IBM Expands Partnership With Siemens to Launch New Solution

International Business Machines Corporation IBM and Siemens recently rolled out a Service Lifecycle Management (SLM) solution designed to aid customers improve the performance and reliability of their assets. The deal expands on the existing long-term partnership between the two companies.

The solution combines elements from IBM’s enterprise asset management solution –– Maximo –– with Siemens’ Xcelerator product life cycle management offering. The combined solution creates a single source of information that helps original equipment manufacturers (OEMs) and equipment owners improve the design and maintenance process of their equipment.

Moreover, by utilizing IoT, the solution provides OEMs with critical data about asset performance, asset degradation, operating conditions and parts failures. This data can be used by manufacturers to reduce maintenance costs, mitigate risks and boost asset resiliency.

The robust features of the new solution are expected to drive its adoption among key industry players which bodes for IBM’s top line. It is also likely to instill investor confidence in the company’s stock.

Notably, shares of IBM have declined 7.4% in the year-to-date period, against the industry’s decline of 11%.

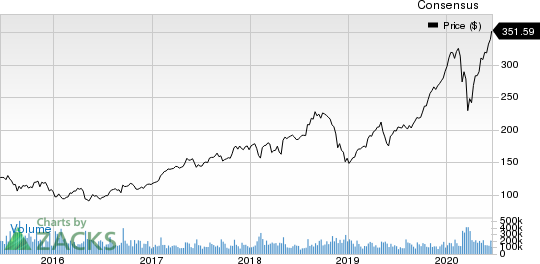

International Business Machines Corporation Price and Consensus

International Business Machines Corporation price-consensus-chart | International Business Machines Corporation Quote

Strengthening Asset Management Capabilities

The latest offering is in line with IBM’s focus on expanding its overall asset management capabilities.

Recently, the company introduced the Maximo Application Suite, also known as Maximo 8.0, which provides asset management services in a single integrated suite. The solution leverages artificial intelligence (AI) to aid businesses increase asset uptime and improve business productivity.

Moreover, IBM acquired Maintenance, Repair and Operations (MRO) solutions provider –– Oniqua –– to enhance its asset optimization capabilities. The buyout has allowed IBM to deliver services that reduce MRO inventories, predict equipment failure and suggest remedies to avoid unplanned downtime.

These endeavors have significantly boosted IBM’s offerings and are expected to bolster their adoption rate in the days ahead. Further, per Markets and Markets data, the EAM market is expected to reach $8.2 billion by 2024, witnessing a CAGR of 10%. Based on the company’s advanced capabilities, IBM is well poised to gain from this robust growth prospect going forward.

Notably, IBM has been positioned in the “Leaders” quadrant by IDC in its latest assessment report on SaaS and Cloud-Enabled Asset-Intensive EAM Applications vendors.

Competitive Scenario

IBM is currently facing stiff competition in the EAM space from players like SAP SAP, Oracle ORCL, and Aspen Technologies AZPN.

Notably, similar offerings from these companies, which include Mtell and ProMV from Aspen, Oracle Enterprise Asset Management solution and SAP Enterprise Asset Management suite, have intensified competition in the space. This is likely to create pricing pressure to maintain market share, which could negatively impact IBM’s margins.

Nevertheless, IBM, which currently carries a Zacks Rank #3 (Hold), is expected to benefit from strength in automation, cognitive and optimization capabilities, which further enhances the company’s EAM offerings. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This young company’s gigantic growth was hidden by low-volume trading, then cut short by the coronavirus. But its digital products stand out in a region where the internet economy has tripled since 2015 and looks to triple again by 2025.

Its stock price is already starting to resume its upward arc. The sky’s the limit! And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

SAP SE (SAP) : Free Stock Analysis Report

Aspen Technology, Inc. (AZPN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance