Investors in AdaptHealth (NASDAQ:AHCO) have unfortunately lost 16% over the last year

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. In contrast individual stocks will provide a wide range of possible returns, and may fall short. One such example is AdaptHealth Corp. (NASDAQ:AHCO), which saw its share price fall 16% over a year, against a market decline of 13%. However, the longer term returns haven't been so bad, with the stock down 12% in the last three years. The last month has also been disappointing, with the stock slipping a further 38%. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

See our latest analysis for AdaptHealth

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

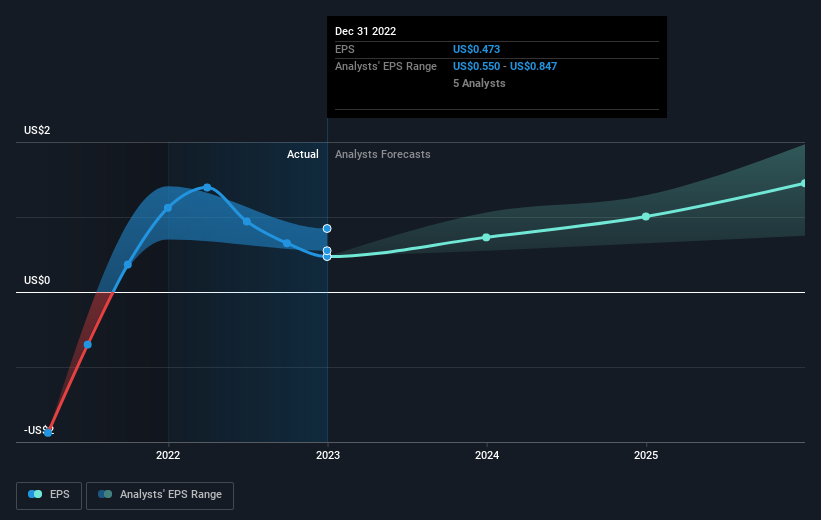

Unfortunately AdaptHealth reported an EPS drop of 58% for the last year. The share price fall of 16% isn't as bad as the reduction in earnings per share. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It is of course excellent to see how AdaptHealth has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

The last twelve months weren't great for AdaptHealth shares, which performed worse than the market, costing holders 16%. Meanwhile, the broader market slid about 13%, likely weighing on the stock. Shareholders have lost 4% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand AdaptHealth better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with AdaptHealth (including 1 which makes us a bit uncomfortable) .

Of course AdaptHealth may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance