Investing in Bougainville Copper (ASX:BOC) three years ago would have delivered you a 424% gain

Bougainville Copper Limited (ASX:BOC) shareholders have seen the share price descend 18% over the month. But that doesn't displace its brilliant performance over three years. In fact, the share price has taken off in that time, up 424%. So you might argue that the recent reduction in the share price is unremarkable in light of the longer term performance. The share price action could signify that the business itself is dramatically improved, in that time.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for Bougainville Copper

Bougainville Copper recorded just K4,058,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, investors may be hoping that Bougainville Copper finds some valuable resources, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Bougainville Copper has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

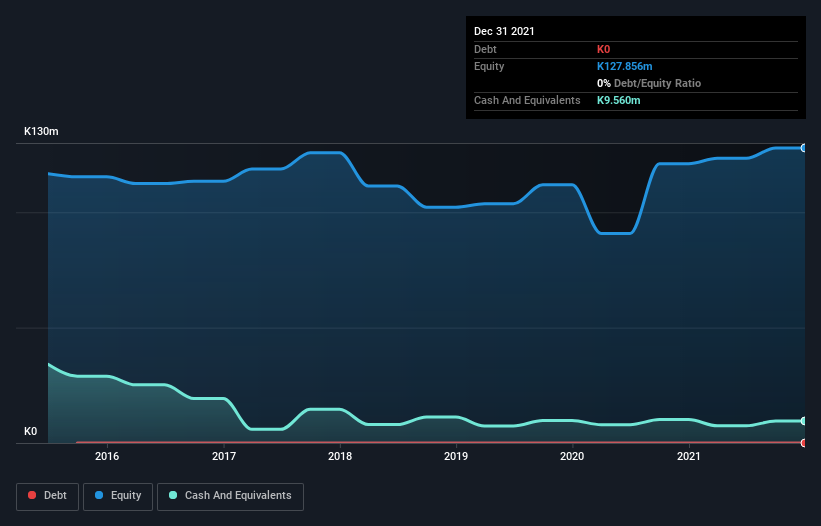

Bougainville Copper had liabilities exceeding cash by K2.3m when it last reported in December 2021, according to our data. That puts it in the highest risk category, according to our analysis. So we're surprised to see the stock up 48% per year, over 3 years , but we're happy for holders. It's clear more than a few people believe in the potential. You can see in the image below, how Bougainville Copper's cash levels have changed over time (click to see the values).

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. One thing you can do is check if company insiders are buying shares. It's usually a positive if they have, as it may indicate they see value in the stock. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

It's nice to see that Bougainville Copper shareholders have received a total shareholder return of 19% over the last year. However, the TSR over five years, coming in at 22% per year, is even more impressive. It's always interesting to track share price performance over the longer term. But to understand Bougainville Copper better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Bougainville Copper you should be aware of, and 1 of them is concerning.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance