These Insiders Ramped Up Their Holdings In May – Should You?

While insiders may sell their shareholdings for many reasons, such as personal needs for cash, they tend to buy more shares with one motive in mind – increase their exposure to the company. Insiders have an unparalleled view into their own firm, compared to a typical individual investor, which provide us with a good reason to take a closer look at their bullish sentiment.

Nufarm Limited (ASX:NUF)

Nufarm Limited, together with its subsidiaries, manufactures and sells crop protection products in Australia, New Zealand, Asia, Europe, North America, Latin America, and internationally. The company now has 3247 employees and with the company’s market cap sitting at AUD A$3.12B, it falls under the mid-cap category.

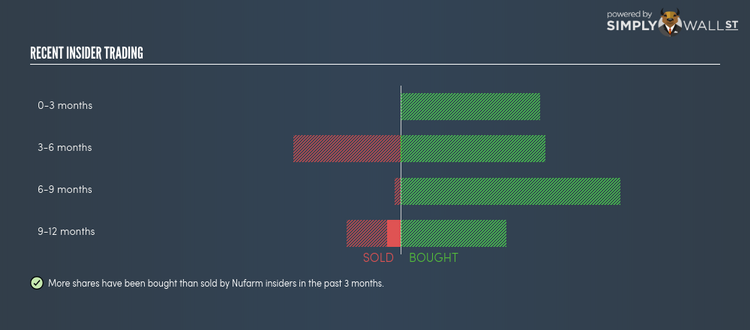

Nufarm Limited’s (ASX:NUF) insiders have invested more than 7 million shares in the large-cap stocks within the past three months. In total, individual insiders own over 26 million shares in the business, which makes up around 7.84% of total shares outstanding.

The insider that recently bought more shares is Marie McDonald (board member) .

The entity that bought on the open market in the last three months was

Ellerston Capital Limited. Although this is an institutional investor, rather than a company executive or board member, the insights gained from direct access to management as a large investor would make it more well-informed than the average retail investor. In this specific instance, I would classify this investor as a company insider.

With a notable expected earnings growth rate of 69.82% in the upcoming year, the current bullish sentiment around the company’s outlook may be a key driver for insiders to rally behind their own stock if they believe this growth potential has not yet been properly factored into the share price. Interested in Nufarm? Find out more here.

Inghams Group Limited (ASX:ING)

Inghams Group Limited, together with its subsidiaries, produces and sells poultry in Australia and New Zealand. Inghams Group was started in 1918 and with the company’s market capitalisation at AUD A$1.46B, we can put it in the small-cap stocks category.

Inghams Group Limited (ASX:ING) is one of Australia’s large-cap stocks that saw some insider buying over the past three months, with insiders investing in more than 24 million shares during this period. In total, individual insiders own over 14 million shares in the business, which makes up around 3.71% of total shares outstanding.

Insiders that have recently bought more shares are: Jacqueline McArthur (board member) . and Linda Nicholls (board member) .

The entity that bought on the open market in the last three months was

UBS Asset Management Vinva Investment Management. Although this is an institutional investor, rather than a company executive or board member, the insights gained from direct access to management as a large investor would make it more well-informed than the average retail investor. In this specific instance, I would classify this investor as a company insider.

Inghams Group’s share price traded at a high of AU$3.90 and a low of AU$3.40 in the past three months. This signals an immaterial change in share price, with a movement of 14.71%. This may mean insiders’ motivation to trade may not be driven by the share price but rather other factors such as their belief in company growth or their personal portfolio rebalancing. More on Inghams Group here.

GBST Holdings Limited (ASX:GBT)

GBST Holdings Limited provides software products for the financial service sector. Founded in 1984, and currently lead by Robert DeDominicis, the company provides employment to 500 people and with the stock’s market cap sitting at AUD A$154.16M, it comes under the small-cap group.

GBST Holdings Limited’s (ASX:GBT) insiders have invested more than 3 million shares in the small-cap stocks within the past three months. In total, individual insiders own over 9 million shares in the business, which makes up around 12.81% of total shares outstanding.

The entity that bought on the open market in the last three months was

Perpetual Limited Pinnacle Investment Management Limited. Although this is an institutional investor, rather than a company executive or board member, the insights gained from direct access to management as a large investor would make it more well-informed than the average retail investor. In this specific instance, I would classify this investor as a company insider.

Over the next three years, analysts expect a robust revenue growth of 23.05% from today’s level, which will drive the meaningful bottom-line growth of 189.74%. GBT’s positive future sentiment could be a key driver of insiders ramping their shares if they believe the growth is not yet reflected in the current share price. Continue research on GBST Holdings here.

For more stocks with high, positive trading volume by insiders, explore this interactive list of stocks with recent insider buying.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance