Interpublic (IPG) Gains From Buyouts, Client Concentration

The Interpublic Group’s IPG strategy to acquire diverse talents strengthens its presence in the international markets. The company’s acquisition strategy enables it to cope with the dynamic marketing services and media prospects.

IPG has reported mixed first-quarter 2024 results. Adjusted earnings (excluding 7 cents from non-recurring items) of 36 cents per share met the Zacks Consensus Estimate but decreased 5.3% on a year-over-year basis. Revenues before billable expenses (net revenues) of $2.2 billion surpassed the consensus estimate marginally but decreased 13.4% year over year. Total revenues of $2.5 billion declined 1% and met our estimate.

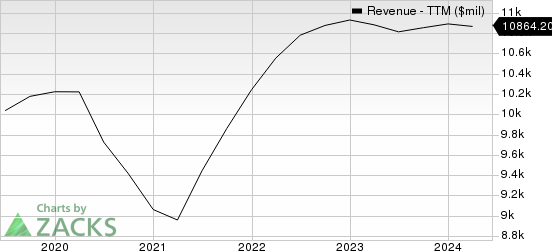

Interpublic Group of Companies, Inc. (The) Revenue (TTM)

Interpublic Group of Companies, Inc. (The) revenue-ttm | Interpublic Group of Companies, Inc. (The) Quote

How Is IPG Doing?

Interpublic’s increasingly diverse workforce provides a competitive edge. The company continues to attract, acquire and develop strategic, creative and digital talent from diverse backgrounds with a vision to increase organic growth and strengthen its foothold in international markets.

The has a disciplined acquisition strategy aimed at high-growth capacities and geographies. It has been expanding its product portfolio by acquiring and investing in companies globally. This strategy allows the company to adjust itself to the rapidly changing marketing services and media prospects. In recent years, Interpublic has acquired agencies across the marketing spectrum, including data, technology, e-commerce and healthcare communication firms, and agencies with full-service capacities. The company completed two acquisitions in 2023, one in 2022, four in 2020, one in 2019 and five in 2018.

Interpublic’s current ratio at the end of first-quarter 2024 was 1.06, flat with the preceding quarter and higher than the year-ago quarter's 1.03.A current ratio of more than 1 often indicates that the company will easily pay off its short-term obligations.

Commitment to shareholder returns makes Interpublic’s shares a reliable instrument to invest, thereby compounding wealth over the long term. In 2023, 2022 and 2021, Interpublic paid out $479.1 million, $457.3 million and $427.7 million in dividends, respectively. Such actions indicate the company’s commitment to create value for shareholders, thereby boosting their confidence in its business.

Client concentration can be a major headwind for Interpublic. The company’s top 10 clients accounted for almost 20% of net revenues in 2023 and 2022. Approximately 4% of net revenues in 2023 and 2022 were generated by IPG’s largest client. This shows Interpublic’s high reliability on its large clients for a significant portion of revenues. Maintaining strong client relationships by retaining the older ones while attracting newer ones is vital for Interpublic.

Seasonality affects Interpublic’s cash position. This is because of clients’ fluctuating annual media spending budgets and changing media spending patterns that vary throughout the year with different localities. Seasonality is observed in the first nine months of a year, with the most significant impact in the first quarter.

Zacks Rank & Stocks to Consider

IPG currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are GEN DIGITAL INC GEN and Omnicom Group OMC.

GEN DIGITAL has a Zacks Rank of 2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

GEN has a long-term earnings growth expectation of 10.2%. It delivered a trailing four-quarter earnings surprise of 0.52%, on average.

Omnicom Group currently carries a Zacks Rank of 2. It has a long-term earnings growth expectation of 5.5%.

OMC delivered a trailing four-quarter earnings surprise of 3.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Interpublic Group of Companies, Inc. (The) (IPG) : Free Stock Analysis Report

Gen Digital Inc. (GEN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance