Infosys (INFY) Implements AssistEdge at Telekom Malaysia

Infosys Limited’s INFY wholly-owned subsidiary, EdgeVerve Systems, recently announced that it has successfully implemented AssistEdge at Telekom Malaysia (TM) under the One View Application Layout program.

EdgeVerve Systems’ AssistEdge has played a crucial role in boosting productivity and efficiency across the customer service centers of Telekom. This has also lowered the average call handling time, thus enhancing customer service quality.

Notably, AssistEdge facilitates quicker resolution of query apart from enhancing customer experience by allowing Telekom to automate all the relevant data required by agents. The solution also makes it simpler for agents to navigate systems by enabling a single window dashboard for all contact centre applications. On implementation, AssistEdge significantly reduces the overall time required to update all systems resulting in increase in productivity and operational efficiency.

Our Take

Infosys’ services and software, which were earlier rolled out, are proving conducive to its top-line growth. For instance, in third-quarter fiscal 2018, new services, in the cloud first and artificial intelligence (AI) first digital experience service area contributed to 9.9% of revenues. Also, software services comprising of Edge, Panaya and Skava contributed to 1.7% of revenue growth in the quarter.

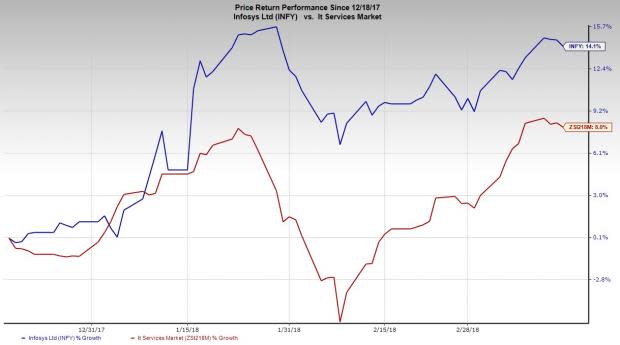

Moreover, the company’s integrated AI platform, Nia, is aiding the accelerating pace of the adopted technology. Of late, cyber security is also acting as one of the company’s prominent profit churners. Notably, the Zacks Rank #3 (Hold) company’s stock has appreciated 14.1% in the past three months, outperforming the industry’s gain of 7.9%.

Meanwhile, the company has been strengthening its core competencies by pursuing strategic collaborations and acquisitions. Going ahead, Infosys has plans to work on areas, including utilization and cost optimization, to boost operational efficiency. This apart, its “Renew New” program that includes restructuring of customer-centric functions, streamlining of sales function, unification of delivery systems and redesigning of other fee and oral processes, is proving to be extremely beneficial allowing the company to offset major challenges.

However, rapid proliferation of customizable internet-based software has been hampering Infosys’ traditional outsourcing business. Also, management believes that economic conditions in many of its markets remain quite challenging, which might weigh on the company’s profitability, moving ahead.

Key Picks

Some better-ranked stocks from the same space are ManTech International Corporation MANT, ASML Holding N.V. ASML and Kemet Corporation KEM. While ManTech International sports a Zacks Rank #1 (Strong Buy), ASML Holding and Kemet carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

ManTech International has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 9.4%.

ASML Holding has outpaced estimates in the preceding four quarters, with an average positive earnings surprise of 18.8%.

Kemet has surpassed estimates thrice in the preceding four quarters, with an average positive earnings surprise of 39.5%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ManTech International Corporation (MANT) : Free Stock Analysis Report

Infosys Limited (INFY) : Free Stock Analysis Report

Kemet Corporation (KEM) : Free Stock Analysis Report

ASML Holding N.V. (ASML) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance