How to Invest in Defense Stocks

The defense sector is unique among U.S. industries in that the business revolves around a single customer. That customer, the U.S. government, can be finicky at times. But it also has deep pockets, and a 200-year history of paying its bills.

Catering to that customer requires a specific skill set, and over the years defense companies have faced real challenges when trying to expand their businesses into commercial realms. But it also provides a barrier to entry, as commercial companies tend to struggle when attempting to navigate the often-Byzantine government procurement process. (Just ask tech giants Microsoft, Alphabet, and Amazon.com what can happen when commercial companies invade the defense space.)

Image source: Getty Images.

Another barrier to entry is that for many projects, employee security clearance is required, which can be a long and cumbersome process for new recruits. Defense companies tend to employ most of the pre-cleared workers, giving them a substantial advantage in bidding for new work.

Clearance issues are a constant concern for defense companies. At times, industry mergers and acquisitions (M&A) have been fueled primarily by a buyer's desire to quickly add more skilled workers with clearances in order to pursue bigger contract awards.

Defense companies rely on a single customer, but that customer does have a huge appetite for their products. The fiscal 2020 Pentagon -- a term referring to the Department of Defense -- budget could come in at around $750 billion, with a substantial portion of that budget going to contractors in the form of equipment purchases, management contracts, and funding for research and development.

The United States accounts for more than 35% of total world military expenditure, according to the Stockholm International Peace Research Institute. Due to security concerns, the government tends to do most of its buying domestically.

The largest players in defense

The defense sector usually refers to all companies that generate most of their revenue from government customers, and is broadly broken down into two kinds of companies: equipment manufacturers and service providers.

The equipment companies make the tanks, warships, and fighter jets commonly associated with the Pentagon, and include well-known names like Lockheed Martin, Boeing, and Raytheon. Service providers, meanwhile, manage IT networks, do consulting work, and perform more mundane outsourcing work like base management and logistics for military and civilian agencies.

There is some overlap. General Dynamics, for example, is both a maker of tanks and warships and owns one of the industry's largest service businesses and Leidos Holdings is best known as a services giant but has been moving into autonomous warships and other areas. But for the most part companies are either known for their manufacturing prowess, or for services.

The industry is dominated by five prime contractors, so named because they are most often the ones dealing directly with the government vying for major defense contracts. The primes are Lockheed Martin, Boeing, Raytheon, General Dynamics, and Northrop Grumman, followed by a second-tier that includes Huntington Ingalls and L3Harris Technologies and smaller vendors like Kratos Defense & Security Solutions.

The services side includes Leidos, CACI International, Booz Allen Hamilton, Science Applications International, ManTech International, and Perspecta.

Company | Market Cap | Annual Revenue |

|---|---|---|

Boeing (NYSE: BA) | $210.06 billion | $101.13 billion |

Lockheed Martin (NYSE: LMT) | $101.98 billion | $53.76 billion |

Northrop Grumman (NYSE: NOC) | $54.73 billion | $30.09 billion |

General Dynamics (NYSE: GD) | $51.10 billion | $36.19 billion |

Raytheon (NYSE: RTN) | $50.42 billion | $27.06 billion |

L3Harris Technologies (NYSE: LHX) | $44 billion | $16.5 billion |

Leidos Holdings (NYSE: LDOS) | $11.36 billion | $10.19 billion |

Huntington Ingalls (NYSE: HII) | $9.32 billion | $8.17 billion |

Booz Allen Hamilton (NYSE: BAH) | $9.31 billion | $6.71 billion |

SAIC (NYSE: SAIC) | $5.12 billion | $4.66 billion |

CACI (NYSE: CACI) | $5.09 billion | $4.47 billion |

Perspecta (NYSE: PRSP) | $3.84 billion | $4.03 billion |

Mantech International (NASDAQ: MANT) | $2.57 billion | $1.96 billion |

Kratos Defense (NASDAQ: KTOS) | $2.371 billion | $618 million |

Data source: Yahoo! Finance. Data as of June 24, 2019. L3Harris numbers are proforma. Revenue is total sales, including non-defense.

Key trends in defense

The defense industry, like most manufacturing sectors, is cyclical, but defense is unique in that its ups and downs are often not based on any particular economic indicator. Rather defense companies tend to go from boom to bust or bust to boom based on the whims, and realities, of Washington.

For example, during the second half of the 1990s as much of the economy was roaring defense was undergoing a dramatic period of consolidation because the Pentagon was going through some post-Cold War belt tightening. More recently defense stocks were flat to down in the early part of the decade even as markets soared because partisan budget battles on Capitol Hill led to the introduction of budget caps that cut into government spending.

Budget battles remain the biggest headwind facing the sector today. Investors considering defense stocks today should be aware of the constant, annual risk of a new round of caps should lawmakers not find common ground with the White House.

Generally speaking, service-oriented companies tend to fare the worst in the event of a budget cap or government shutdown, as major equipment purchases and R&D are long-term funded projects while IT modernization or consulting deals are more easily pushed aside until funding is available.

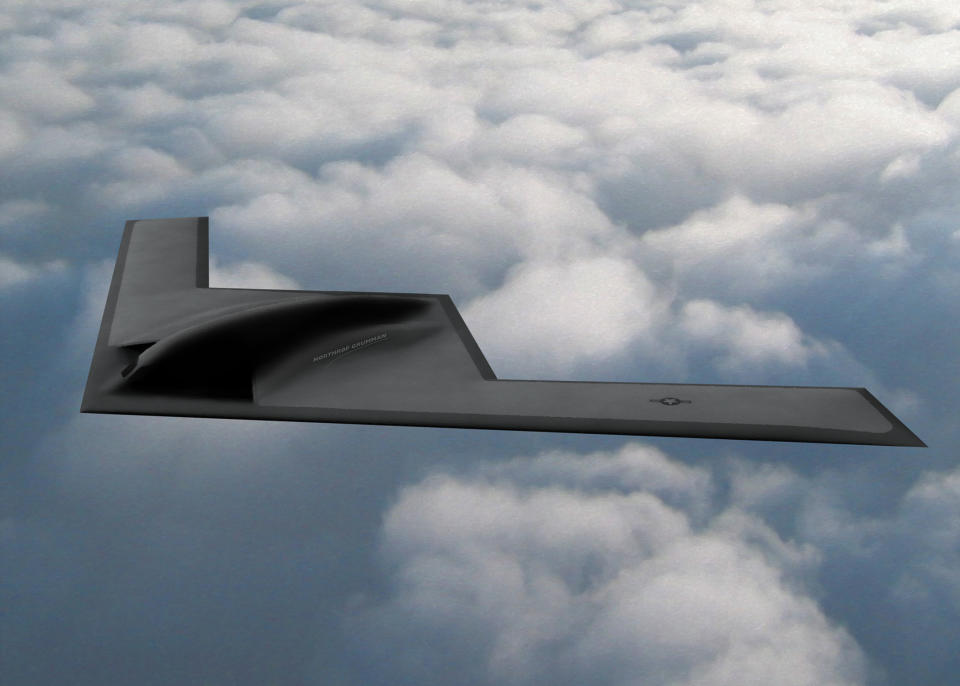

Image source: Northrop Grumman.

Investors in the sector need to monitor the annual Pentagon budgeting process, which kicks off early in the calendar year with a formal White House proposal and tends to drag through the summer as Congress conducts hearings and individual programs are evaluated. It usually takes longer than expected to get done: September 2018 marked the first time in a decade that the U.S. Congress passed a defense budget prior to the end of the government's fiscal year.

There are tailwinds that should excite investors as well. The Pentagon is in the middle of a major weapons system refresh that includes refocusing its priorities away from battling insurgents in the desert and toward major power conflicts with Russia and China. That's causing a major rethink in what equipment will be needed in the next decade, and what technologies that equipment will require, that over time is likely to create winners and losers among defense firms.

The U.S. government is also in the process of revitalizing the nuclear triad, a collection of warheads, bombers, and submarines in place since the 1960s designed to project power and act as a deterrence against a nuclear strike. Much of that equipment is aging and replacing it is considered a top national security priority, but it will be costly. The Congressional Budget Office estimates that the U.S. will have to spend $494 billion over the course of a decade to fully enact its nuclear plan.

Finally, while defense and civil agencies have hit the pause button on IT upgrades in years past headlines concerning foreign entities hacking into secure networks have made those modernization efforts a priority. Meanwhile the government is likely to increasingly embrace outsourcing as lawmakers look to fund growing entitlement programs and provide necessary services without raising taxes. That should mean steadily increasing opportunities for services firms even in a flat budget environment.

Reasons to avoid investing in defense stocks

Defense companies manufacture extremely lethal products, which are used around the globe by numerous governments for various reasons. Some might say strength is the best deterrent, and a strong arsenal is the best way to ensure safety and peace, but not every investor is going to feel comfortable betting big on this industry and its products.

That's an ethical question best left to individual investors, and to date, there is ample demand for defense shares. But if public perception were to evolve over time against defense companies similar to what happened to tobacco stocks, it could weigh on the sector and depress valuations.

Individual companies can also be subject to high-profile headline risk. There were corporate entities in the periphery of the Abu Ghraib prison scandal, for example, and a large defense firm employed Edward Snowden prior to him becoming famous (or infamous). These companies have been called before Congress to answer for project delays or accusations of overcharging, and in recent years high-ranking elected officials have attempted to renegotiate contracts via social media.

This is the rare industry that has to worry about an irate customer who has subpoena power.

There hasn't been a recent scandal that has permanently derailed a defense contractor, but it's a risk investors should keep in mind, as it could at least temporarily pressure individual stocks.

Key industry metrics

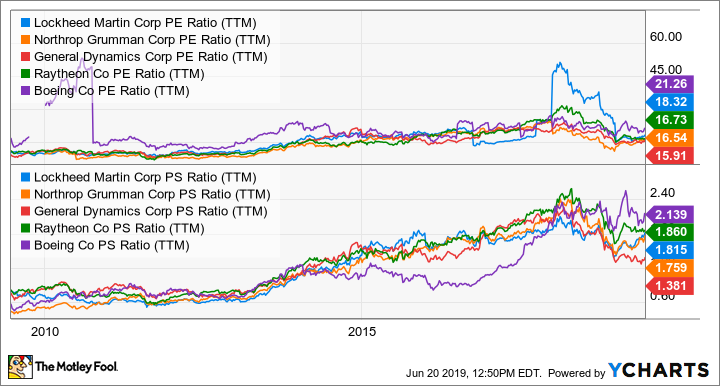

Because defense tends to be such a closed market, it can be helpful to compare defense companies to each other instead of comparing to the market at large. Evaluating which stocks are expensive and which are more affordable is an important first step toward choosing between various contractors.

Standard valuation metrics including a company's share price relative to earnings, or P/E ratio, and a share price relative to sales, or P/S ratio, are good comparison tools, though investors need to take the extra step and evaluate why a stock is more expensive or cheaper than its peers. Dividend yield, a company's total annual payout relative to its share price, is also a relevant measure as most of the largest companies pay a healthy dividend.

In defense, valuation metrics have trended higher in recent years along with the overall Pentagon budget, and the government's push to invest in modernization, so at the time of this writing, most of the industry seems expensive compared to a few years ago. But if the Pentagon budget is able to grow in the coming years, there are opportunities for the companies to grow into lofty valuations.

Defense prime valuation metrics. Data by YCharts.

As orders surge, investors should also track free cash flow as a gauge of a company's earnings power and momentum. And book-to-bill ratios, a measure comparing orders received in a given quarter compared to the amount billed during the same period, can provide insight into a company's future.

Finally, given many of these large procurement contracts span multiple years and include milestone payments investors should pay close attention to corporate backlogs, or future sales that have been awarded, and how much of that backlog is definitely funded by Congress and how much of it still needs to go through the budget approval process. The companies typically make that information available on quarterly earnings reports or conference calls.

Four top defense stocks to buy now

Given the industry's reliance on the U.S. government, the stocks tend to largely move in the same direction over long periods of time based on the outlook for federal spending. To pick outperformers, investors need to look for companies that have the potential for stronger-than-average growth, usually because their offerings match up to Pentagon priorities.

There can also be occasions where a particular stock is depressed because of issues that appear temporary in nature, creating buying opportunities. Here's a snapshot at a handful of top companies, including two traditional contractors with predictable businesses and two less traditional contractors with the potential to outpace the competition.

There are detailed reasons why some defense stocks are likely to perform better for investors than others. Here's a brief rundown of some top companies.

Company | Business Highlights |

|---|---|

Lockheed Martin | Fighter jets, missiles and missile defense, helicopters, hypersonics |

General Dynamics | Ships, submarines, ground vehicles, IT, business jets |

Leidos Holdings | IT network management, electronics and consulting, autonomous vessels |

Kratos Defense & Security | Drones, defense electronics |

Data source: Company information.

Lockheed Martin is the world's largest pure-play defense contractor, and the company has been winning more than its fair share of work in all of the areas where it competes. The company is responsible for the F-35 Joint Strike Fighter, the most expensive weapons platform in history.

In the past the criticism around Lockheed Martin was that it was a one-hit wonder, overly exposed to the difficult teething process of trying to get the new fighter airborne. But Lockheed in recent years has shown the diversity of its product line, proving itself to be a top winner in missiles and missile defense, space, software, and helicopters.

Lockheed has the industry's most complete portfolio, and most of its area of strengths are also key Pentagon priorities. The compounding effect of being strong in areas where the customer is committed to spending should serve Lockheed shareholders for years to come.

General Dynamics, on the other hand, has been a consistent laggard. The reason for the underperformance is its commercial unit, Gulfstream business jets, which has not yet recovered from the Great Recession. As an industry, business jet sales are still not yet back to 2007 levels.

At long last, business jet sales are beginning to show signs of life, spurred in part by an aging corporate fleet and also by changes in U.S. tax law. Gulfstream has a new line of products to sell into a recovery. It will take time for that business to hit the bottom line, as margins on new products tend to improve over time as development costs are paid down, but Gulfstream should be a major contributor to profit improvements heading into the new decade.

A General Dynamics-made Gulfstream G650. Image source: General Dynamics.

General Dynamics defense business has also struggled with profitability due to the early nature of some of its biggest programs, including the Navy's Columbia-class ballistic submarine. That's a short-term problem that will turn into a strength as all of the company's relatively recent orders turn into revenue and profits.

This is a company that has underperformed its peers due to issues that over time should resolve themselves. As they do, the valuation gap should close and investors should benefit.

Leidos Holdings is on the services side of the industry, and benefits from being the largest player in a business where scale is of the utmost importance. Leidos' size allows it to bid for larger, more complex projects requiring thousands of workers with special clearances, and to spread its costs around a wider base to profitably bid low for key business.

There is no sign of a slowdown for service companies as far as the eye can see, as the government's campaign to modernize its IT infrastructure was put on hold during the mid-decade budget battles. Given the growing importance of cybersecurity, plus the need to catch up for lost time when the modernization effort was sidelined, Leidos appears to be best positioned in an area poised for growth.

Finally, Kratos is a higher-risk, higher-potential reward stock. The company is smaller than the other companies on this list, and its business has been much less consistent through the years. But the company is finally finding its own with its emerging drone program, including a Valkyrie aircraft undergoing tests with the Air Force that could one day fly into battle alongside crewed aircraft to provide added firepower or to overwhelm enemy anti-aircraft defenses.

Kratos' XQ-58A Valkyrie drone. Image source: Kratos.

Kratos over the years has traded more like a tech stock than a staid defense stock and could experience continued volatility in the years to come. But its key businesses are maturing quarter by quarter, and the stock is looking like less of a gamble. For those able to handle a wild ride, Kratos could be an enticing opportunity.

Opportunities and risks to defense investing

In the 1990s, I was involved in venture capital and tech investing in Northern Virginia, which was an emerging tech hotbed -- in no small part thanks to the intellectual firepower brought to the region by the defense sector. There was a natural tension between old economy and new, with upstarts and dot-coms eager to separate themselves from stodgy government contractors.

By the end of the decade, after the dot-com bubble had crashed, many of the rare survivors among those upstarts were pivoting toward government work instead of shying away from it, drawn to a customer still able to pay its bill amid the private sector carnage. Some of those start-ups were eventually merged into the government services giants still at work today.

That was a long time ago, but the story still seems an apt description of the defense industry. For the most part, defense companies won't provide the glamor or the eye-watering gains possible from biotech or from Silicon Valley. The government, though a prolific spender, does its best to ensure reasonable profits for the industry to make sure the defense base remains healthy but eschews sky-high profit margins.

What these companies can offer investors is a nice, predictable income stream and the ability to sleep well at night knowing the business supporting that income is at no risk of drying up overnight. On many of the government's largest procurement projects, things like aircraft carriers, bombers, fighter jets, and nuclear submarines, there is a spending plan that extends well into the next decade and is unlikely to be derailed. Few industries can offer a similar revenue road map.

The key is to pick the right companies among the defense contractors, seeking stocks that are either undervalued due to temporary factors or are well positioned to outperform in the years to come. The United States enjoys the world's most powerful and sophisticated arsenal. Investors can profit off the spending that makes that arsenal possible.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool's board of directors. Lou Whiteman owns shares of General Dynamics, L3Harris, and Perspecta Inc. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Amazon, and Microsoft. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance