Insurance Stocks' Q3 Earnings on Nov 1: AIG, PRU and More

Improved pricing, exposure growth, solid retention, favorable renewals, reinsurance agreements and accelerated digitalization in the third quarter are likely to have benefited insurance industry players such as American International Group, Inc. AIG, Prudential Financial Inc. PRU, Assurant Inc. AIZ, Unum Group UNM and RenaissanceRe Holdings Ltd. RNR, which are due to report tomorrow. However, an active catastrophe level is likely to have weighed on the upside.

Better pricing, solid retention and exposure growth across business lines are likely to have aided premiums. An active catastrophe environment accelerated the policy renewal rate and aided in better pricing in the third quarter.

Better pricing, reinsurance arrangements, portfolio repositioning, reinsurance covers, favorable reserve development and prudent underwriting are likely to drive an improvement in underwriting results. The third quarter of 2022 bore the brunt of Hurricane Ian. Swiss Re estimates claims stemming from Hurricane Ian to be in the range of $50 billion to $65 billion.

Increased travel across the world is likely to have induced higher auto premiums. A stronger mortgage market is likely to have favored mortgage insurance premiums. A low unemployment rate is likely to have aided commercial insurance and group insurance. Lower mortality claims are likely to have aided margin expansion.

Insurers, being beneficiaries of an improving rate environment, are expected to come up with improved investment results. The third quarter itself saw two rate hikes. A larger investment asset base and alternative investments in private equity, hedge funds, and real estate among others are expected to have aided net investment income.

Accelerated digitalization is expected to have saved costs, thus aiding margins. A solid capital position aided insurers to get involved in strategic mergers and acquisitions to sharpen their competitive edge, build on a niche, expand geographically and diversify their portfolio apart from engaging in share buybacks and raising dividends in the third quarter.

Let’s take a sneak peek into how the abovementioned insurers are poised prior to their third-quarter 2022 earnings on Nov 1.

According to the Zacks model, a company needs the right combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or better — to increase the odds of an earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

American International Group’s improved retention, new business and continued growth in the insurance premium rate are likely to have increased net premiums earned in General Insurance for the third quarter. Total premiums from Life and Retirement are expected to have increased due to improved pension risk transfer activities. However, profits from General Insurance are likely to have decreased due to increased losses and loss adjustment expenses, as well as a lower net investment income. (Read more: What to Expect From American International's Q3 Earnings?)

The Zacks Consensus Estimate for AIG’s third-quarter earnings per share of 59 cents indicates a 39.2% increase from the year-ago quarter reported figure. The company has an Earnings ESP of 0.00% and a Zacks Rank #4 (Sell).

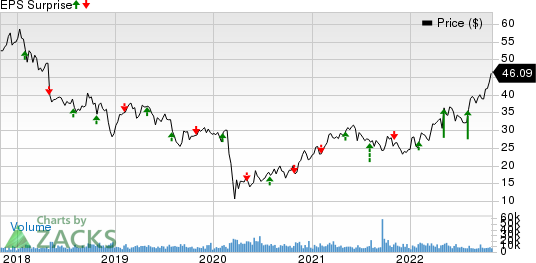

AIG’s earnings surpassed estimates in three of the last four reported quarters while missing in one. This is depicted in the chart below:

American International Group, Inc. Price and EPS Surprise

American International Group, Inc. price-eps-surprise | American International Group, Inc. Quote

Prudential’s U.S. business in the third quarter is likely to have been affected by lower spread income due to less favorable variable investment income and lower fee income. International businesses are likely to have been affected by lower earnings from joint venture investments, lower net investment results and less favorable underwriting. The Group Insurance business is likely to benefit from more favorable underwriting results. Prudential estimates earnings per share to be $2.63 for the third quarter of 2022. (Read more: Prudential to Report Q3 Earnings: What's in the Offing?)

The Zacks Consensus Estimate for PRU’s third-quarter earnings per share of $2.21 indicates a 41.5% decrease from the year-ago quarter reported figure. The company has an Earnings ESP of 0.00% and a Zacks Rank #4.

PRU’s earnings surpassed estimates in three of the last four reported quarters while missing in one. This is depicted in the chart below:

Prudential Financial, Inc. Price and EPS Surprise

Prudential Financial, Inc. price-eps-surprise | Prudential Financial, Inc. Quote

Assurant’s third-quarter revenues are likely to have benefited from improved net earned premiums, higher fees and other income and net investment income. Net earned premiums are expected to have benefited from continued organic growth from strong U.S. sales in the Global Automotive business. The Global Lifestyle segment is expected to have benefited from solid business automobile and auto. Total benefits, losses and expenses might have escalated due to higher selling, underwriting, general and administrative expenses. The third quarter has been affected by higher catastrophes. AIZ expects adjusted EBITDA in the to-be-reported quarter to be $116 million, down 31.4% due to reduced segment earnings and higher reportable catastrophes. Assurant estimates $124 million pre-tax in reportable catastrophes for the third quarter, stemming from Hurricane Ian. AIZ estimates Global Housing adjusted EBITDA to be a loss of $25 million. (Read more: Here's What to Expect From Assurant in Q3 Earnings)

The Zacks Consensus Estimate for AIZ’s third-quarter earnings per share of $1.00 indicates a 29.1% decrease from the year-ago quarter reported figure. The company has an Earnings ESP of 0.00% and a Zacks Rank #5 (Strong Sell).

AIZ’s earnings surpassed estimates in three of the last four reported quarters while missing in one. This is depicted in the chart below:

Assurant, Inc. Price and EPS Surprise

Assurant, Inc. price-eps-surprise | Assurant, Inc. Quote

Unum Group’s Unum U.S. segment is likely to have benefited from higher premium levels in the employee benefits lines, individual disability and voluntary benefits, growth in the in-force block, solid persistency, and growth in the dental and vision product line. Improvement in mortality rates is likely to have favored Unum US Group Life and AD&D business. Continued higher persistency, higher sales and favorable incidence in all the product lines and management’s focus on moving on to a mix of businesses with higher growth and stable margins are likely have favored performance at Colonial Life. (Read more : Here's What to Expect From Unum Group Q3 Earnings)

The Zacks Consensus Estimate for UNM’s third-quarter earnings per share of $1.40 indicates a 35.9% increase from the year-ago quarter reported figure. The company has an Earnings ESP of -3.04% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

UNM’s earnings surpassed estimates in three of the last four reported quarters while missing in one. This is depicted in the chart below:

Unum Group Price and EPS Surprise

Unum Group price-eps-surprise | Unum Group Quote

RenaissanceRe Holdings’ third-quarter results are likely to benefit from solid segmental results. The Casualty and Specialty and Property segments are expected to have witnessed premium growth. However, higher catastrophe loss is expected to weigh on third-quarter results. RNR thus expects to report an operating loss attributable to common shareholders in the third quarter. RNR estimates catastrophe events to have a net negative impact of approximately $650 million.

The Zacks Consensus Estimate for the bottom line is pegged at a loss per share of $5.71, narrower than $8.98 loss incurred in the year-ago quarter. The consensus estimate for revenues is pegged at $1.7 billion, indicating an increase of 7% year over year. The company has an Earnings ESP of 0.00% and a Zacks Rank 3.

RNR’s earnings surpassed estimates in two of the last four reported quarters while missing in two.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American International Group, Inc. (AIG) : Free Stock Analysis Report

Prudential Financial, Inc. (PRU) : Free Stock Analysis Report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

RenaissanceRe Holdings Ltd. (RNR) : Free Stock Analysis Report

Unum Group (UNM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance