Intuit (INTU) Introduces QuickBooks Small Business Index

Intuit INTU unveiled a powerful monthly indicator of employment and hiring among small businesses in Canada, the United States and the U.K., called Intuit QuickBooks Small Business Index.

Developed under Intuit QuickBooks’ collaboration with an international team of economists led by Professor Ufuk Akcigit, the Arnold C. Harberger Professor of Economics at the University of Chicago, the Intuit QuickBooks Small Business Index utilizes purpose-built economic models to normalize anonymized QuickBooks Online Payroll customer records against official government statistics. This represents the general population of small businesses in Canada, the United States and the U.K.

Region wise, in Canada, the Intuit Index shows the number of people employed by small businesses with 1-19 employees in the previous month while for the United States, it shows that same with 1-9 employees in the previous month. In the U.K., the Index shows the number of job vacancies at small businesses with 1-9 employees in the previous month. In all the three regions, the Index captures any change in the number compared with the previous month using statistical methods.

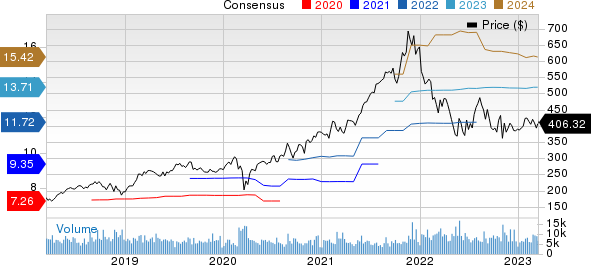

Intuit Inc. Price and Consensus

Intuit Inc. price-consensus-chart | Intuit Inc. Quote

In Canada, the data insights from the newly released Intuit Index are available at national, regional and sector levels, and are based on a total sample of almost 66,000 businesses. In the United States, the data insights are available at national, regional, state and sector levels, and are based on a total sample of almost 333,000 businesses. In the U.K., the data insights are available at the national (the U.K.), country (England, Wales, Scotland, Northern Ireland) and sector levels, and are based on a total sample of almost 25,000 businesses. The data insights are seasonally adjusted to limit the effect of seasonal employment and hiring patterns throughout the year.

The Intuit QuickBooks Small Business Index will get published several days before the release of Statistics Canada's Labour Force Survey and around two weeks before the Office for National Statistics’ monthly Vacancy Survey is released in the U.K. In the United States, its data insights are available up to nine months earlier than equivalent official statistics, delivering an enhanced small business employment snapshot of the region.

With the latest release, Intuit intends to accelerate growth of small businesses and its success rates across Canada, the United States and the U.K. region. The Index is likely to serve as a decision-making tool for economists, policymakers and small businesses, providing them insights related to the number of small businesses, their employability and growth status across the regions.

INTU is benefiting from strong momentum in online ecosystem revenues and solid professional tax revenues. The company’s strategy of shifting its business to cloud-based subscription model will help it generate stable revenues over the long run.

In January, the company increased the availability of its QuickBooks Business Network solution among millions of small- and mid-market businesses in the United States. This is to enable eligible QuickBooks Online customers based in the United States to easily connect with each other in the business-to-business (B2B) network to accelerate B2B payments, leverage automation for simplification and streamlining administrative tasks, and get access to better collaboration and connection possibilities.

In December 2022, the company entered an agreement to acquire financial health startup SeedFi. This will enable Intuit to accelerate and upscale its Credit Karma business members’ financial progress through SeedFi’s Credit Builder technology.

Nevertheless, macroeconomic and geopolitical headwinds might significantly hurt small business operations, thereby posing risks for Intuit’s top-line growth in the near term. Higher costs and expenses due to increased investments in marketing and engineering teams are likely to continue impacting the bottom line in the near term.

Zacks Rank & Key Picks

Intuit currently carries a Zacks Rank #3 (Hold). Shares of INTU have lost 11.2% in the past year.

Some better-ranked stocks from the broader Computer and Technology sector are Airbnb ABNB, Baidu BIDU and Fabrinet FN. While Airbnb currently sports a Zacks Rank #1 (Strong Buy), Baidu and Fabrinet have Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Airbnb’s first-quarter 2023 earnings has been revised northward from breakeven to 14 cents per share over the past 30 days. For 2023, earnings estimates have moved up 52 cents to $3.38 in the past 30 days.

ABNB's earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 57.2%. Shares of the company have declined 27% in the past year.

The Zacks Consensus Estimate for Baidu’s first-quarter 2023 earnings has been revised 17 cents northward to $2.60 per share over the past 30 days. For 2023, earnings estimates have fallen 0.8% to $11.53 per share over the past 30 days.

BIDU’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 45.5%. Shares of the company have decreased 11.7% in the past year.

The Zacks Consensus Estimate for Fabrinet's third-quarter fiscal 2023 earnings has been revised upward by 7 cents to $1.90 per share over the past 30 days. For fiscal 2023, earnings estimates have moved north by 24 cents to $7.71 in the past 30 days.

FN’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, missing once, the average surprise being 5.1%. Shares of the company have jumped 10.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

Intuit Inc. (INTU) : Free Stock Analysis Report

Fabrinet (FN) : Free Stock Analysis Report

Airbnb, Inc. (ABNB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance