Interpublic (IPG) to Report Q4 Earnings: What's in the Offing?

The Interpublic Group of Companies, Inc. IPG is scheduled to report fourth-quarter 2022 results on Feb 9, before the opening bell.

Let's check out how things have shaped up for the announcement.

What to Expect This Time Around

Favorable impacts of organic net revenues, led by broad-based growth across regions, client sectors and operating units, are likely to have aided Interpublic’s top line in the fourth quarter of 2022. The Zacks Consensus Estimate is pegged at $2.56 billion, indicating an increase of 0.25% from the year-ago quarter’s reported figure.

Decrease in operating expenses is likely to have aided on IPG’s bottom line. The Zacks Consensus Estimate for earnings is pegged at $1.02 per share, indicating growth of 24.4% from the year-ago period’s reported figure.

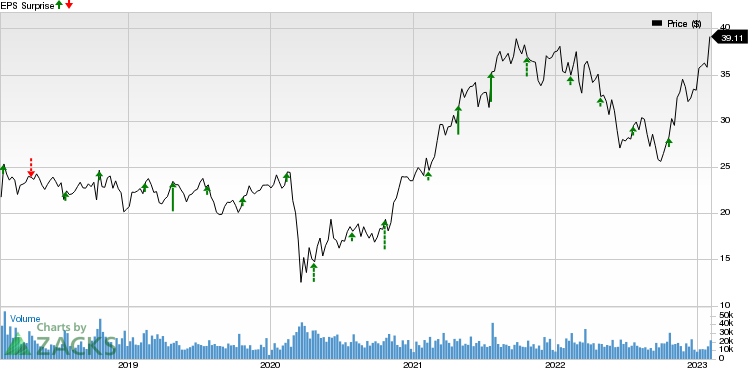

Interpublic Group of Companies, Inc. (The) Price and EPS Surprise

Interpublic Group of Companies, Inc. (The) price-eps-surprise | Interpublic Group of Companies, Inc. (The) Quote

What Our Model Says

Our proven model does not conclusively predict an earnings beat for Interpublic this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which isn’t the case here. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Interpublic has an Earnings ESP of -0.49% and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Here are a few stocks from the broader Zacks Business Services sector that investors may consider, as our model shows that these have the right combination of elements to beat on earnings this season.

Accenture plc ACN has an Earnings ESP of +3.30% and a Zacks Rank of 3.

Accenture has an expected earnings growth rate of 7% for fiscal 2023. ACN has a trailing four-quarter earnings surprise of 3.2%, on average.

Avis Budget Group, Inc. CAR has an Earnings ESP of +7.40% and is Zacks #3 Ranked.

CAR has a trailing four-quarter earnings surprise of 67.2%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Accenture PLC (ACN) : Free Stock Analysis Report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Interpublic Group of Companies, Inc. (The) (IPG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance