Investors Who Bought Mobecom (ASX:MBM) Shares A Year Ago Are Now Down 76%

It's not a secret that every investor will make bad investments, from time to time. But it would be foolish to simply accept every extremely large loss as an inevitable part of the game. It must have been painful to be a Mobecom Limited (ASX:MBM) shareholder over the last year, since the stock price plummeted 76% in that time. While some investors are willing to stomach this sort of loss, they are usually professionals who spread their bets thinly. Mobecom hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Shareholders have had an even rougher run lately, with the share price down 59% in the last 90 days.

See our latest analysis for Mobecom

Mobecom isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, Mobecom increased its revenue by 31%. That's definitely a respectable growth rate. However, it seems like the market wanted more, since the share price is down 76%. One fear might be that the company might be losing too much money and will need to raise more. We'd posit that the future looks challenging, given the disconnect between revenue growth and the share price.

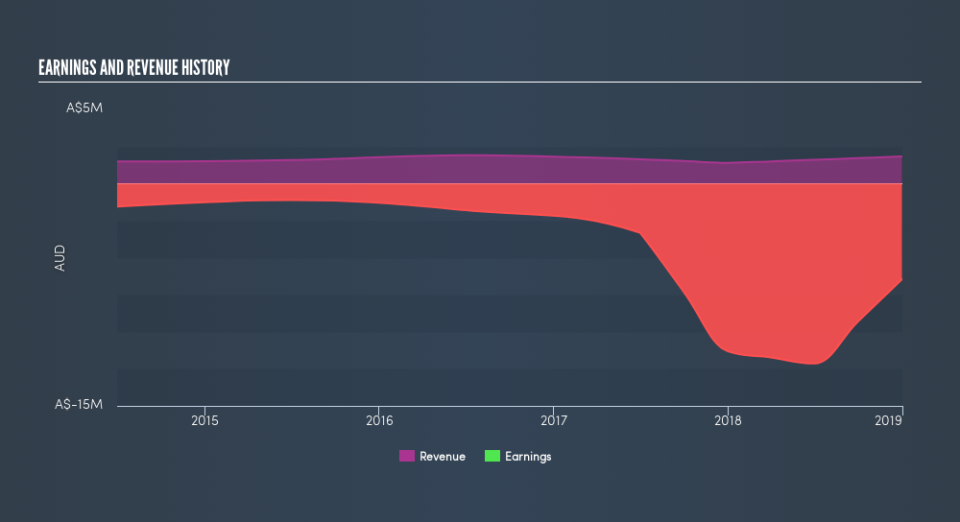

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While Mobecom shareholders are down 76% for the year, the market itself is up 13%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 59% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. You could get a better understanding of Mobecom's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: Mobecom may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance