Internet Stocks' Aug 6 Earnings Roster: UBER, TTD, ZG & More

Internet stocks’ second-quarter 2020 results are likely to reflect massive demand for cloud computing services, courtesy of work-from-home, online learning and remote health diagnostic trends.

Moreover, the practice of social distancing in a bid to contain the contagious virus has been bolstering the usage of Internet-of-Things based services, robotics, e-commerce, contactless payment and online delivery solutions worldwide. Also, travel restrictions has led to growth in preference for online-mode conferences.

The uptick in digital payments trend is quite evident from PayPal’s PYPL stellar second-quarter results, wherein earnings and revenues surpassed the estimates and improved year over year, reflecting an uptrend in net new active accounts, strengthening customer engagement on its platform and synergies from Honey acquisition.

Further, Amazon and Shopify delivered stellar second-quarter 2020 results, reflecting gains from e-commerce boom.

Key Factors to Note

High demand for SaaS-based (or Software as a Service) applications pertaining to employee collaboration, cybersecurity, infrastructure monitoring, asset performance management and human capital management solutions, telehealth care, are likely to have driven the industry participants’ performance in the second quarter.

Additionally, stay-at-home wave has increased demand to access social-media platforms, online gaming, music and video streaming services. This upside might get reflected in the Internet companies' impending quarterly results.

Markedly, Facebook’s second-quarter 2020 results were driven by steady user growth across all regions. The company benefited from increased engagement with its products in the reported quarter as more people were compelled to stay at home due to the coronavirus outbreak.

However, decline in ad revenues, led by coronavirus crisis induced broader macroeconomic weakness and sluggish spending on ad from small and medium sized businesses may have weighed on Internet companies’ performance in the quarter to be reported. Also, companies catering to online travel, tourism and hospitality domains are likely to reflect the impact of coronavirus crisis-induced travel restrictions.

For instance, Twitter’s second-quarter 2020 revenues declined year over year due to softness in advertising demand.

Alphabet’s second-quarter 2020 top line was also impacted by decrease in advertising revenues despite strength in cloud and YouTube businesses.

Moreover, Expedia Group’s second-quarter 2020 dismal results were impacted by worsening travel trends on account of the coronavirus pandemic that has been wreaking havoc on global travel industry since its onset.

Sneak Peak of Few Upcoming Q2 Releases

Given this mixed backdrop, investors interested in the Internet companies keenly await quarterly earnings results from notable companies slated to report on Aug 6.

Our quantitative model predicts an earnings beat for the company with a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) as this combination increases its chances of beating estimates. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The Trade Desk’s TTD second-quarter 2020 results are likely to have benefited from the momentum in programmatic ad buying.

Our proven model predicts an earnings beat for The Trade Desk this time around. The company has an Earnings ESP of +73.08% and a Zacks Rank #3.

The Zacks Consensus Estimate for earnings has moved north by 3.3% to 31 cents per share over the past 30 days.

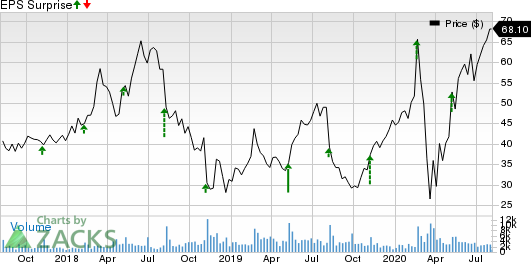

The Trade Desk Inc. Price and EPS Surprise

The Trade Desk Inc. price-eps-surprise | The Trade Desk Inc. Quote

Notably, the emergence of digital content boosted the usage of the company’s inventory across all forms of connected TV, which might get reflected in the to-be-reported quarter’s revenues. However, sluggish spending by advertisers, particularly in verticals like Travel, is likely to have hindered growth. (Read More: The Trade Desk to Report Q2 Earnings: What's in Store?)

Cloudflare's NET second-quarter 2020 results are likely to reflect benefits from its recurring subscription-based business model and a diversified customer base despite the coronavirus crisis.

Our proven model predicts an earnings beat for Cloudflare this time around. The company has an Earnings ESP of +6.38% and a Zacks Rank #3.

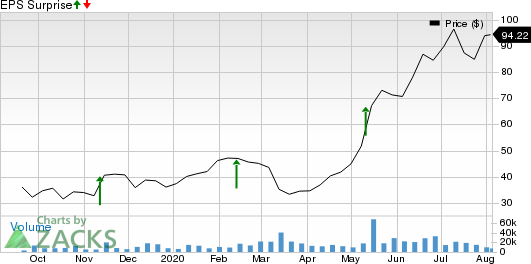

Cloudflare, Inc. Price and EPS Surprise

Cloudflare, Inc. price-eps-surprise | Cloudflare, Inc. Quote

The Zacks Consensus Estimate for bottom line is pegged at loss of 6 cents per share for the past 30 days. (Read More: Cloudflare to Report Q2 Earnings: What's in Store?)

Zillow Group’s ZG second-quarter 2020 results are likely to reflect solid growth in Homes segment revenues and robust demand for Zillow Offers. The company has resumed home buying in multiple markets after a temporary pause as the economy starts to reopen amid the COVID-19 pandemic.

Although Zillow Group carries a Zacks Rank #2, an Earnings ESP of 0.00% makes surprise prediction difficult. You can see the complete list of today’s Zacks #1 Rank stocks here.

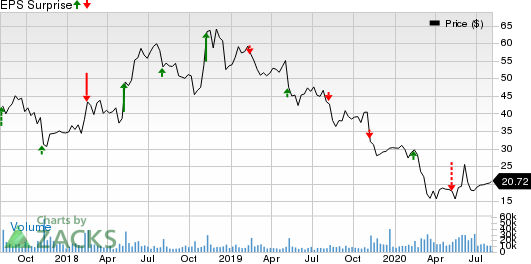

Zillow Group, Inc. Price and EPS Surprise

Zillow Group, Inc. price-eps-surprise | Zillow Group, Inc. Quote

The Zacks Consensus Estimate for bottom line stands at a loss of 43 cents, which narrowed from a loss of 44 cents in the past 30 days.

Datadog's DDOG second-quarter 2020 results are likely to reflect increased adoption of its cloud-based monitoring and analytics platform.

Datadog has an Earnings ESP of 0.00% and a Zacks Rank #3.

Datadog, Inc. Price and EPS Surprise

Datadog, Inc. price-eps-surprise | Datadog, Inc. Quote

The Zacks Consensus Estimate for earnings is currently pegged at 1 cent per share, unchanged over the past 30 days. (Read More: Datadog to Report Q2 Earnings: What's in the Cards?)

TripAdvisor's TRIP second-quarter 2020 results are likely to reflect sluggishness in all the three revenue segments — namely Hotels, Media & Platform, Experiences & Dining, and Other — due to COVID-19-induced stringent travel restrictions and physical distancing norms.

TripAdvisor has an Earnings ESP of 0.00% and a Zacks Rank #3.

TripAdvisor, Inc. Price and EPS Surprise

TripAdvisor, Inc. price-eps-surprise | TripAdvisor, Inc. Quote

The Zacks Consensus Estimate for the bottom line has remained stable at a loss of 72 cents per share over the past 30 days. (Read More: What's in the Offing for TripAdvisor's Q2 Earnings?)

Uber Technologies’ UBER second-quarter 2020 results are likely to reflect sluggish Rides business, thanks to coronavirus restricting people to their homes.

Nevertheless, with people mostly staying indoors to avoid virus concerns, momentum in Uber’s food delivery business, Uber Eats, might have limited revenue decline.

Uber has an Earnings ESP of -2.67% and a Zacks Rank #3.

Uber Technologies, Inc. Price and EPS Surprise

Uber Technologies, Inc. price-eps-surprise | Uber Technologies, Inc. Quote

The Zacks Consensus Estimate for bottom line is pegged at a loss of 78 cents, unchanged in the past 30 days. (Read More: How Much Will Rides Business Hurt Uber's Q2 Earnings?)

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TripAdvisor, Inc. (TRIP) : Free Stock Analysis Report

Zillow Group, Inc. (ZG) : Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

The Trade Desk Inc. (TTD) : Free Stock Analysis Report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report

Cloudflare, Inc. (NET) : Free Stock Analysis Report

Datadog, Inc. (DDOG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance