Introducing European Lithium (ASX:EUR), The Stock That Slid 56% In The Last Year

European Lithium Limited (ASX:EUR) shareholders should be happy to see the share price up 15% in the last month. But that's small comfort given the dismal price performance over the last year. During that time the share price has sank like a stone, descending 56%. It's not that amazing to see a bounce after a drop like that. It may be that the fall was an overreaction.

Check out our latest analysis for European Lithium

With just AU$114,240 worth of revenue in twelve months, we don't think the market considers European Lithium to have proven its business plan. You have to wonder why venture capitalists aren't funding it. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). For example, investors may be hoping that European Lithium finds some valuable resources, before it runs out of money.

We think companies that have neither significant revenues nor profits are pretty high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some European Lithium investors have already had a taste of the bitterness stocks like this can leave in the mouth.

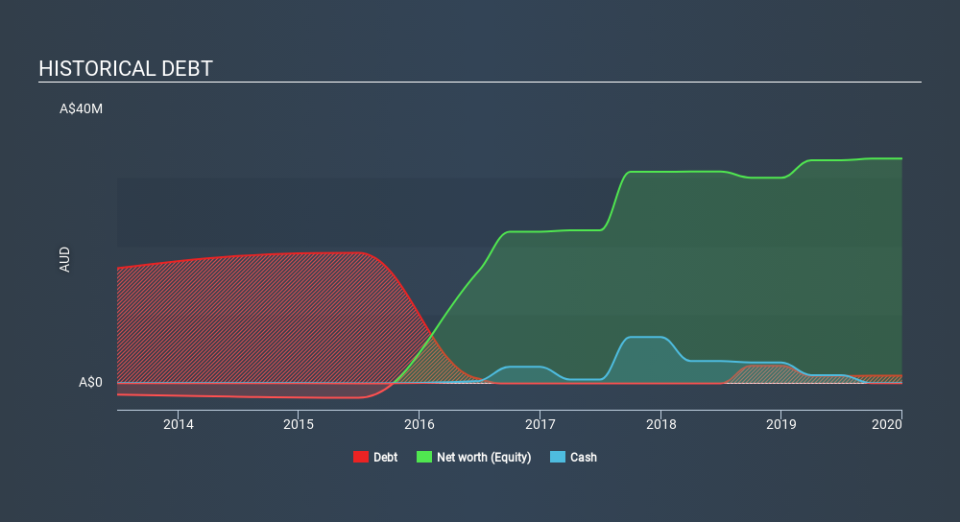

European Lithium had liabilities exceeding cash by AU$2.7m when it last reported in December 2019, according to our data. That makes it extremely high risk, in our view. But since the share price has dived -56% in the last year , it looks like some investors think it's time to abandon ship, so to speak. You can see in the image below, how European Lithium's cash levels have changed over time (click to see the values).

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Would it bother you if insiders were selling the stock? I would feel more nervous about the company if that were so. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

The last twelve months weren't great for European Lithium shares, which performed worse than the market, costing holders 56%. The market shed around 14%, no doubt weighing on the stock price. The three-year loss of 3.4% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. It's always interesting to track share price performance over the longer term. But to understand European Lithium better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with European Lithium (at least 2 which are concerning) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance