IBM's (NYSE:IBM) Underwhelming Returns have Potentially Bottomed

This article first appeared on Simply Wall St News .

“ Nobody ever got fired for buying IBM “ – this old Wall Street Proverb has likely been challenged in recent times, as International Business Machines Corporation ( NYSE: IBM )struggled to keep pace with the broad market.

In this article, we will reflect on that and look at the company's actions to stop and potentially reverse this trend.

Latest Developments

Dish Network Corp just signed an agreement to use IBM's technology to help roll out their 5G network. As a part of the ambitious plan to cover at least 20% of the U.S population by the next summer, IBM will help them manage and automate the process.

However, projects do not always go the right way – as demonstrated by the case where the company failed to upgrade Pennsylvania's unemployment computer system and eventually settled for US$33m in penalties. While a trivial sum for a company of this size, this example perfectly shows how things can go wrong with projects with massive, mature companies after the project ran 4 years behind and US$60m over the budget.

Meanwhile, IBM is scoring some PR points by partnering up with Adobe to help the less-privileged students. Two companies are collaborating to offer no-cost visual design coursework to prepare them for an academic or professional career. Learning will be available for free through IBM's SkillsBuild for Students.

Finally, after dropping out in August, IBM is back on the Top of the Crop list by Credit Suisse. This list looks for the high conviction combined with the least demanding market expectations.

See our latest analysis for International Business Machines

Examining the Underperformance

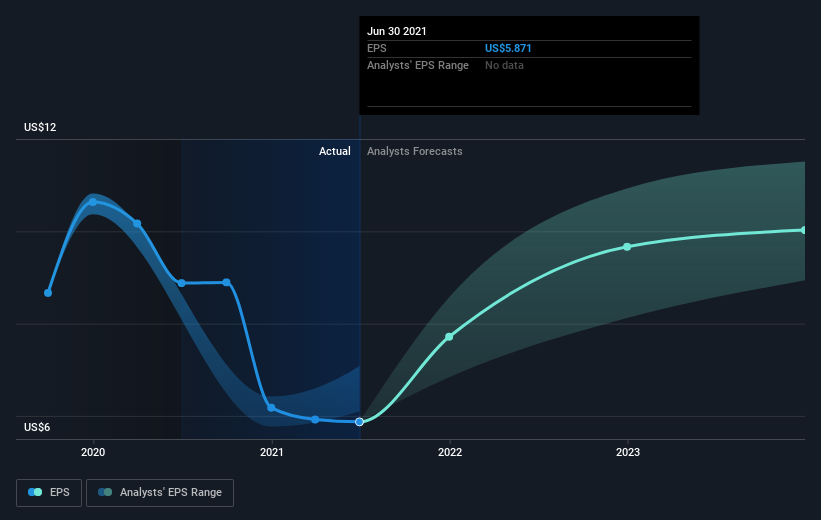

One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the five years over which the share price declined by 12% , International Business Machines' earnings per share (EPS) dropped by 14% each year.This fall in the EPS is worse than the 3% compound annual share price fall.The relatively muted share price reaction might be because the market expects the business to turn around.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year.Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on International Business Machines' earnings, revenue, and cash flow .

Dividend helps a little bit

As well as measuring the share price return, investors should also consider the total shareholder return (TSR).

The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested.It's fair to say that the TSR gives a complete picture for stocks that pay a dividend.

We note that for International Business Machines, the TSR over the last 5 years was 9.7%, which is better than the share price return mentioned above.This is largely a result of its dividend payments.

Uninspiring Gains but Getting Better

International Business Machines shareholders gained a total return of 15% during the year,but that was short of the market average.

On the bright side, that's still a gain, and it's actually better than the average return of 1.9% over half a decade.It is possible that the worst is in the rear-view mirror, and returns will improve along with the business fundamentals.

Hopefully, the upcoming company spin might provide a chance to consolidate the businesses and finally deliver the returns to shareholders.

To truly gain insight, we need to consider other information, too. For example, we've discovered 4 warning signs for International Business Machines that you should be aware of before investing here.

International Business Machines is not the only stock that insiders are buying. This free list of growing companies with recent insider purchasing could be just the ticket for those who like to find winning investments.

Please note, the market returns quoted in this article reflect the market-weighted average returns of stocks that currently trade on US exchanges.

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance