Have Insiders Been Buying Amcor Limited (ASX:AMC) Shares This Year?

It is not uncommon to see companies perform well in the years after insiders buy shares. On the other hand, we’d be remiss not to mention that insider sales have been known to precede tough periods for a business. So before you buy or sell Amcor Limited (ASX:AMC), you may well want to know whether insiders have been buying or selling.

Do Insider Transactions Matter?

It is perfectly legal for company insiders, including board members, to buy and sell stock in a company. However, such insiders must disclose their trading activities, and not trade on inside information.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But equally, we would consider it foolish to ignore insider transactions altogether. As Peter Lynch said, ‘insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.’

See our latest analysis for Amcor

Want to help shape the future of investing tools? Participate in a short research study and receive a 6-month subscription to the award winning Simply Wall St research tool (valued at $60)!

The Last 12 Months Of Insider Transactions At Amcor

In the last twelve months, the biggest single purchase by an insider was when Independent Non-Executive Chairman Graeme Liebelt bought AU$401k worth of shares at a price of AU$13.32 per share. That means that an insider was happy to buy shares at around the current price. That means they have been optimistic about the company in the past, though they may have changed their mind. We generally consider it a positive if insiders have been buying on market, even if the share price has increased a bit since then.

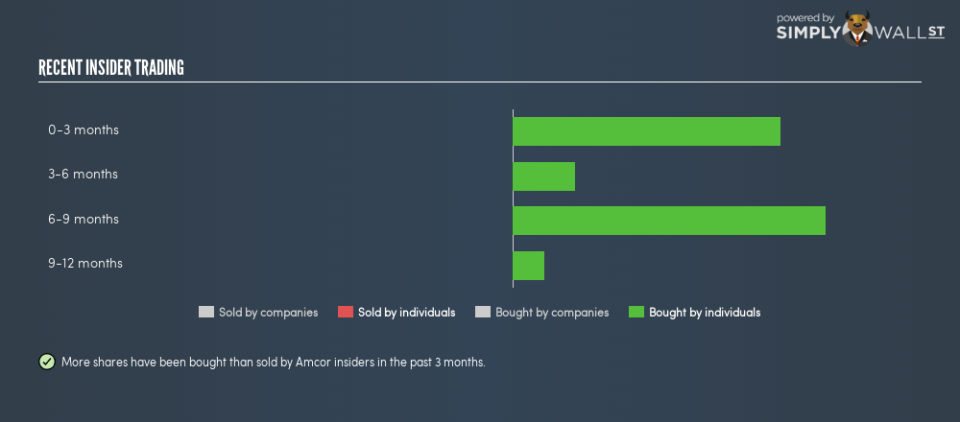

Happily, we note that in the last year insiders bought 75.59k shares for a total of AU$1.0m. In total, Amcor insiders bought more than they sold over the last year. The average buy price was around AU$13.48. These transactions show that insiders have confidence to invest their own money in the stock, albeit at slightly below the recent price of AU$13.58. The chart below shows insider transactions (by individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Insiders at Amcor Have Bought Stock Recently

Over the last three months, we’ve seen significant insider buying at Amcor. Specifically, Graeme Liebelt bought US$401k worth of shares in that time, and we didn’t record any sales whatsoever. That shows some optimism about the company’s future.

Does Amcor Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. I reckon it’s a good sign if insiders own a significant number of shares in the company. Amcor insiders own about AU$28m worth of shares. That equates to 0.2% of the company. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

What Might The Insider Transactions At Amcor Tell Us?

It is good to see recent insider purchase. And the longer term insider transactions also give us confidence. Insiders likely see value in Amcor shares, given these transactions (along with notable insider ownership of the company). Therefore, you should should definitely take a look at this FREE report showing analyst forecasts for Amcor.

But note: Amcor may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance