HSBC's Restructuring Efforts & High Rates Aid Amid Cost Woes

HSBC Holdings PLC HSBC remains well-positioned for growth on the back of restructuring initiatives, higher interest rates and an extensive network. However, rising costs and a tough operating backdrop are headwinds.

HSBC has been consistently undertaking several measures to enhance its performance with a focus on building operations in Asia. The company aims to become a top bank for high-net-worth and ultra-high-net-worth clients in the region. Aligning with this, in June 2024, the company acquired Citigroup’s retail wealth management business in China. Further, it re-launched its private banking business in India to cater to the needs of the rising super-rich class.

Additionally, in 2022, HSBC acquired 100% of the issued share capital of AXA Insurance in Singapore and L&T Investment Management Limited. Moreover, HSBC increased its ownership stake in its China securities JV – HSBC Qianhai Securities Limited, while in 2021, the company got a regulatory nod to acquire the remaining 50% stake in its China life insurance JV – HSBC Life Insurance Company Limited. These initiatives are likely to further strengthen the company’s position in Asia, which constitutes more than half of its operations.

HSBC has been engaged in restructuring efforts to enhance its operational efficiency. The company announced its transformation plan to reshape underperforming businesses, simplify complex organizational structures and mitigate costs. Consequently, the company realized $5.6 billion of gross savings, with a cost of $6.5 billion to implement the plan by 2022-end. It anticipates to witness further cost savings this year, primarily driven by the initiatives taken in 2023. In April 2024, the company entered into an agreement to divest its Argentina business, while in February, HSBC agreed to sell its Armenian unit. The company exited retail banking businesses in the United States, Canada, France, New Zealand, Greece and Russia.

Further, HSBC’s brand and capital strength, alongside its extensive global network and positioning, enable it to consistently attract and retain clients. The company’s product and service leadership across offerings in alternative investments, foreign exchange, credit, investment advice and many other cross-border banking services helps the company in expanding its customer base.

In sync with this, the company acquired the failed Silicon Valley Bank’s – SVB UK division – in March 2023. The deal strengthened its commercial banking segment and boosted its ability to serve innovative and rapidly growing firms in the technology and life science sectors. In June 2023, HSBC Innovation Banking was launched, which included SVB UK together with newly formed teams in the United States, Hong Kong and Israel. This newly established unit aims to deliver globally integrated, specialized banking services to aid innovation businesses and their investors.

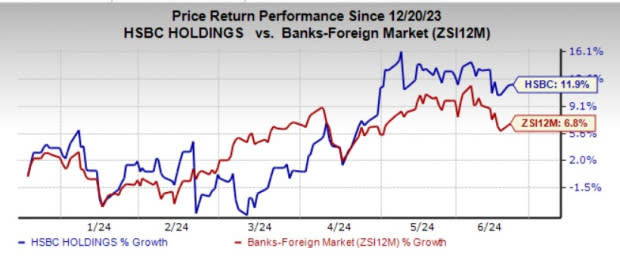

HSBC currently carries a Zacks Rank #3 (Hold). Over the past six months, shares of the company have gained 11.9%, outperforming the industry’s growth of 6.8%.

Image Source: Zacks Investment Research

HSBC has remained focused on profitable markets and boosting operational efficiency through divestitures and closure of non-core operations over the past several years, which kept its expenses under control. However, operating expenses rose in the first quarter of 2024. Overall costs are likely to remain elevated in the near term amid the company’s efforts to expand market share in the United Kingdom and Asia alongside initiatives to strengthen digital capabilities globally. The company expects operating expenses to rise 5% in 2024.

Moreover, subdued revenue generation over the past quarters remains another headwind. Though the interest rate scenario improved across the world, the financial impact of Brexit continues to exert pressure on the company’s top-line expansion. Though the company’s revenues increased year over year in 2023 and in the first quarter of 2024, subdued loan demand and the challenging macroeconomic environment in several markets could pose challenges in the near term, thus affecting revenues.

Foreign Banking Stocks Worth Considering

Some better-ranked foreign banking stocks worth a look are Bank Hapoalim B.M. BKHYY and Crédit Agricole S.A. CRARY, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks Rank #1 stocks here.

The Zacks Consensus Estimate for BKHYY’s current-year earnings has been revised 22% upward in the past 30 days. Bank Hapoalim’s shares have gained 3.1% over the past six months.

The Zacks Consensus Estimate for CRARY’s current-year earnings has been revised 8.9% north in the past month. Credit Agricole’s shares have gained 18% over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

Credit Agricole SA (CRARY) : Free Stock Analysis Report

Bank Hapoalim (BKHYY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance