Indian Exchange Growth Companies With Up To 37% Insider Ownership

The Indian stock market has experienced a slight decline of 1.7% over the last week, yet it boasts an impressive annual growth of 38%, with earnings projected to increase by 16% per annum. In such a robust market, companies with high insider ownership can be particularly appealing, as this often reflects confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.1% |

Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 28.6% |

Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 38% | 22.9% |

Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 33.1% |

Pricol (NSEI:PRICOLLTD) | 25.5% | 26.9% |

Aether Industries (NSEI:AETHER) | 31.1% | 39.8% |

Let's explore several standout options from the results in the screener.

Apollo Hospitals Enterprise

Simply Wall St Growth Rating: ★★★★★☆

Overview: Apollo Hospitals Enterprise Limited operates a network of hospitals, diagnostic clinics, and pharmacies primarily in India, offering a range of healthcare services with a market capitalization of approximately ₹857.24 billion.

Operations: The company generates ₹99.39 billion from healthcare services, ₹13.64 billion from retail health and diagnostics, and ₹78.27 billion from digital health and pharmacy distribution.

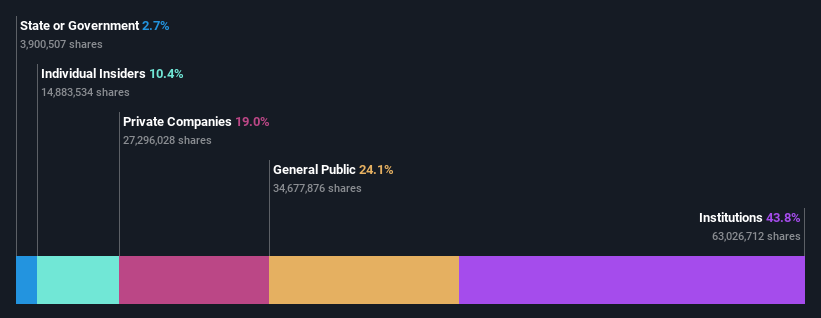

Insider Ownership: 10.4%

Apollo Hospitals Enterprise has demonstrated robust growth with earnings increasing by 25% annually over the past five years. Looking ahead, significant growth is anticipated, with earnings expected to rise by 33.07% annually and revenue forecasted to grow at 15.9% per year, outpacing the Indian market's average of 9.5%. Although insider buying data is not available for the last three months, the company’s high Return on Equity (23.6%) indicates efficient management of shareholders' equity. Recent leadership changes align with strategic shifts towards expanding its digital health and omni-channel pharmacy sectors, potentially enhancing long-term value creation for stakeholders.

Info Edge (India)

Simply Wall St Growth Rating: ★★★★☆☆

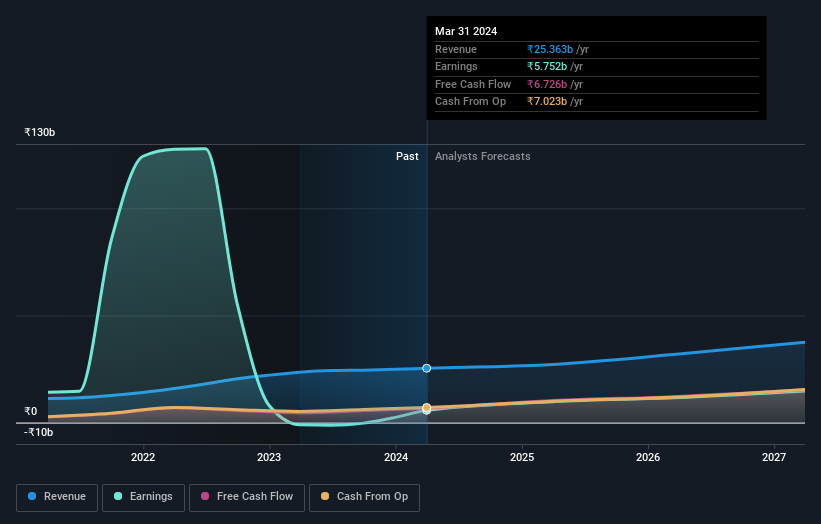

Overview: Info Edge (India) Limited, with a market cap of approximately ₹790.23 billion, operates as an online classifieds company focusing on recruitment, matrimony, real estate, and education sectors both domestically and internationally.

Operations: The company generates revenue primarily through recruitment solutions amounting to ₹18.80 billion, followed by real estate services under the brand 99acres, which contribute ₹3.51 billion.

Insider Ownership: 37.9%

Info Edge (India) has shown a significant turnaround this fiscal year, transitioning from a net loss to reporting substantial net income and revenue growth. Despite high insider ownership, recent months have seen more insider selling than buying. The company's earnings are expected to grow significantly over the next three years, outpacing the Indian market's average. However, its dividend track record remains unstable and Return on Equity is projected to be low in three years' time.

Varun Beverages

Simply Wall St Growth Rating: ★★★★★☆

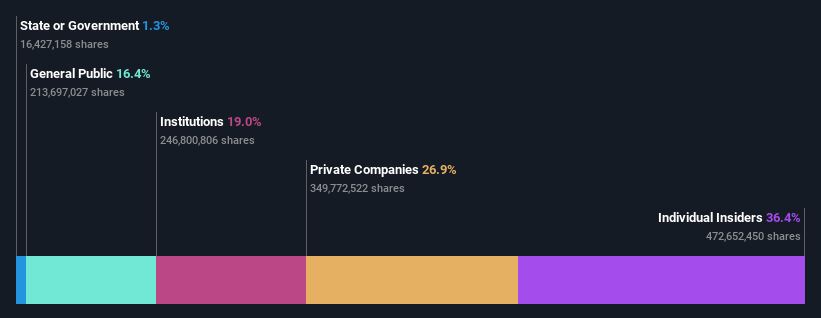

Overview: Varun Beverages Limited operates as a franchisee of PepsiCo, producing and distributing carbonated soft drinks and non-carbonated beverages, with a market capitalization of approximately ₹1.95 trillion.

Operations: The company generates revenue primarily through the manufacturing and sale of beverages, amounting to ₹164.67 billion.

Insider Ownership: 36.4%

Varun Beverages demonstrates robust growth prospects with its earnings expected to outpace the broader Indian market. Recent expansions into Zimbabwe and product launches in Uttar Pradesh underline its strategic initiatives to boost market presence. However, it operates with a high level of debt, which could be a concern. The appointment of a new CFO with extensive experience might steer financial strategies effectively amidst these expansions. Insider ownership remains substantial, aligning management’s interests with shareholder value.

Turning Ideas Into Actions

Get an in-depth perspective on all 81 Fast Growing Indian Companies With High Insider Ownership by using our screener here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:APOLLOHOSP NSEI:NAUKRI and NSEI:VBL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance