How to Invest in Railroad Stocks

Warren Buffett was once asked what his single most favorite economic indicator was, and he chose freight car loadings -- data that's freely available from the Association of American Railroads. Buffett's choice speaks to the critical importance of the railroad sector to the economy, and to the idea that an investment in the railroad industry is a vote of confidence in the U.S. industrial economy. It's a notion that Buffett obviously shares, because he described his acquisition of railroad BNSF as a "bet on the country."

If you feel like Buffett about the North American economy (don't forget Canadian railroad stocks), and you're looking for stocks with a strong business moat, then the railroad sector might fit the bill. Here's all you need to know about investing in railroad stocks.

Image source: Getty Images.

What industries do railroads depend on?

In order to get a flavor of investing in the sector, it's a good idea to break apart the earnings of one of the leading railroads and see just how it makes money. In this way, you can better see exactly what earnings drivers of railroads are. Let's start by looking at one of the leading Eastern railroads, namely CSX and its full-year 2018 revenue breakout.

As you can see below, it's a relatively diverse revenue stream, but there are few key things to look out for.

For example, chemicals, minerals, metals & equipment, and intermodal can all largely be seen as contingent on the cyclicality of the economy. In case you are wondering, intermodal transportation simply means containers that are transported using two or more modes. So, for example, a truck delivers a container to a train and then back to a truck in another location.

In a nutshell, this means that revenue from these activities will tend to move up and down in line with the economy. In CSX's case, these cyclical activities made up around 45% of its revenue in 2018. However, it's not just the size of their revenue that matters, but also the fact that it's volatile and will, therefore, be the swing factor in the railroad's earnings.

Agriculture & food, fertilizers, and forestry products have their own specific industry dynamics, and they may or may not align with overall GDP growth. For example, agricultural activity is tied to harvesting patterns and crop prices. Meanwhile, fertilizer revenue depends on planting plans of farmers -- something also influenced by crop prices and export demand. Together these three end markets made up 21% of revenue.

Image source: Getty Images.

Revenue from automotive end markets (around 10% of 2018 revenue) is largely dependent on automotive sales and production in the U.S. -- something that tends to follow the interest rate cycle and trends in employment.

Last but definitely not least, coal contributed 18% of CSX's revenue in 2018. This is something to look out for when looking at a railroad, because the ongoing decline in usage of coal as a source of energy for electricity production is a long-term challenge for the railroad industry. As a point of reference, CSX's revenue from coal in 2013 was a whopping $2.9 billion, compared to $2.2 billion in 2018.

CSX Revenue Stream | Full-Year 2018 Volume (thousands of units) | Full-Year 2018 Revenue ($millions) | Full-Year 2018 Revenue per unit ($) |

Chemicals | 675 | $2,339 | $3,465 |

Automotive | 463 | $1,267 | $2,737 |

Agricultural & Food Products | 447 | $1,306 | $2,922 |

Minerals | 315 | $518 | $1,644 |

Forest Products | 285 | $850 | $2,982 |

Metals & Equipment | 267 | $769 | $2,880 |

Fertilizers | 248 | $442 | $1,782 |

Coal | 887 | $2,246 | $2,532 |

Intermodal | 2895 | $1,931 | $667 |

Total | 6482 | $12,250 | $1,890 |

Data source: CSX Corporation presentations.

All told, there's no way to get around it. Investing in railroads means investing in prospects for the U.S. industrial economy. However, after you've made the decision to invest in the sector, you will need to dig into the details of each particular railroad's idiosyncratic end-market exposure.

The good news is that it's relatively simple to do this because each railroad, by definition, operates within a defined geography and is its own mix of end customers.

A good way to think about this is to compare CSX's exposure to the East Coast and, say, coal from the Appalachian region to Union Pacific, which has exposure to coal in the Powder River Basin and energy assets in the Permian Basin.

Similarly, Canadian railroads like Canadian Pacific (NYSE: CP) and Canadian National Railway (NYSE: CNI) will obviously have specific exposure to Canada, while Kansas City Southern's routes in the south and its concessions in Mexico give it specific exposure to cross-border trade.

What is a railroad operating ratio?

Now that you've got a handle on what guides the top line, it's time to take a look at what feeds through into the bottom line, i.e., earnings. The key metric to follow here is a railroad's operating ratio. Simply put, this is the ratio of a railroad's operating expenses to its revenue. Since railroads would prefer lower expenses in relation to revenue, the lower the operating ratio, the more efficiently a railroad is run and the more revenue converts into earnings.

At this point, it's important to note that the key here is not so much a direct comparison between railroads, but an appreciation for the potential for a railroad to improve the ratio. If a railroad can cut its expenses over the long term, it can achieve a significant increase in earnings and cash flow, which will encourage the market to rerate the stock higher.

In order to illustrate this point, here's a table of some of the leading companies and how they reduced their operating ratio during the 2014-2018 period. It's not fair to compare railroads in completely different localities, but for reference, Union Pacific competes directly with Kansas City Southern, and Norfolk Southern competes with CSX.

There are no prizes for guessing that CSX was the best-performing stock in the 2014-2018 period with a 116% rise -- almost double the return of Kansas City Southern and Norfolk Southern.

Railroad Operating Ratio | 2018 | 2017 | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|

Union Pacific (NYSE: UNP) | 62.7% | 61.8% | 63.7% | 62.9% | 63.5% |

Kansas City Southern (NYSE: KSU) | 63.7% | 64.3% | 64.9% | 66.4% | 68.8% |

Norfolk Southern (NYSE: NSC) | 65.4% | 68.1% | 69.6% | 72.8% | 69.4% |

CSX (NASDAQ: CSX) | 60.3% | 67.4% | 69.2% | 69.3% | 71% |

Data source: Company presentations.

In a nutshell, the operating ratio counts, and investors should listen carefully to what plans a railroad's management has to improve it. But what can management actually do to accomplish this?

Is it merely a function of end-demand and the mix of volume? After all, as you can see in the CSX data above, there are significant differences in revenue per carload between materials transported. Moreover, it's easy to think of railroads as relatively easy-to-run businesses enjoying a pseudo-monopoly on the routes they run.

As we shall soon see, it's far more complicated than that. In fact, one man alone is largely responsible for creating a set of operating principles that have significantly changed the way railroading is run and reduced operating ratios in the process.

What is precision scheduled railroading?

Although Hunter Harrison died in 2017 his legacy lives on in the wide-scale adoption of precision scheduled railroading (PSR). At the heart of PSR lies a determination to make sure railroad assets are fully utilized. In order to do this, a PSR-run network would run trains between two points on a network at fixed times, with pricing adjusted to make sure cars are never idle. In a nutshell, this means prices can be lowered in order to make sure cars are utilized on a route, or raised to take advantage of demand. The key point: The schedule remains the same.

This is distinct from a so-called hub-and-spoke model, where railcars enter the hub and are then attached to other trains along the way to their final destination. In this case, schedules can vary considerably. The big advantage of PSR is that cars aren't left idle, therefore car dwell (the time a car spends at a scheduled stop without moving) is reduced and train movements are balanced -- meaning that trains and crews don't end up stacking up at one end (without cars) just because it's a more popular route.

The other big advantage of PSR is -- wait for it -- it works! Hunter Harrison was hugely successful at reducing the operating ratios of Canadian National Railway and Canadian Pacific Railway during his tenure as CEO of each company, respectively.

In addition, he took over as CEO of CSX in the spring of 2017, and although he died at the end of the year, his PSR principles are largely responsible for the dramatic reductions in CSX's operating ratio that you can see above. CSX's dramatic improvements surely influenced Union Pacific's decision to implement PSR in 2018, and Norfolk Southern and Kansas City Southern quickly followed suit.

All told, the adoption of PSR is an example of how a railroad can improve its operating ratio through self-help initiatives, and investing in railroads that implement it has turned out to be hugely successful. As such, one investing theme could be to look at the railroads stepping up implementation of PSR and how management plans to reduce the operating ratio as a consequence.

A freight train platform. Image source: Getty Images.

Key railroad metrics

Whether a railroad is PSR-led or not, it's important to keep a keen eye on the key operating metrics that indicate an improvement in performance and ultimately the operating ratio. There are two key operational metrics that railroad investors should follow.

Train velocity or speed

Terminal car dwell

These metrics can be calculated differently from railroad to railroad, so an apples-to-apples comparison can sometimes be misleading. No matter; an analysis of the ongoing metrics of each individual railroad will give a good measure of progress.

Borrowing definitions from Kansas City Southern, train velocity measures the average velocity of a train between its origin and destination and includes the time spent at intermediate locations. Since this also includes time spent changing crews and terminal car dwell (more on that later), it's a very important metric to indicate efficacy of a network. This metric should increase considerably if PSR (and other operational improvements) is working effectively to ensure cars are being utilized properly -- a faster velocity is better.

Terminal car dwell measures the average amount of time a car spends at a terminal location -- a smaller number is better, since it implies more efficient use of assets.

Examples of train velocity and terminal car dwell

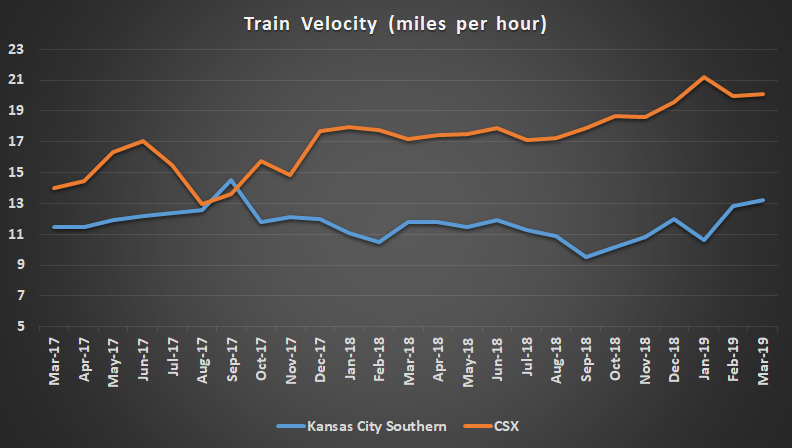

The following chart shows train velocity in the two-year period after CSX started implementing PSR, as compared with Kansas City Southern -- a railroad which only implemented PSR after the period in question -- and shows that improvements in train velocity can be generated.

Data source: Company presentations. Chart by author.

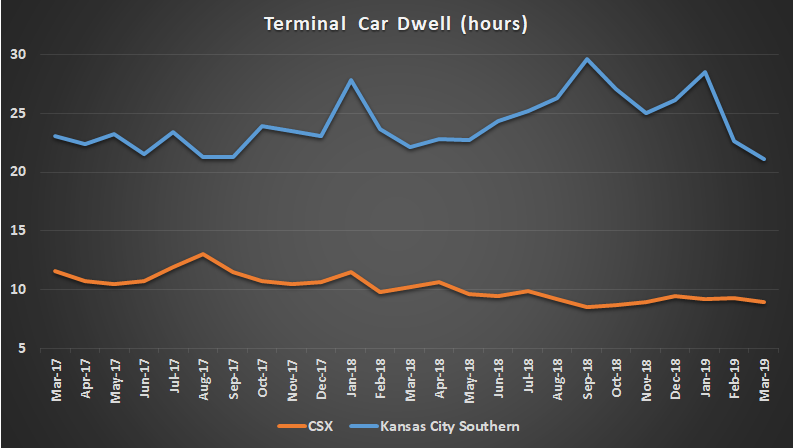

It's a similar story with terminal car dwell -- remember that a lower number is better. As you can see below, CSX made significant improvements in reducing the amount of time its cars spent at a terminal location in the two years after the implementation of PSR. Compare this with the struggles that Kansas City Southern has had in reducing terminal car dwell in the same period.

Data source: Company presentations. Chart by author.

Putting this together, it's clear that investors can look at a railroad's operational metrics -- most of which are published weekly -- in order to gauge whether its operating ratio is set to come down or not.

How PSR could hurt railroad industry suppliers

Investing in railroad stock isn't just about buying the railroads themselves; there's also a universe of suppliers like locomotive, brake, and signaling technology company Wabtec or railcar manufacturer Greenbrier Companies. However, they may face some structural problems over the long term.

Let's put it this way: If wide-scale adoption of PSR is going to make railroads more efficient, it implies relatively less demand for locomotives and railcars -- that's not good news for the companies that manufacture them. In fact, the evidence is that PSR is likely to lead to a relative decline in demand.

Focusing on CSX, in the year after the adoption of PSR, management claimed to have reduced its number of hump yards (railway yards essential for the hub-and-spoke model) from 12 to 5, reduced its workforce by 4,000 employees, and removed 1,100 locomotives and 28,000 railcars from its network.

From these figures alone, it's not a stretch to say that the successful wide-scale rollout of PSR will create challenges for locomotive and railcar technology manufacturers alike. This could be a particular concern for Wabtec, given its purchase of General Electric's transportation segment in 2019.

Clearly, taking a long-term view on railroad suppliers requires an appreciation for how PSR could change the industry and projections for long-term economic growth.

How to value railroads and other cyclical stocks

If you've decided that you are a long-term investor, are willing to ride out the cyclicality that's part of investing in railroad stocks, and you like the long-term outlook for the railroad industry, then the next bit -- often the hardest part -- is selecting an appropriate entry point into a stock.

As ever with cyclical stocks, a simple valuation-based method, such as a price-to-earnings (P/E) ratio, is rarely the right approach. This is because when economic growth is strong, railroads tend to earn significantly more money, meaning that their P/E ratios can start to look cheap. However, if the economy turns down, then earnings will suddenly fall and the P/E ratio will rise.

In a nutshell, buying a railroad on a low P/E ratio might not necessarily be a good idea. Conversely, buying a railroad on a high P/E ratio during a recession might be a good idea, provided the economy is going to turn up and take railroad earnings with it. It's the classic conundrum of buying into a cyclical stock.

One solution is to normalize the railroad's earnings to a long-term growth trend instead of just analyzing the numbers based on a cyclical trough or peak. After this, an investor could make an assumption of the long-term earnings margin over the cycle and then apply it to the normalized revenue figure.

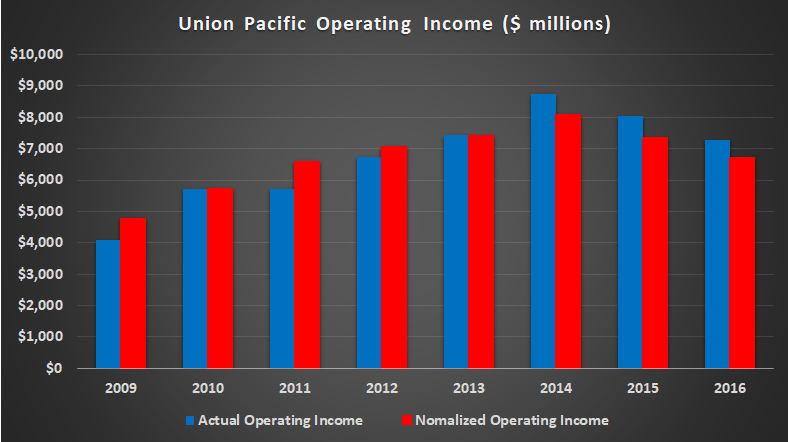

In this way, investors can approximate the current earnings based on normalized earnings, and then use the calculated earnings figure to calculate the normalized P/E ratio. An example, using Union Pacific's figures from 2009-2016 (a trough-to-trough period, therefore representing a full cycle) can be seen below.

The normalized earnings are calculated using the average operating income margin over the cycle (around 33.8%). The chart demonstrates how there are periods when actual earnings are above normalized earnings (2014-2016), which will make the stock look superficially cheap, and periods (2009-2012) where actual earnings are below normalized earnings, making it look expensive. If you dogmatically stick to only buying a stock based on an actual earning valuation, it could lead you to buy and sell at the wrong time.

Data source: Company presentations. Chart by author.

Furthermore, when projecting ahead it's important to recognize that a fall in the operating ratio (and therefore an increase in operating income margin) will lead to a significant hike in earnings projections over, say, the next 10-year cycle. In other words, any step-change in the outlook in the operating ratio should lead to a significant rerating in the stock -- even if current actual earnings don't appear to justify it.

What to know before you invest in railroads

Putting all of this together, there's a clear checklist of things you must believe/do before deciding to buy an individual railroad stock or not.

Believe in the long-term prospects for the U.S. industrial economy and have a willingness to ride out cyclicality of railroad earnings.

Assess the drivers of each railroad's end-demand drivers, and whether there is any structural issue in them or not.

Look out for management's commentary on lowering the operating ratio, particularly if it involves initiatives like PSR.

Monitor the key metrics (velocity, terminal care dwell, etc.) that contribute to a fall in the operating ratio.

Be aware of any structural changes in the industry; for example, the adoption of PSR could lead to a fall in demand for locomotives and railcars.

Time entry and exit points in the stock with an understanding of the cyclicality of earnings and potential for a fall in the operating ratio.

The list may seem daunting, but it's not a lot of work for an investment that could last a lifetime. After all, railroads are a relatively stable business in terms of market positioning. If that can be married with earnings growth due to margin expansion from operational improvement, then the sector could offer a nice mix of stability and growth for long-term investors.

More From The Motley Fool

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Canadian National Railway and Westinghouse Air Brake Technologies. The Motley Fool recommends Union Pacific. The Motley Fool has a disclosure policy.

This article was originally published on Fool.com

Yahoo Finance

Yahoo Finance