Health Care stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Ramsay Health Care shareholders gained a total return of 11% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 4% over half a decade This could indicate that the company is winning over new investors, as it pursues its strategy. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Ramsay Health Care (of which 1 is concerning!) you should know about.

Ramsay Health Care is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance