Investors Who Bought 8I Holdings (ASX:8IH) Shares Three Years Ago Are Now Down 86%

8I Holdings Limited (ASX:8IH) shareholders should be happy to see the share price up 20% in the last month. But only the myopic could ignore the astounding decline over three years. Indeed, the share price is down a whopping 86% in the last three years. So it sure is nice to see a big of an improvement. Of course the real question is whether the business can sustain a turnaround.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for 8I Holdings

8I Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

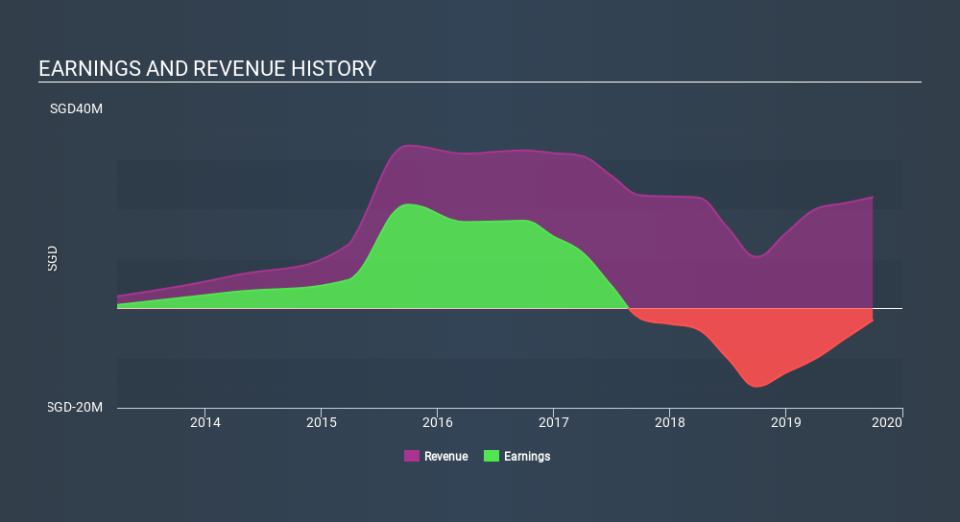

Over the last three years, 8I Holdings's revenue dropped 21% per year. That means its revenue trend is very weak compared to other loss making companies. The swift share price decline at an annual compound rate of 49%, reflects this weak fundamental performance. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. There is a good reason that investors often describe buying a sharply falling stock price as 'trying to catch a falling knife'. Think about it.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on 8I Holdings's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

8I Holdings provided a TSR of 20% over the last twelve months. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 25% per year, over five years. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for 8I Holdings (of which 1 makes us a bit uncomfortable!) you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance