Incyte (INCY) to Post Q2 Earnings: Will Jakafi Sales Disappoint?

Incyte Corporation INCY is scheduled to release second-quarter 2021 results on Aug 3, before market open.

The company has a decent track record. It beat earnings expectations in three of the last four quarters and missed in one, the average surprise being 2.37%. In the last reported quarter, the company beat earnings estimates by 3.08%.

Incyte Corporation Price, Consensus and EPS Surprise

Incyte Corporation price-consensus-eps-surprise-chart | Incyte Corporation Quote

Factors to Note

Incyte primarily derives product revenues from sales of lead drug, Jakafi, in the United States and Iclusig. Patient demand for Jakafi, a first-in-class JAK1/JAK2 inhibitor, in all approved indications (polycythemiavera, myelofibrosis and refractory acute graft-versus-host disease [GVHD]) was soft in the previous quarter due to a decline in new patient starts as a result of the ongoing pandemic. The situation has most likely improved with the easing of lockdown restrictions. Sales are likely to have increased in the to-be-reported quarter. Jakafi sales were up 1% in the previous quarter and the second quarter has most likely witnessed a sequential increase. The Zacks Consensus Estimate for Jakafi sales stands at $527 million.

The company also earns product royalty revenues from Novartis AG NVS for the commercialization of Jakafi in ex-U.S. markets. Royalty revenues grew 16% in the previous quarter and Incyte has most likely received higher royalties in the quarter under review.

We remind investors that while Jakafi sales and royalties are key catalysts for the company’s revenue growth, Iclusig sales and Olumiant royalties from Eli Lilly also contribute to the top line. Hence, these are likely to have aided the company’s revenues in the to-be-reported quarter. Net product revenues of Iclusig amounted to $25.6 million in the previous quarter and similar or higher levels of contribution are likely to have been witnessed by the company in the to-be-reported quarter. The Zacks Consensus Estimate for Iclusig sales stands at $26.85 million.

Olumiant product royalty revenues came in at $32.3 million in the previous quarter, up 27% year over year, and similar levels of growth are likely to have boosted the top line in the to-be-reported quarter.

Incremental sales from newly approved drugs are likely to have boosted sales. The FDA approved Pemazyre (pemigatinib), a kinase inhibitor indicated for the treatment of adults with previously treated, unresectable, locally advanced or metastatic cholangiocarcinoma. Sales in the previous quarter came in at $13.4 million and the quarter under review has most likely witnessed a sequential increase.

Incyte also receives royalties from sales of Tabrecta (capmatinib) for the treatment of adult patients with metastatic non-small cell lung cancer (NSCLC). Its partner Novartis has exclusive worldwide development and commercialization rights to Tabrecta. Royalties from the same might have resulted in incremental sales in the second quarter.

Operating expenses are likely to have increased due to an increase in R&D expenses and selling, general and administrative expenses.

Key Pipeline Updates

Apart from the regular top and bottom-line numbers, we expect investors to focus on the company’s pipeline updates.

The FDA extended the review period for Incyte’s new drug application (NDA) for ruxolitinib cream for the treatment of atopic dermatitis (AD). The Prescription Drug User Fee Act (PDUFA) action date has been extended by three months to Sep 21, 2021.

The agency also extended the review period for the supplemental new drug application (sNDA) for Jakafi (ruxolitinib), by three months. The sNDA is seeking the label expansion of the drug for the treatment of adult and pediatric patients aged 12 years and older with steroid-refractory chronic GVHD. The FDA recently issued a Complete Response Letter (CRL) for the biologics license application (BLA) for its intravenous PD-1 inhibitor, retifanlimab, for the treatment of adult patients with locally advanced or metastatic squamous cell carcinoma of the anal canal (SCAC) who have progressed on, or who are intolerant of, platinum-based chemotherapy.

Updates on the same will be awaited on the call.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Incyte this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Unfortunately, that is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP for Incyte is -16.33% as the Zacks Consensus Estimate is pegged at 74 cents while the Most Accurate Estimate is pegged at 62 cents.

Zacks Rank: It currently carries a Zacks Rank #4 (Sell).

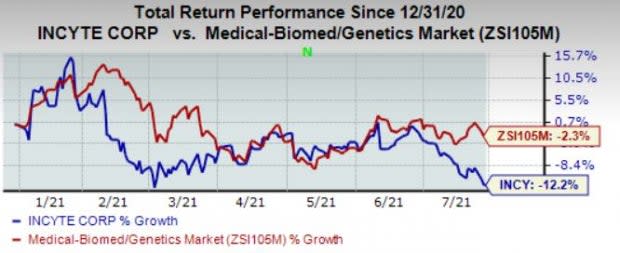

Share Price Performance

Incyte’s stock has lost 12.2% in the year so far compared with the industry’s 2.3% decline.

Image Source: Zacks Investment Research

Stocks to Consider

Here are a few stocks you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat.

Ironwood Pharmaceuticals IRWD has an Earnings ESP of +11.11% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

AbbVie ABBV has an Earnings ESP of +0.56% and a Zacks Rank #3.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

Ironwood Pharmaceuticals, Inc. (IRWD) : Free Stock Analysis Report

Incyte Corporation (INCY) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance