Installed Building (IBP) Looks Promising: Invest in the Stock

Installed Building Products, Inc. IBP is poised to gain from the strong end-market demand, the continued success of local branches, an asset-light business model and proficient acquisition strategies. Also, its national scale and diverse product categories and end markets are added to the positives.

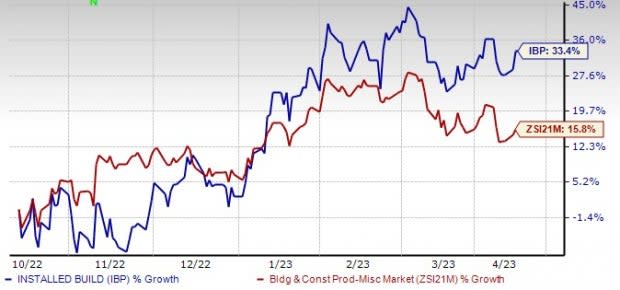

Shares of this residential insulation installer have gained 33.4% over the past six months compared with the Zacks Building Products - Miscellaneous industry’s 15.8% rise. Also, the 2023 earnings per share estimates for this Zacks Rank #1 (Strong Buy) company have moved 13.3% upward over the past 60 days. This positive trend signifies bullish analysts’ sentiments, indicating robust fundamentals and the expectation of outperformance in the near term.

We believe that IBP offers a sound investment opportunity, as evidenced by its VGM Score of B.

Image Source: Zacks Investment Research

Let us delve deeper into other factors that make this stock a profitable pick.

What Makes the Stock an Attractive Pick?

Inorganic Moves: Acquisitions are an important part of Installed Building Products’ growth strategy. This led to the diversification of its geographies, end markets and products. The company maintains a robust pipeline of acquisition candidates that considers the geographic expansion in the core residential insulation end market and acquisition opportunities that continue end-market and end-product diversification strategies.

During 2022, IBP completed eight acquisitions, representing approximately $109 million in annual revenues, surpassing the company’s target of $100 million in acquired revenues. For 2023, IBP’s acquisition pipeline remains robust, and as a result, it expects to acquire at least $100 million of revenues again in 2023.

Higher Return on Equity (ROE): Installed Building Products’ trailing 12-month ROE is indicative of its growth potential. ROE for the trailing 12 months is 58.7%, much higher than the industry’s 8.6%, reflecting the company’s efficient usage of shareholders’ funds.

Solid Performance: The company has been capitalizing on the strong end-market demand and the continued success of local branches, which prudently align selling prices with the value IBP offers its customers. Although interest rates continue to increase from historically low levels, the company remains optimistic, given the strong demand for installation services.

The company’s net revenues grew 35.6% year over year to a record $2.7 million in 2022. The price mix improved 23% year over year in 2022. Consistent with the inflationary trends in the construction industry and the increasing demand for services, the company’s pricing strategies and relatively stable product mix contributed to the largest annual increase in price mix it has achieved since becoming a public company.

On a same-branch basis, net revenues improved 24.6% from 2021. Adjusted EBITDA was $439.3 million, reflecting an increase of 53.9% from the prior year. Adjusted EBITDA margin was 16.5%, increasing from 14.5% in the prior year. Meanwhile, the company also returned $200.3 million to shareholders in 2022 through dividends and share repurchases.

Other Top-Ranked Construction Stocks Hogging in the Limelight

Eagle Materials Inc. EXP — holding a Zacks Rank #2 (Buy) — produces and supplies heavy construction materials and light building materials in the United States. You can see the complete list of today’s Zacks #1 Rank stocks here.

EXP’s expected earnings growth rate for fiscal 2023 is 29.4%. This company surpassed earnings estimates in three of the trailing four quarters but met on one occasion, with the average surprise being 4.1%.

Otis Worldwide Corporation OTIS — holding a Zacks Rank #2 — is one of the leading elevator and escalator manufacturing, installation and service companies. Otis’ primary focus on innovation is core to its strategy. The company connects global R&D efforts through an operating model that sets global and local priorities based on customer and segment needs. Its focus is on innovation and expansion of the digital ecosystem, and a suite of digital solutions for both existing service portfolio customers and new equipment shipments from factories.

OTIS surpassed earnings estimates in all of the trailing four quarters, with the average surprise being 4.6%. The company’s earnings for 2023 are expected to increase 8.2%.

Masco Corporation MAS — holding a Zacks Rank #2 — manufactures, sells and installs home improvement and building products.

MAS benefits from its market-leading brands, acquisition synergies and cost-saving move. Notably, its solid long-term growth prospect amid slow housing demand is commendable. MAS’ VGM score is A.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Masco Corporation (MAS) : Free Stock Analysis Report

Eagle Materials Inc (EXP) : Free Stock Analysis Report

Installed Building Products, Inc. (IBP) : Free Stock Analysis Report

Otis Worldwide Corporation (OTIS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance