INFLATION — What you need to know in markets on Wednesday

The biggest inflation report in a long time is due out on Wednesday.

At 8:30 a.m. ET, the Bureau of Economic Analysis will release the January consumer price index, a key check on whether inflation pressures are beginning to accelerate in the U.S. economy. The January reading on retail sales will also come out Wednesday morning, with an expected slowdown from December expected.

Recall that back on February 2, the January jobs report showed that wages rose 2.9% over the prior year, more than expected and a sign that inflation could return to the economy more quickly than expected. This sent Treasury yields higher, pressuring stock prices and beginning the stock market chaos last week that twice saw the Dow lose more than 1,000 points in a single trading session.

Expectations are for headline CPI — which includes the more volatile costs of food and gas that the Fed prefers to exclude from its inflation readings — to rise 0.3% over the prior month and 1.9% over the prior year. “Core” inflation is expected to rise 0.2% over the prior month and 1.7% over the prior year.

And yet with investors on high-alert for any signs that much-feared inflation is returning to the economy, even an in-line report could send interest rates higher. Additionally, Wednesday’s report comes at the beginning of what some economists expect will be a sustained move higher in consumer prices as we head into the spring.

Torsten Sløk, chief international economist at Deutsche Bank, noted in an email on Tuesday that economists surveyed by Bloomberg expect core inflation to average 1.8% in the second quarter of the year, up from 1.5% in the first quarter. “I currently spend significant amounts of time on the phone, emails, and in meetings explaining this coming jump in the March and April inflation data,” Sløk said. “And I have come to the conclusion that this is not priced in to rates at all.”

The sooner markets start to price this in, the sooner we’re likely to see interest rates rise further.

On the earnings side, Wednesday is expected to feature reports from Cisco (CSCO), Marriott (MAR), Molson Coors (TAP), TripAdvisor (TRIP), and Groupon (GRPN).

Small businesses can’t find workers

It’s really hard for small businesses to find workers right now.

According to the latest small business optimism report from the National Federation for Independent Business, 89% of firms trying to hire reported few or no qualified applicants for the positions they were trying to fill.

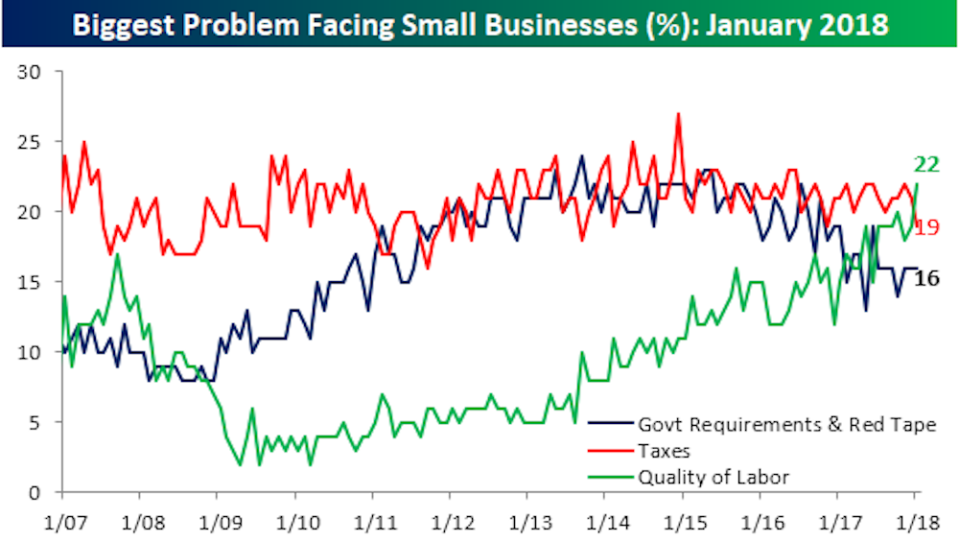

And as Bespoke Investment Group noted Tuesday, for the first time since at least 2007 labor is cited as a bigger problem facing businesses than either taxes or government regulations.

“One would think that it is only a matter of time before the higher wages that employers will have to pay to attract quality labor will become a problem,” Bespoke writes.

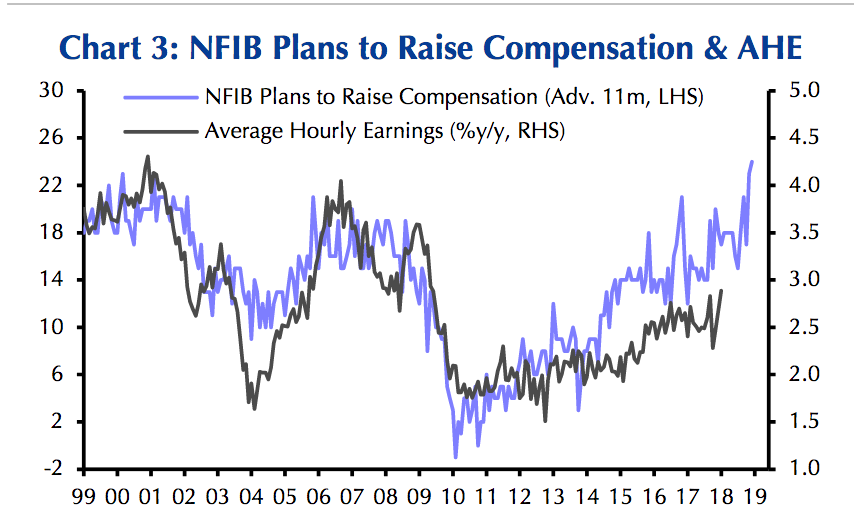

In a note to clients on Tuesday, Andrew Hunter, U.S. economist at Capital Economics, said Tuesday’s data from the NFIB also pointed to higher wages with 34% of firms unable to fill a job vacancy in January. “The net share of firms planning to raise compensation over the next three months rose to 24% in January, its highest in 29 years,” Hunter writes.

“At face value, that points to a fairly sharp rise in average hourly earnings growth from the current 2.9% to above 4% over the next 12 months. The rising share of firms saying that labour quality is their biggest problem points to a similar acceleration.”

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

One candidate for Amazon’s next headquarters looks like a clear frontrunner

Tax cuts are going to keep being a boon for the shareholder class

Auto sales declined for the first time since the financial crisis in 2017

Foreign investors might be the key to forecasting a U.S. recession

It’s been 17 years since U.S. consumers felt this good about the economy

Yahoo Finance

Yahoo Finance