Integer Holdings (ITGR) Q1 Earnings & Revenues Top Estimates

Integer Holdings Corporation ITGR reported first-quarter 2020 adjusted earnings per share (EPS) of $1.25, which surpassed the Zacks Consensus Estimate of $1.06 by 17.9%. The bottom line also improved 25% on a year-over-year basis.

Revenues improved 4.4% year over year to $328.4 million on a reported basis. Further, the top line beat the Zacks Consensus Estimate by 4.9%.

Segmental Analysis

Integer Holdings operates through two segments — Medical Sales and Non-Medical Sales.

Medical Sales

At the segment, reported revenues were $318.3 million, up 5.7% year over year. Revenues improved 5.4% from the prior-year quarter on an organic basis.

Medical Sales has three sub-segments — Advanced Surgical, Orthopedics and Portable Medical (AS&O); Cardio & Vascular; and Cardiac & Neuromodulation.

Advanced Surgical, Orthopedics and Portable Medical

Integer Holdings’ Advanced Surgical, Orthopedics & Portable Medical segment has been divested to Viant. Consequently, revenues at the segment include net sales from the acquirer Viant under supply agreements associated with the divestiture.

Revenues amounted to $31.2 million, down 1.1% on both year-over-year and organic basis. Per management, the downside can be attributed to lower Portable Medical battery demand. However, higher end-market demand for advanced surgical and orthopedic products offset the downside.

Cardio & Vascular

Revenues at the segment totaled $179.2 million, up 17.5% from the prior-year quarter and 16.8% organically. Per management, the upside can be attributed to a substantial rise in peripheral vascular demand from a customer’s continued launch of an existing program into a new geography and overall market growth. The segment also benefited from incremental sales from the start of a customer contract on existing business.

Cardiac & Neuromodulation

Revenues at this segment totaled $107.8 million, declining 7.8% on both year-over-year and organic basis. This can be attributed to Nuvectra bankruptcy ($6 million) and headwinds from 2019 supply agreement commitments. However, solid CRM growth from product launched and higher battery demand was partially offset by the impact of signing a customer contract on existing business in the prior year.

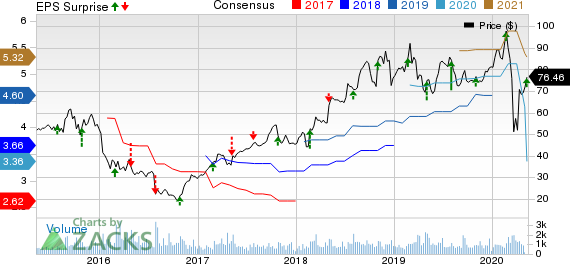

Integer Holdings Corporation Price, Consensus and EPS Surprise

Integer Holdings Corporation price-consensus-eps-surprise-chart | Integer Holdings Corporation Quote

Non-Medical Sales

Reported revenues at the segment totaled $10.2 million, down 25.3% on both year-over-year and organic basis.

Margin Analysis

Integer Holdings generated a gross profit of $96.7 million in the first quarter, up 9.1% year over year. As a percentage of revenues, gross margin in quarter expanded 120 basis points (bps) to 29.4%.

Selling, general and administrative expenses (SG&A) were $36.5 million, up 4.3% year over year.

Research, development and engineering costs grossed $13.2 million in the quarter, up 14.2% year over year.

Total operating income amounted to $44.1 million, up 12.5% year over year.

Operating margin in the quarter under review was 13.4%, up 100 bps year over year.

2020 Guidance

The company has decided to suspend its previously issued full-year 2020 guidance on account of the uncertainty surrounding the impact and recovery period of the COVID-19 pandemic. Integer Holdings anticipates the pandemic to lower sales and profits on a temporary basis.

Summing Up

Integer Holdings exited the first quarter on a strong note, wherein both earnings and revenues beat their respective Zacks Consensus Estimate. The company gained from its Cardio and Vascular product line in the quarter under review. Strong demand across key areas like structural heart and peripheral vascular is an added positive. The company also paid portion of its debt in the quarter under review. Also, expansion in both gross and operating margins is a positive.

Meanwhile, the company witnessed declines in both Advanced Surgical, Orthopedics and Portable Medical and Cardiac & Neuromodulation sub-segments in the quarter under review.

Zacks Rank

Currently, Integer Holdings carries a Zacks Rank #4 (Sell).

Key Picks

Some better-ranked stocks in the broader medical space are Aphria Inc. APHA, Biogen Inc. BIIB and Eli Lilly and Company LLY.

Aphria reported third-quarter fiscal 2020 adjusted EPS of 2 cents, beating the Zacks Consensus Estimate of a loss of 4 cents. Net revenues of $64.4 million surpassed the consensus mark by 14.6%. The company carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Biogen currently carries a Zacks Rank #2. It reported first-quarter 2020 adjusted EPS of $9.14, surpassing the Zacks Consensus Estimate by 18.1%. Revenues of $3.53 billion outpaced the consensus mark by 3.2%.

Eli Lilly reported first-quarter 2020 EPS of $1.75, outpacing the Zacks Consensus Estimate by 12.9%. Revenues of $145.3 million surpassed the consensus estimate by 6.3%. The company currently sports a Zacks Rank #1.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.1% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc (BIIB) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Aphria Inc (APHA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance