Immutep (IMMP) Surges 65% on Upbeat Lung Cancer Study Data

Shares of Immutep Limited IMMP surged 64.8% on May 17, after it announced positive data from part A of the phase II TACTI-002 study that evaluated the combination use of its lead pipeline candidate, eftilagimod alpha (“efti”) in first-line (“1L”) non-small cell lung cancer (“NSCLC”).

Part A of the TACTI-002 study, which evaluated the combination of efti and Merck‘s MRK blockbuster anti-PD-1 therapy Keytruda (pembrolizumab), achieved robust initial overall survival (“OS”) in patients with 1L NSCLC, regardless of PD-L1 expression status. An initial median OS of 25 months was achieved in 1L NSCLC patients who have a PD-L1 tumor proportion score (“TPS”) of >1%.

Per Immutep, this initial median OS of 25-months attained in patients receiving efti plus Merck’s Keytruda was significantly higher than patients who received other anti-PD-1 monotherapy and various immune checkpoint inhibitor combinations with and without chemotherapy. Management believes that adding efti to an anti-PD-1 therapy like Merck’s Keytruda provided deep and durable responses in study participants, without any additional toxicity.

Based on these results, the data monitoring committee recommends extending overall survival follow-up collection to show mature 3-year and potentially 5-year OS rates of the efti-Keytruda combination. Immutep intends to present more mature data from the TACTI-002 study later this year at a medical meeting.

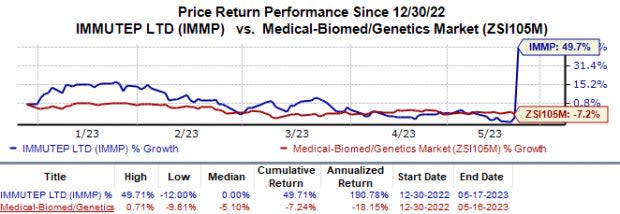

In the year so far, shares of Immutep have increased 49.7% against the industry’s 7.2% fall.

Image Source: Zacks Investment Research

Merck’s Keytruda is already approved for the treatment of many cancers globally. Keytruda sales are gaining from continued strong momentum in metastatic indications, including in some types of NSCLC, renal cell carcinoma, head and neck squamous cell carcinoma (“HNSCC”), TNBC and MSI-H cancers and a rapid uptake across recent earlier-stage launches. Keytruda is continuously growing and expanding into new indications and markets globally. In first-quarter 2023, Merck recorded $5.8 billion from Keytruda product sales.

The TACTI-002 study is also evaluating the efti-Keytruda combination in two other parts — second-line NSCLC indication and second-line HNSCC.

Last October, the FDA granted fast track designation to efti-Keytruda combo in 1L NSCLC based on early data from the TACTI-002 study. The efti plus Keytruda combination has already been granted a fast-track designation for 1L HNSCC.

Earlier this week, Immutep announced that it has received positive feedback from the FDA on its plans for a late-stage study evaluating efti-Keytruda combination in 1L NSCLC patients based on which it will seek approval. The late-stage study will be called TACTI-004.

Zacks Rank & Stocks to Consider

Immutep currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector include ANI Pharmaceuticals ANIP and Allogene Therapeutics ALLO. While ANI Pharmaceuticals sports a Zacks Rank #1 (Strong Buy), Allogene carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2023 earnings per share have increased from $2.42 to $3.31. During the same period, the earnings estimates per share for 2024 have risen from $3.76 to $4.32. Shares of ANI Pharmaceuticals are up 10.6% in the year-to-date period.

Earnings of ANI Pharmaceuticals beat estimates in each of the last four quarters, delivering an average earnings surprise of 68.64%. In the last reported quarter, ANI Pharmaceuticals’ earnings beat estimates by 244.12%.

In the past 60 days, estimates for Allogene Therapeutics’ 2023 loss per share have improved from $2.50 to $2.32. During the same period, the loss estimates per share for 2024 have narrowed from $2.48 to $2.21. Shares of Allogene Therapeutics have declined 2.7% in the year-to-date period.

Earnings of Allogene Therapeutics beat estimates in three of the last four quarters while missing the mark on one occasion. On average, the company’s earnings witnessed a surprise of 5.08%. In the last reported quarter, Allogene Therapeutics’ earnings beat estimates by 7.94%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

Prima BioMed Ltd (IMMP) : Free Stock Analysis Report

Allogene Therapeutics, Inc. (ALLO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance