Investors Should be Aware of Beyond Meat's, Inc. (NASDAQ:BYND) New 1 Billion USD Debt

This article was originally published on Simply Wall St News

Beyond Meat, Inc. (NASDAQ:BYND) recently took on more debt. For a new company, debt can be dangerous, and we need to see what this means for them going forward.

At a glance, Beyond Meat is one of the fastest growing US food companies. They produce and sell plant based food as an alternative to meat based products. They are taking on a US$1.4t industry, and sell in more than 80 countries, with their products available in 118,000 retail and food service outlets.

In this article, we will take a look at the long term debt for Beyond Meat, and what it means for shareholders.

See our latest analysis for Beyond Meat

What Is Beyond Meat's Debt?

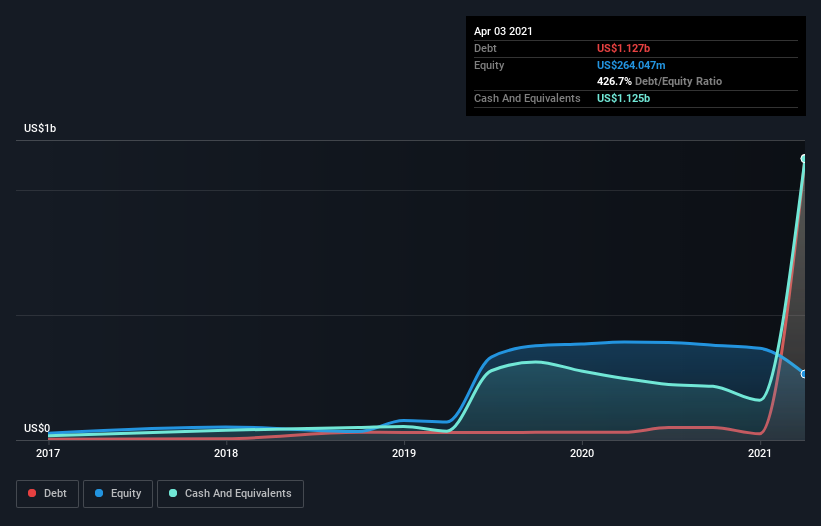

You can click the graphic below for the historical numbers, but it shows that as of April 2021 Beyond Meat had US$1.13b of debt, a large increase from over a year ago. However, it does have US$1.13b in cash offsetting this, leading to net debt of about US$1.71m.

Beyond Meat's debt is relatively new, and the company will likely use it to fund capital expenditures and growth opportunities. However, a large debt balance from a new company may set back the value of the stock for investors, and the company should make sure to be able to raise a good amount of financing both from debt and equity investors.

In researching Beyond Meat's latest quarterly report (p 32), we found that the company intends to use the remaining proceeds of the new debt for "general corporate purposes and working capital". The vagueness of intention is disheartening, but we hope the move is strategic.

This may be less than optimal, because money losing young growth companies should be careful in utilizing debt at such an early phase.

The stock has a rather large market capitalization of US$8b and the debt to market level of equity is 14.3%, however the debt to book value of equity is 426%. The close to US$1b debt is arguably small in an absolute sense, but a company with a beta of 1.62 cannot claim to have a stable enough market cap in order to justify a 14.3% debt to market equity portion.

How Healthy Is Beyond Meat's Balance Sheet?

The latest balance sheet data shows that Beyond Meat had liabilities of US$73.1m due within a year, and liabilities of US$1.14b falling due after that. Offsetting this, it had US$1.13b in cash and US$39.9m in receivables that were due within 12 months. So, it has liabilities totaling US$46.6m more than its cash and near-term receivables, combined.

Having regard to Beyond Meat's size, it seems that its liquid assets are well-balanced with its total liabilities.

It's very unlikely that the US$7.96b company is short on cash, but still worth keeping an eye on the balance sheet.

There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Beyond Meat's ability to maintain a healthy balance sheet going forward. So if you're focused on the future, you can check out this free report showing analyst profit forecasts.

Over 12 months, Beyond Meat reported revenue of US$418m, which is a gain of 17%, although it did not report any earnings before interest and tax. That rate of growth is a bit slow and has gotten slower through the last year.

Over the last twelve months, Beyond Meat produced earnings before interest and tax (EBIT) loss. Indeed, it lost US$58m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that a company should be using so much debt.

Conclusion

Beyond Meat took on an additional US$1b debt at an early phase, the move might be strategic, but it is hard to justify it with an intention of use citing "general corporate purposes and working capital".

The company has massive growth potential and is constantly partnering with global retailers and other food service venue in order to deliver growth, but shareholders should know that aggressive expansion also leave room for mistakes that might be hard to cover later on.

The company is still young and deserves a bit more breathing room even when taking bold steps. So we would not judge them on how much debt they took, but rather give them time to see what they will deliver with that move.

Every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 1 warning sign for Beyond Meat you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance