Immunovant (IMVT) Sees Wider Q4 Loss, to Study Batoclimab in TED

Immunovant, Inc. IMVT reported net loss of 41 cents per share in the fourth quarter of fiscal 2022 (ended Mar 31, 2022), wider than the Zacks Consensus Estimate of a loss of 38 cents. In the year-ago quarter, the company had reported a loss of 29 cents.

Currently, the company does not have any approved product in its portfolio. As a result, it is yet to generate revenues.

Shares of Immunovant lost 8.2% on Wednesday following the announcement of the news. The stock has plunged 54% in the year so far compared with the industry’s decrease of 23.2%.

Image Source: Zacks Investment Research

Quarter in Detail

In the reported quarter, research and development (R&D) expenses were $32 million, up 72% from the year-ago quarter. The year-over-year surge was due to increased personnel-related expenses, higher costs of cross-indication clinical studies and clinical research costs.

General and administrative (G&A) expenses were $15.2 million in the reported quarter, up 47.5% on a year-over-year basis. The uptick was primarily due to increased personnel-related expenses as well as other professional costs.

As of Mar 31, 2022, the company had cash balance of approximately $493.8 million compared with $527 million as of Dec 31, 2021.

With its existing cash balance, Immunovant expects to fund its operating expenses and capital expenditure requirements through 2025.

Pipeline Update

Immunovant is developing its lead pipeline candidate, batoclimab, as a subcutaneous injection for the treatment of myasthenia gravis (“MG”) and thyroid eye disease (“TED”).

Along with its earnings release, Immunovant announced that it has achieved alignment with the FDA’s Division of Ophthalmology to initiate two phase III studies evaluating batoclimab for treating TED.

The two placebo-controlled phase III studies evaluating batoclimab in TED are expected to begin in the second half of 2022. Top-line data from both studies are expected in the first half of 2025.

Per the company, the potential success of said studies can support registration of batoclimab for TED.

This apart, Immunovant remains on track to initiate a pivotal phase III study evaluating batoclimab for the treatment of MG by the end of the ongoing month. Top-line data from the same is expected in the second half of 2024.

In the absence of a marketed drug, successful development of batoclimab remains the main focus of the company.

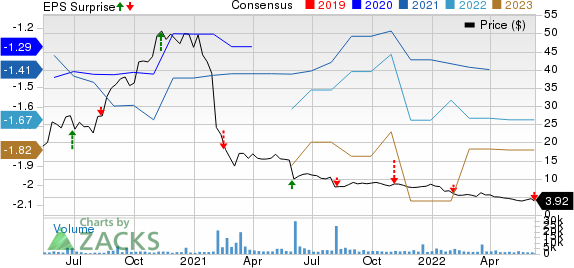

Immunovant, Inc. Price, Consensus and EPS Surprise

Immunovant, Inc. price-consensus-eps-surprise-chart | Immunovant, Inc. Quote

Zacks Rank & Stocks to Consider

Immunovant currently carries a Zacks Rank #4 (Sell).

Better-ranked stocks in the biotech sector are Leap Therapeutics, Inc. LPTX, Anavex Life Sciences Corp. AVXL and Precision BioSciences, Inc. DTIL, all carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Leap Therapeutics’ loss per share has narrowed 11.1% for 2022 and 5.9% for 2023 in the past 60 days.

Earnings of Leap Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion. LPTX delivered an earnings surprise of 1.92%, on average.

Anavex Life Sciences’ loss per share estimates narrowed 12.6% for 2022 and 3.2% for 2023 in the past 60 days.

Earnings of Anavex Life Sciences have surpassed estimates in two of the trailing four quarters and missed the same on the other two occasions. AVXL delivered an earnings surprise of 0.48%, on average.

Precision BioSciences’ loss per share estimates narrowed 21.7% for 2022 and 31.4% for 2023 in the past 60 days.

Earnings of Precision BioSciences have surpassed estimates in each of the trailing four quarters. DTIL delivered an earnings surprise of 76.15%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Anavex Life Sciences Corp. (AVXL) : Free Stock Analysis Report

Leap Therapeutics, Inc. (LPTX) : Free Stock Analysis Report

Precision BioSciences, Inc. (DTIL) : Free Stock Analysis Report

Immunovant, Inc. (IMVT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance