Immunovant (IMVT) Falls as Q4 Earnings Miss, Pipeline in Focus

Immunovant, Inc. IMVT reported fourth-quarter fiscal 2024 net loss of 52 cents per share, wider than the Zacks Consensus Estimate of a loss of 43 cents. The reported figure is also wider than the year-ago quarter's loss of 46 cents per share.

Currently, Immunovant does not have any approved product in its portfolio. As a result, it has yet to generate revenues.

Quarter in Detail

Research and development (R&D) expenses totaled $66.1 million, up 27% from the year-ago quarter’s reported figure. The year-over-year rise can be attributed to increased operational costs and R&D activities for IMVT-1402 and batoclimab programs.

General and administrative expenses amounted to $14.8 million, up 19% on a year-over-year basis. The rise was primarily due to an increase in personnel-related expenses and legal and other professional fees.

As of Mar 31, 2024, Immunovant had a cash balance of $635 million compared with $691 million as of Dec 31, 2023.

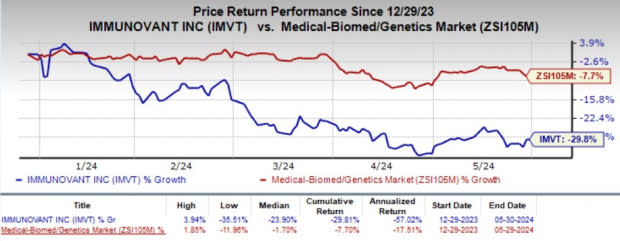

The company’s stock lost 5.3% in the after-market hours as the investors were disappointed by the wider-than-expected fiscal fourth-quarter loss. Year to date, shares of Immunovant have plunged 29.8% compared with the industry’s 7.7% decline.

Image Source: Zacks Investment Research

Fiscal FY24 Result

Immunovant reported a loss of $1.88 per share for fiscal 2024, wider than the Zacks Consensus Estimate of a loss of $1.78 per share. The company has incurred a loss of $1.71 per share in the previous year.

Pipeline Update

Immunovant has crowned IMVT-1402, a next-generation FcRn inhibitor, as the lead asset going forward given its broad potential across several indications. Management believes that this investigational candidate has a tremendous opportunity in the immunology market based on positive early-stage data reported last year.

Immunovant recently met with the FDA and stated that it Is on track to initiate four to five potentially registrational programs for IMVT-1402in several therapeutic areas, including endocrinology and neurology, over the next fiscal year (ending Mar 31, 2025).

Over the next two fiscal years, IMVT plans to initiate studies in a total of 10 indications for IMVT-1402. The company also expects to achieve financial efficiencies in its IMVT-1402 development program by leveraging the data already available from batoclimab studies.

The broad set of late-stage studies expected to be initiated for IMVT-1402 will include several indications including, Graves’ disease (GD), Myasthenia Gravis (MG) and Chronic Inflammatory Demyelinating Polyneuropathy (CIDP).

Immunovant is evaluating its second candidate, batoclimab, in several ongoing mid-late-stage studies across different autoimmune indications, including GD, MG, CIDP and thyroid eye disease (TED).

Top-line results from the MG study of batoclimab are expected by the end of this fiscal year (Mar 31, 2025). Given the profile of IMVT-1402 compared with batoclimab, Immunovant expects to initiate a potentially registrational program for IMVT-1402 in MG by March-end 2025. A final decision will be made based on the results of the batoclimab MG study.

IMVT may also transition its batoclimab CIDP study to a registrational CIDP program with IMVT-1402. The company believes that the data from the ongoing batoclimab CIDP study will substantially benefit the design of a potentially registrational study with IMVT-1402 for the same indication.

Given the significant role that the batoclimab CIDP study results will play, the company has decided to run the batoclimab CIDP study approximately two quarters longer before reporting data to better ensure that it can be used to optimize the IMVT-1402 CIDP study design.

Immunovant also expects to report detailed results from the batoclimab study for GD, along with an overview of the company’s development plan for IMVT-1402 in GD in the fall of 2024.

Furthermore, the company is also scheduled to share top-line data from the TED study of batoclimab in the first half of 2025. Such results will form the basis of a decision regarding which Immunovant’s asset, batoclimab or IMVT-1402, will advance to registration in TED.

Immunovant, Inc. Price and EPS Surprise

Immunovant, Inc. price-eps-surprise | Immunovant, Inc. Quote

Other Updates

The U.S. patent grant for IMVT-1402 in March 2024 also reaffirms the company’s innovation in developing novel therapies for diseases with high unmet medical needs. The patent will ensure market exclusivity for the candidate until 2043.

Immunovant’s stock price gained temporarily during market hours on May 29 after its competitor, Biohaven BHVN, failed to meet investor expectations concerning mean IgG lowering in the early-stage study evaluating four doses of its lead candidate, BHV-1300, in separate cohorts for IgG-mediated autoimmune indications.

However, both IMVT-1402 and batoclimab in a phase I study and a phase II GD study, respectively, have shown reductions in IgG upward of 70%, which encouraged investors to place their bets on Immunovant.

Biohaven’s BHV-1300 isa first-in-human IgG degrader.

BHVN reported that treatment of healthy subjects with the candidate led to dose-dependent and rapid IgG reductions within hours of administrationin the first four cohorts completed to date. Some subjects experienced IgG reductions as low as 50-70% of baseline.

Per Biohaven, it plans to evaluate approximately six cohorts of the candidate in the phase I study, based on the encouraging level of IgG lowering observed to date. BHVN expects to achieve more than 70% lowering of IgG in the planned additional cohorts of the phase 1 study.

Zacks Rank and Other Stocks to Consider

Immunovant currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the drug/biotech industry are ALX Oncology Holdings ALXO and Entera Bio Ltd. ENTX, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for ALX Oncology’s 2024 loss per share has narrowed from $3.33 to $2.89. During the same period, the consensus estimate for 2025 loss per share has narrowed from $2.85 to $2.73. Year to date, shares of ALXO have lost 25.1%.

ALX Oncology beat estimates in two of the trailing four quarters and missed twice, delivering an average negative surprise of 8.83%.

In the past 30 days, the Zacks Consensus Estimate for Entera Bio’s 2024 loss per share has remained constant at 25 cents. During the same period, the consensus estimate for 2025 loss per share has remained constant at 54 cents. Year to date, shares of ENTX have skyrocketed 290%.

ENTX’s earnings beat estimates in three of the trailing four quarters and missed once, delivering an average surprise of 6.50%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biohaven Ltd. (BHVN) : Free Stock Analysis Report

Entera Bio Ltd. (ENTX) : Free Stock Analysis Report

Immunovant, Inc. (IMVT) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance