Invesco (IVZ) Q4 Earnings & Revenues Beat, AUM Balance Down

Invesco’s IVZ fourth-quarter 2022 adjusted earnings of 39 cents per share surpassed the Zacks Consensus Estimate of 36 cents. The bottom line, however, plunged 54.7% from the prior-year quarter. Our estimate for earnings was 33 cents.

Results benefited from a decline in operating expenses. On the other hand, lower assets under management (AUM) balance and long-term outflows hurt revenues.

On a GAAP basis, net income attributable to common shareholders was $187.8 million or 41 cents per share, down from $426.8 million or 92 cents per share a year ago.

In 2022, adjusted earnings per share of $1.68 beat the consensus estimate by a penny but declined 45.6% year over year. Our estimate for earnings was $1.62. Net income attributable to common shareholders (GAAP) was $683.9 million or $1.49 per share, down from $1.39 billion or $2.99 per share in 2021.

Revenues & Expenses Decline

Adjusted quarterly net revenues were $1.11 billion, falling 19.3% year over year. The top line, however, outpaced the Zacks Consensus Estimate of $1.06 billion. Our estimate for net revenues was $1.05 billion.

In 2022, adjusted net revenues declined 11.7% from 2021 to $4.65 billion. The top line also lagged the consensus estimate of $5.13 billion. Our estimate for net revenues was $4.59 billion.

Adjusted operating expenses were $769.2 million, down 3.4% year over year.

The adjusted operating margin was 30.6%, down from 42% a year ago.

AUM Balance Falls

As of Dec 31, 2022, AUM was $1.41 trillion, which declined 12.5% year over year. Average AUM at the fourth-quarter end totaled $1.39 trillion, down 12.1%.

The company witnessed long-term net outflows of $3.2 billion in the quarter.

Balance Sheet Strong

As of Dec 31, 2022, cash and cash equivalents were $1.23 billion compared with $1.90 billion as of Dec 31, 2021.

Long-term debt amounted to $1.49 billion. The credit facility balance was nil as of Dec 31, 2022.

Our View

Invesco remains well-poised to benefit from its global footprint, product offerings and strategic buyouts. However, elevated expenses, a challenging market environment and high debt levels are major near-term concerns.

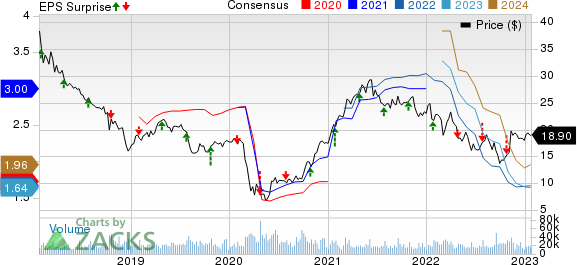

Invesco Ltd. Price, Consensus and EPS Surprise

Invesco Ltd. price-consensus-eps-surprise-chart | Invesco Ltd. Quote

Currently, IVZ carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance & Earnings Date of Other Asset Managers

BlackRock, Inc.’s BLK fourth-quarter 2022 adjusted earnings of $8.93 per share surpassed the Zacks Consensus Estimate of $7.99. The figure reflects a decrease of 16.4% from the year-ago quarter.

The quarterly results benefited from a decline in expenses. However, lower revenues and assets under management (AUM) balance were the major headwinds for BLK.

Ameriprise Financial, Inc. AMP is slated to report fourth-quarter 2022 results on Jan 25.

Over the past 30 days, the Zacks Consensus Estimate for AMP’s quarterly earnings has moved marginally lower to $6.35. Nonetheless, it indicates a 3.3% rise from the prior-year quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

Ameriprise Financial, Inc. (AMP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance