Important AUD Pairs’ Technical Outlook: 14.11.2018

AUD/USD

While pullbacks from 0.7235-40 indicate the AUDUSD’s dip to re-test fortnight old ascending TL, at 0.7180 now, it’s further declines are less likely as not only upward slanting support-line but the 0.7165-60 area also stands ready to challenge the sellers. As a result, chances of the pair’s U-turn to 0.7265 on the break of 0.7240 are much brighter while 0.7300-0.7305 could confine the quote’s upside then after. If at all the pair rises past-0.7305, the 61.8% FE level of 0.7340 may flash on the chart. On the contrary, pair’s slide beneath 0.7160 can recall the 0.7125 and the 0.7100 supports whereas 0.7055 might trouble additional south-run. Assuming the Bears’ refrain to respect 0.7055 level, the 0.7020 and the 0.7000 can become their favorites.

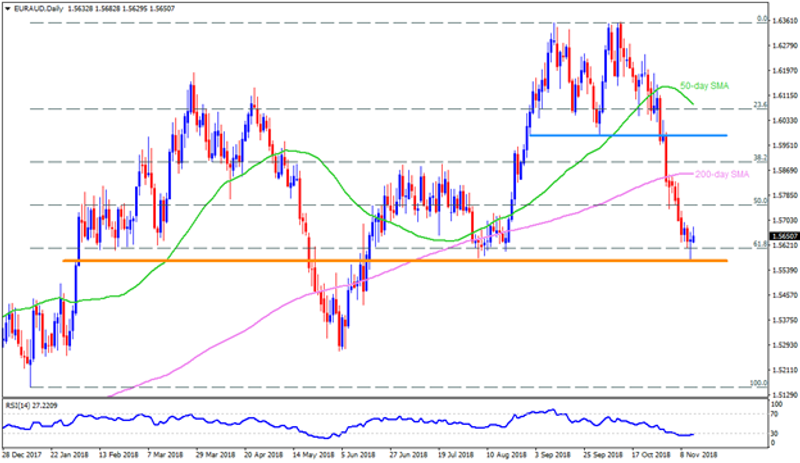

EUR/AUD

EURAUD’s bounce off the 1.5575-65 could help the pair to visit 1.5700 round-figure while the 1.5800 & 200-day SMA level of 1.5855 might raise the bar for its extended rise. Should prices rally beyond 1.5855, the 1.5885-90, the 1.5950 and the 1.5980-85 can entertain the buyers. Alternatively, a D1 close below 1.5565 highlights the importance of 1.5530 and the 1.5460 as rest-points, breaking which 1.5360 may appear on the pessimists’ radar to target. Moreover, pair’s sustained downturn after 1.5360 could question the strengths of 1.5270, 1.5200 and 1.5150 as supports.

AUD/CAD

Even after breaking eight-month old descending resistance-line & 100-day SMA confluence, the AUDCAD still struggles to lure Bulls as 0.9570 repeatedly activates the pair’s profit-booking moves. Though, the pair needs to provide a daily closing beneath 0.9485-80 support-confluence in order to claim 0.9410 rest-point. If at all the pair continue trading downwards below 0.9410, the 50-day SMA level of 0.9335 and the 0.9250 trend-line number seem crucial to observe. Let’s say the pair manage to surpass 0.9570 barrier, then it can aim for 0.9610 and the 200-day SMA level of 0.9665. It should also be noted that successful clearance of 0.9665 enables the pair to confront 0.9720 & 0.9780 resistance-levels.

AUD/CHF

Inability to conquer 200-day SMA keep making the AUDCHF liable to meet the 0.7220 and the 0.7170 mark, comprising 100-day SMA. However, 0.7120-30 horizontal-region and the 0.7085 TL support can limit the pair’s further downside, if not then 0.7025 and the 0.7000 may gain market attention. Meanwhile, the 0.7295-0.7300 resistance-zone, encompassing 200-day SMA, acts as immediate upside hurdle for the pair, breaking which 0.7320 and ten-month long downward slanting resistance-line, at 0.7400, could play their roles. In case the quote successfully crosses 0.7400 mark, the 0.7445 & the 0.7500 could be looked closely if holding long position.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance