The International Cement Group (SGX:KUO) Share Price Is Down 58% So Some Shareholders Are Wishing They Sold

Even the best stock pickers will make plenty of bad investments. Unfortunately, shareholders of International Cement Group Ltd. (SGX:KUO) have suffered share price declines over the last year. The share price has slid 58% in that time. International Cement Group may have better days ahead, of course; we've only looked at a one year period. Unfortunately the share price momentum is still quite negative, with prices down 42% in thirty days.

View our latest analysis for International Cement Group

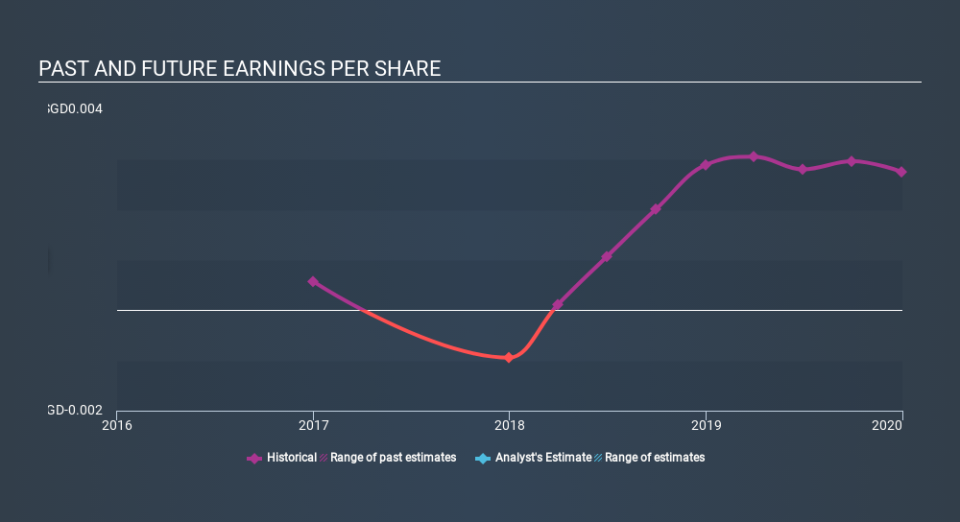

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately International Cement Group reported an EPS drop of 4.7% for the last year. The share price decline of 58% is actually more than the EPS drop. So it seems the market was too confident about the business, a year ago. The less favorable sentiment is reflected in its current P/E ratio of 5.08.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It might be well worthwhile taking a look at our free report on International Cement Group's earnings, revenue and cash flow.

A Different Perspective

We doubt International Cement Group shareholders are happy with the loss of 58% over twelve months. That falls short of the market, which lost 18%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. The share price decline has continued throughout the most recent three months, down 18%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 2 warning signs we've spotted with International Cement Group (including 1 which is makes us a bit uncomfortable) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance