Introducing Tremont Mortgage Trust (NASDAQ:TRMT), The Stock That Slid 67% In The Last Year

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Investing in stocks comes with the risk that the share price will fall. And unfortunately for Tremont Mortgage Trust (NASDAQ:TRMT) shareholders, the stock is a lot lower today than it was a year ago. The share price has slid 67% in that time. Tremont Mortgage Trust may have better days ahead, of course; we've only looked at a one year period. The falls have accelerated recently, with the share price down 53% in the last three months.

View our latest analysis for Tremont Mortgage Trust

Tremont Mortgage Trust isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

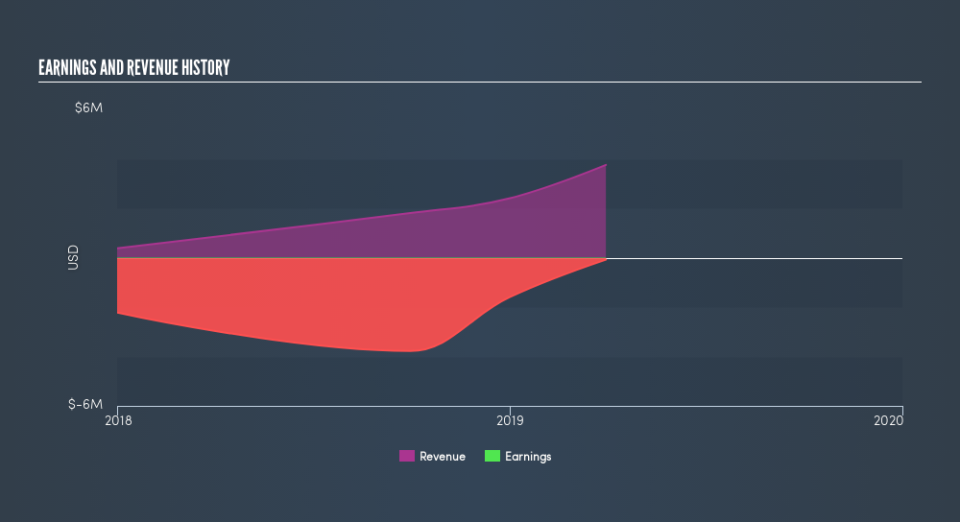

In the last year Tremont Mortgage Trust saw its revenue grow by 341%. That's well above most other pre-profit companies. Meanwhile, the share price slid 67%. Typically a growth stock like this will be volatile, with some shareholders concerned about the red ink on the bottom line (that is, the losses). We'd definitely consider it a positive if the company is trending towards profitability. If you can see that happening, then perhaps consider adding this stock to your watchlist.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on Tremont Mortgage Trust

A Different Perspective

Given that the market gained 4.6% in the last year, Tremont Mortgage Trust shareholders might be miffed that they lost 66% (even including dividends). While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 53%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. If you would like to research Tremont Mortgage Trust in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance