Investors Who Bought Botanix Pharmaceuticals (ASX:BOT) Shares Three Years Ago Are Now Up 150%

Botanix Pharmaceuticals Limited (ASX:BOT) shareholders might be rather concerned because the share price has dropped 57% in the last month. In contrast, the return over three years has been impressive. In fact, the share price is up a full 150% compared to three years ago. It's not uncommon to see a share price retrace a bit, after a big gain. The fundamental business performance will ultimately dictate whether the top is in, or if this is a stellar buying opportunity.

Check out our latest analysis for Botanix Pharmaceuticals

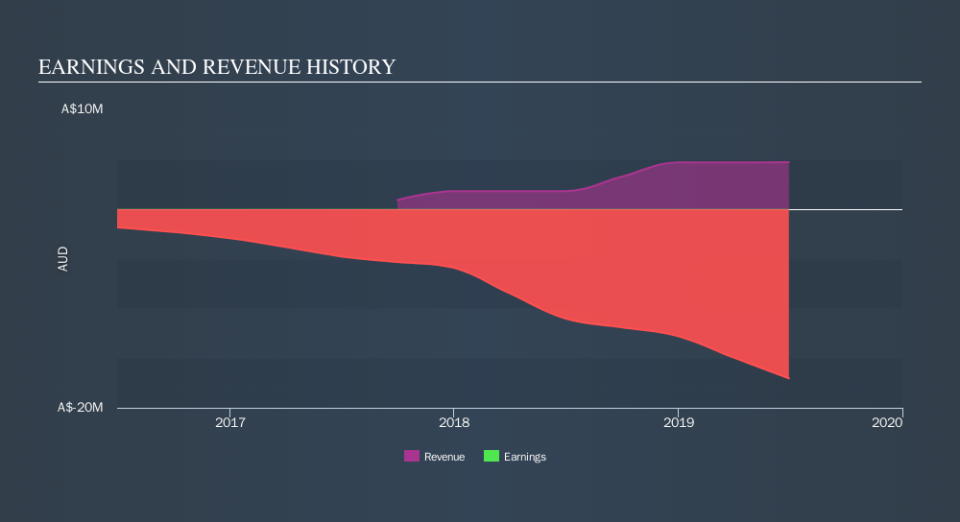

Because Botanix Pharmaceuticals is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Botanix Pharmaceuticals stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Pleasingly, Botanix Pharmaceuticals's total shareholder return last year was 35%. The TSR has been even better over three years, coming in at 36% per year. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance