Insurance Stocks to Watch for Q4 Earnings on Feb 1: MET, AFL & More

The insurance industry is anticipated to have gained on continued rate increases, solid retention rates, an improving interest rate environment and significant technological advancements in the fourth quarter of 2022. However, an active catastrophe environment and persistent inflationary pressures are likely to have thrown roadblocks for insurers. Some of the insurers, including MetLife, Inc. MET, Aflac Incorporated AFL, The Allstate Corporation ALL, American Financial Group, Inc. AFG and MGIC Investment Corporation MTG, are set to report their fourth-quarter earnings on Feb 1.

The insurance space is housed within the broader Finance sector (one of the 16 broad Zacks sectors within the Zacks Industry classification). Per the latest Earnings Preview, the total earnings of finance companies for fourth-quarter 2022 are anticipated to fall 9.9% from the prior-year quarter’s reported figure, while revenues of these companies are expected to grow 2.8%.

Factors Likely to Shape Insurers’ Performance in Q4

The top lines of insurance companies are likely to have benefited on the back of growing premiums resulting from uninterrupted rate hikes, exposure growth and solid customer retention rates in the fourth quarter. A rising premium level bodes well, as they contribute a chunk to an insurer’s revenues. Diversified portfolios, which minimize concentration risks, possessed by insurers, are also expected to have provided an impetus to their fourth-quarter premiums.

Per MarketScout, a Texas-based insurance distribution and underwriting company, the commercial insurance rates in the United States grew at a composite rate of 5.1% in the to-be-reported quarter. The same source cited a composite rate increase of 5.2% across the personal lines insurance business in the fourth quarter of 2022.

However, significant catastrophe losses stemming from Winter Storm Elliott are expected to have acted as drags on the underwriting results of insurance companies in the to-be-reported quarter. Karen Clark & Company expects the storm to produce an estimated loss of $5.4 billion for the U.S. insurance industry.

Despite coming with its share of worries, catastrophe losses usually ramp up the policy renewal rate and prompt insurers to implement rate hikes.

In the fourth quarter, an improving interest rate scenario is likely to have boosted investment yields for those insurers that have exposure to rate-sensitive products. An aging U.S. population is expected to have sustained steady premium flows for life insurers from their insurance and protection products in the to-be-reported quarter.

Easing of border restrictions and receding effects of the COVID-19 pandemic have imparted more confidence to people in traveling, which, in turn, is likely to have boosted auto premiums in the fourth quarter. However, inflationary pressures are anticipated to have elevated auto part expenses or labor costs, which is likely to have exerted pressure on the margins of auto insurers.

Strength in the mortgage market, supported by increased policy renewal and lower unemployment rates, is likely to have favored mortgage insurance premiums in the to-be-reported quarter.

The insurance industry frequently resorts to significant technology investments in blockchain, AI and advanced analytics, which are aimed to accelerate claim payments and automate processes. These investments are likely to have curbed costs and aided the margins of insurers in the fourth quarter.

Let’s find out how the following insurers are placed before their fourth-quarter 2022 results on Feb 1.

The Zacks model suggests that a company needs to have the right combination of the two key ingredients — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — to increase the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

You can see the complete list of today's Zacks #1 Rank stocks here.

MetLife: In the fourth quarter, revenues of MetLife are likely to have benefited on the back of solid performances of its U.S., Latin America, and the Europe, the Middle East and Africa segments. However, reduced net investment income, and universal life and investment-type product policy fees are likely to have acted as headwinds. (Read more: Can Lower Premiums Dampen MetLife's Q4 Earnings?)

The Zacks Consensus Estimate for MET’s fourth-quarter 2022 earnings is pegged at $1.76 per share, indicating an 18.9% plunge from the prior-year quarter’s reported figure. The consensus mark for revenues is pinned at $17 billion, suggesting a 16.1% decline from the year-ago quarter’s reported figure.

MetLife has an Earnings ESP of -1.50% and a Zacks Rank #3.

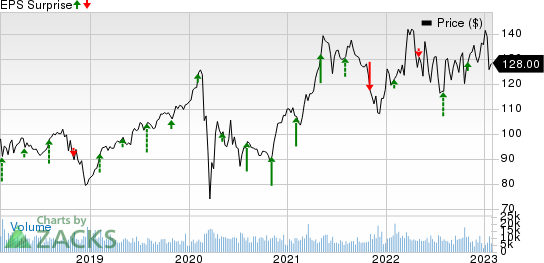

MET’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 28.00%. The same is depicted in the chart below:

MetLife, Inc. Price and EPS Surprise

MetLife, Inc. price-eps-surprise | MetLife, Inc. Quote

Aflac: Fed interest rate hikes are likely to have provided an impetus to Aflac’s U.S. operations in the fourth quarter, but Japan’s operations are likely to have suffered a blow from adversities on sales. Multiple cost-curbing efforts pursued by AFL are expected to have led to a decline in expenses, thereby aiding margins in the to-be-reported quarter. (Read more: Can Aflac's Q4 Earnings Beat Estimates on Lower Expenses?)

The Zacks Consensus Estimate for Aflac’s fourth-quarter 2022 earnings of $1.21 per share indicates a decline of 5.5% from the prior-year quarter’s reported figure. The consensus mark for revenues is pegged at $4.5 billion, suggesting a 17.4% fall from the year-ago quarter’s reported figure.

AFL has an Earnings ESP of +1.29% and a Zacks Rank #2.

Aflac’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 4.83%. The same is depicted in the chart below:

Aflac Incorporated Price and EPS Surprise

Aflac Incorporated price-eps-surprise | Aflac Incorporated Quote

Allstate: In the fourth quarter, Allstate is expected to have benefited on the back of growing premiums earned in the Property-Liability and Protection Services segments in the to-be-reported quarter. Catastrophe losses, mostly originating from Winter Storm Elliott, are likely to have strained its underwriting results. Management estimates pretax catastrophe losses of $779 million for the fourth quarter. (Read more: Allstate to Report Q4 Earnings: What's in the Cards?)

The Zacks Consensus Estimate for ALL’s fourth-quarter 2022 earnings is pegged at a loss of $1.37 per share. Notably, earnings of $2.75 per share were reported in the prior-year quarter. The consensus mark for revenues stands at $12.5 billion, which indicates a decline of 2% from the year-ago quarter’s reported figure.

Allstate has an Earnings ESP of 0.00% and a Zacks Rank of #5 (Strong Sell).

ALL’s earnings outpaced estimates in three of the trailing four quarters and missed the mark once, the average surprise being 8.29%. The same is depicted in the chart below:

The Allstate Corporation Price and EPS Surprise

The Allstate Corporation price-eps-surprise | The Allstate Corporation Quote

American Financial: AFG’s fourth-quarter results are expected to have gained on improved property and casualty insurance net earned premiums, coupled with other income. However, lower net investment income and an elevated expense level are likely to have created headwinds to the quarterly performance of American Financial.

The Zacks Consensus Estimate for AFG’s fourth-quarter 2022 earnings of $2.95 per share indicates a 28.4% decrease from the prior-year quarter’s reported figure. The consensus mark for revenues is pegged at $1.7 billion, suggesting a 3.8% decline from the year-ago quarter’s reading.

American Financial has an Earnings ESP of 0.00% and is Zacks #3 Ranked.

AFG’s earnings outpaced estimates in each of the trailing four quarters, the average beat being 28.16%. The same is depicted in the chart below:

American Financial Group, Inc. Price and EPS Surprise

American Financial Group, Inc. price-eps-surprise | American Financial Group, Inc. Quote

MGIC Investment: The performance of the insurer is likely to have been driven by higher new business written and solid persistency rates leading to a rise in premiums in the fourth quarter. Claim payments are likely to have witnessed a downtrend in the to-be-reported quarter. However, escalating underwriting and other expenses are expected to have exerted pressure on the margins of MGIC Investment.

The Zacks Consensus Estimate for MTG’s fourth-quarter 2022 earnings is pegged at 59 cents per share, which hints toward a 3.3% fall from the year-ago quarter’s reported figure. The consensus mark for revenues is pegged at $334.1 million, suggesting 14% growth from the prior-year quarter’s reported figure.

MGIC Investment has an Earnings ESP of 0.00% and a Zacks Rank of 3.

MTG’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 36.34%. The same is depicted in the chart below:

MGIC Investment Corporation Price and EPS Surprise

MGIC Investment Corporation price-eps-surprise | MGIC Investment Corporation Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MGIC Investment Corporation (MTG) : Free Stock Analysis Report

MetLife, Inc. (MET) : Free Stock Analysis Report

Aflac Incorporated (AFL) : Free Stock Analysis Report

The Allstate Corporation (ALL) : Free Stock Analysis Report

American Financial Group, Inc. (AFG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance