Intellia's (NTLA) Q2 Loss Wider Than Expected, Revenues Beat

Intellia Therapeutics NTLA incurred a loss of $1.33 per share in second-quarter 2022, wider than the year-ago quarter’s loss of $1.01 and the Zacks Consensus Estimate of a loss of $1.31.

Intellia’s total revenues, comprising collaboration revenues, came in at $14 million for the second quarter compared with $6.6 million reported in the year-ago period. Revenues also beat the Zacks Consensus Estimate of $12 million.

The significant year-over-year increase in revenues was on account of revenues recorded by the company from its joint venture with AvenCell and its collaboration with Kyverna Therapeutics.

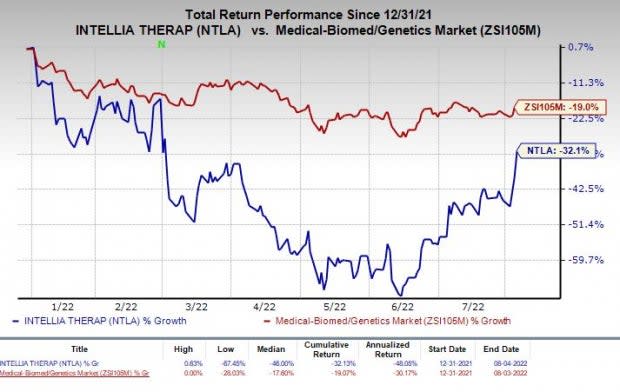

Shares of Intellia have plunged 32.1% in the year so far compared with the industry’s 19% decline.

Image Source: Zacks Investment Research

Quarter in Detail

For the reported quarter, research and development expenses were $90.2 million, up 53.2% from the year-ago quarter’s figure, due to increased costs for developing Intellia’s lead programs plus the expansion of the development organization.

General and administrative expenses also surged 32.7% year over year to $22.1 million due to higher employee-related costs.

As of Jun 30, 2022, NTLA had cash, cash equivalents and marketable securities of $906.9 million compared with $994.7 million on Mar 31, 2022.

Pipeline Updates

Intellia is developing curative therapeutics using the CRISPR/Cas9 technology. NTLA is evaluating its lead in-vivo genome-editing candidate NTLA-2001 in a phase I study as a single-dose treatment of transthyretin (ATTR) amyloidosis.

In June, Intellia and Regeneron Pharmaceuticals REGN reported positive interim data from the part 2 portion of the ongoing phase I study evaluating NTLA-2001 for treating ATTR amyloidosis. The study demonstrated that the reduction in serum transthyretin (TTR) remained durable after a single dose of NTLA-2001 in an extended follow-up data from 15 patients with hereditary ATTR amyloidosis with polyneuropathy (ATTRv-PN). The study achieved mean reductions of 93% and maximum reductions of 98% by day 28 in the 1.0 mg/kg dose cohort. The study also attained mean reductions of 86% at day 28 in the 0.7 mg/kg dose cohort.

NTLA announced that it has plans to add a second cohort to the dos-expansion portion of the ATTRv-PN, subject to regulatory approval. The company plans to submit a protocol amendment evaluating a fixed dose corresponding to 0.7mg/kg in the dose-expansion study. Intellia expects to complete the patient enrollment in the program by the end of 2022, subject to approvals.

Alongside its Q2 earnings results, Intellia also announced the completion of the dose-escalation portion of the ATTR-CM arm.

NTLA-2001 is part of Intellia’s co-development and co-promotion agreement with Regeneron. While NTLA is the lead party in the deal over NTLA-2001, Regeneron shares 25% of the development costs and commercial profits. Both Intellia and Regeneron are also developing therapies for hemophilia A and B.

Apart from NTLA-2001, Intellia is evaluating another pipeline candidate, NTLA-2002, in an ongoing phase I/II study for the treatment of hereditary angioedema (HAE). NTLA-5001 is Intellia’s first wholly-owned ex-vivo genome editing candidate to treat cancer.

However, Intellia announced that it plans to discontinue its first-in-human study of NTLA-5001 and is pivoting to an allogenic version of the program. The company has decided to concentrate its ex vivo development efforts exclusively on allogeneic cell therapies manufactured by healthy donors. The decision is based on the potential of the company’s allogenic platform to deliver readily available, high-quality cell products for aggressive cancer treatments and not on the safety and efficacy data from the preclinical study.

Intellia Therapeutics, Inc. Price, Consensus and EPS Surprise

Intellia Therapeutics, Inc. price-consensus-eps-surprise-chart | Intellia Therapeutics, Inc. Quote

Zacks Rank & Stocks to Consider

Intellia currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same sector are BioNTech BNTXand Pliant Therapeutics PLRX, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

BioNTech’s earnings estimates for 2022 have improved from $33.18 to $34.28 in the past 30 days. Shares of BioNTech have declined 30.2% year to date. Earnings of BNTX beat earnings estimates in all the last four quarters. BNTX delivered an earnings surprise of 56.87%, on average.

Pliant Therapeutics’ loss estimates for 2022 have narrowed from $3.36 to $3.20 in the past 30 days. Shares of Pliant Therapeutics have returned 28.1% year to date. Earnings of PLRX beat earnings estimates only once in the last four quarters. PLRX delivered an earnings surprise of 0.90%, on average

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Intellia Therapeutics, Inc. (NTLA) : Free Stock Analysis Report

BioNTech SE Sponsored ADR (BNTX) : Free Stock Analysis Report

Pliant Therapeutics, Inc. (PLRX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance