Important CAD Pairs’ Technical Overview: 12.07.2018

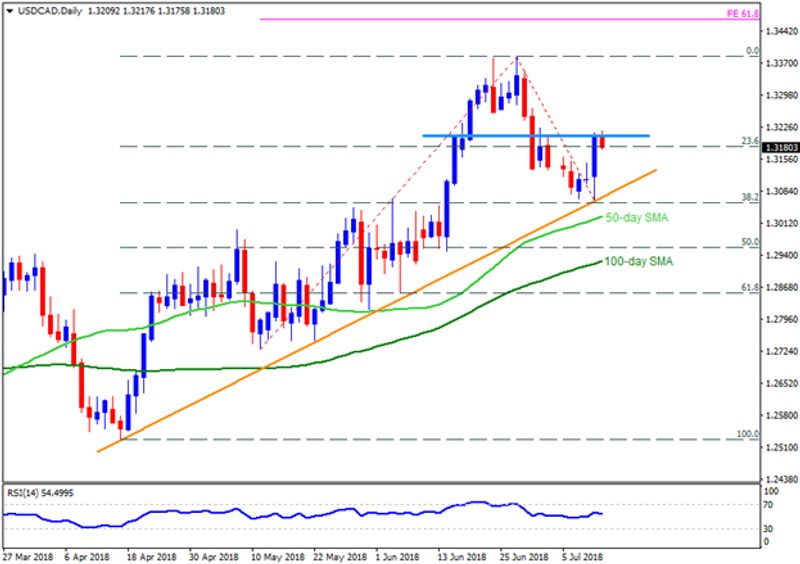

USD/CAD

USDCAD’s bounce off the three-month old ascending trend-line presently struggles with 1.3200-1.3210 horizontal-region in order to justify its strength in targeting the 1.3260 and the 1.3340 resistances. In case the pair manage to extend its recovery beyond 1.3340 on a daily closing basis, the 1.3385 and the 1.3470, comprising 61.8% FE can please the Bulls. On the contrary, the 1.3130-20 is likely immediate support for the pair to test during its pullback before revisiting the 1.3060 TL figure. Assuming that the quote keep declining beneath the 1.3060, the 50-day SMA level of 1.3025 and the 1.3000 round-figure can act as buffers prior to highlighting the 1.2925 mark, encompassing 100-day SMA.

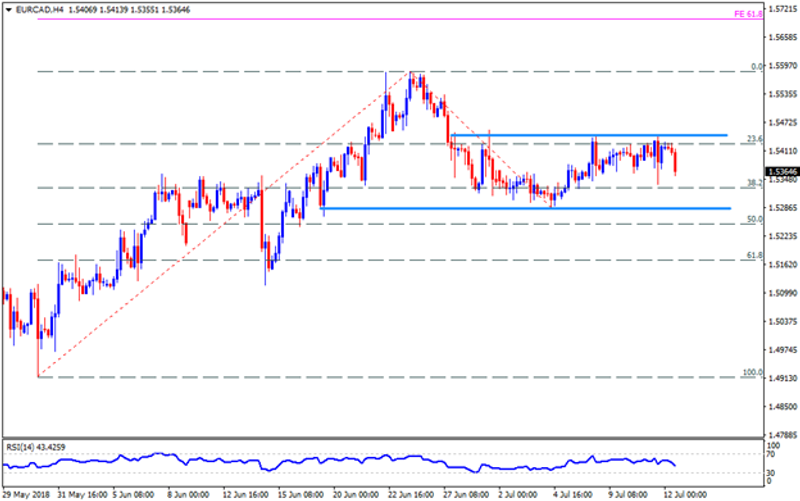

EUR/CAD

Having failed to surpass the 1.5440-45 resistance-zone, the EURCAD seems inclined to re-test the 1.5285-80 support-area; however, the 1.5340 can offer intermediate halt to the pair. Should prices dip below 1.5280, the 1.5220 and the 1.5150 are expected following rests that can be availed if holding short positions. Let’s say the pair surpasses the 1.5445 upside barrier, then it can quickly rise to 1.5480 and the 1.5540 resistances. Moreover, pair’s successful rally above 1.5540 can push buyers to aim for the 1.5585 and the 61.8% FE level of 1.5700.

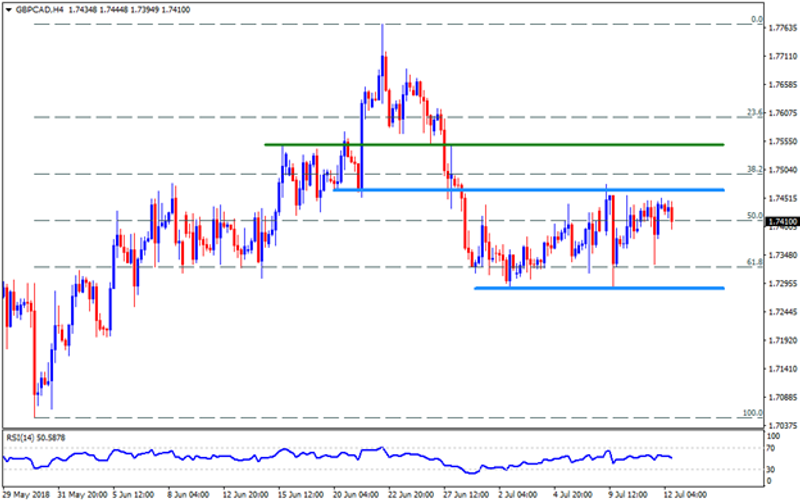

GBP/CAD

Even after bouncing off the 1.7285-95 support-region, the GBPCAD has to clear the 1.7460-70 hurdle if the pair is to make itself eligible for the 1.7515 and the 1.7550 resistances. Given the pair crosses the 1.7550, the 1.7580, the 1.7615 and the 1.7670 could try challenging the optimists ahead of channeling market attention towards recent high of 1.7770. Alternatively, the 1.7360, the 1.7360 and the 1.7295-85 may offer nearby supports to the pair, breaking which the 1.7250 and the 1.7200 could entertain the sellers. During the pair’s additional declines below 1.7200, the 1.7110 and the 1.7050 may appear in the traders’ radar.

CAD/JPY

With more than six-month old descending trend-line restricting the CADJPY’s immediate upside, together with overbought RSI, the pair is likely witnessing profit-booking towards the 84.70 and the 84.40 but 100-day SMA level of 83.95 may limit its further south-run. If the pair refrains to respect the 83.95 SMA number, the 83.50, the 83.00 and an upward slanting trend-line, at 82.40, should be watched carefully. Meanwhile, pair’s ability to run above the 85.45 TL on a daily closing basis can escalate its north-run to 85.90 and the 200-day SMA level of 86.20 whereas 86.70-80 horizontal-region can provide tough resistance afterwards. In case prices continue rallying beyond 86.80, the 87.80 and the 88.30 could become crucial.

This article was originally posted on FX Empire

More From FXEMPIRE:

Gold Price Edges Up On Sino-US Trade War Woes & Sour NATO Proceedings

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – July 12, 2018 Forecast

E-mini S&P 500 Index (ES) Futures Technical Analysis – July 12, 2018 Forecast

U.S Inflation Figures and ECB Minutes to Drive the USD and the EUR

USD/JPY Fundamental Daily Forecast – Could Spike to 113 Handle if US CPI Beats Estimate

Yahoo Finance

Yahoo Finance