How toilet paper and hand sanitizer may surprisingly save these 3 retailers

In the post COVID-19 world where new consumer shopping habits such as curbside pickup for daily needs will be ingrained and people only want to make one trip to a store to reduce the potential of getting sick, those non-essential retailers with the best-positioned stores will be the winners.

That is if they are nearby jam-packed grocery stores like Kroger (KR) or Target (TGT).

“Given the continued strength we see in essential retailers like grocery stores and broadline retailers, we think those retailers with real estate that is most closely located near them will likely benefit from a faster recovery of sales at their store locations,” said Goldman Sachs retail analyst Kate McShane in a new note to clients.

The investment thesis here is straightforward. A consumer visits a grocery store for milk, eggs, toilet paper and hand sanitizer, they get the stuff put into the car, and then they are tempted to stop at a TJ Maxx for a cheap new shirt because you have to pass it to get home or it is in the same shopping center. No going out of the way required.

McShane highlights three winners from her real estate deep dive: Ulta (ULTA), TJX Companies (TJX) and Ross Stores (ROST).

All three retailers have some of the best exposure to Kroger locations, as seen below.

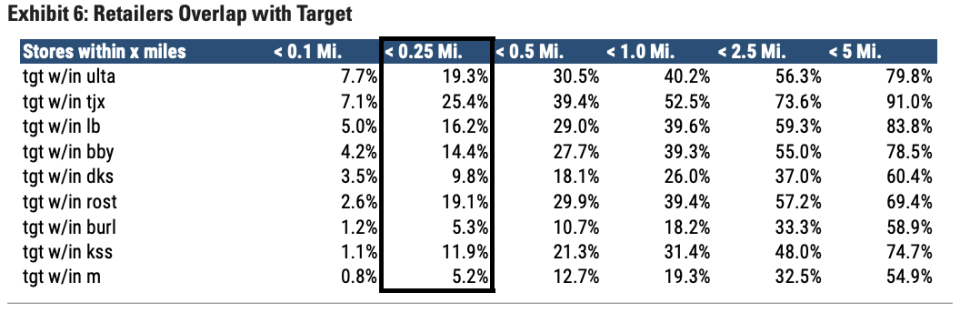

But the real prize for the likes of Ulta, TJX Companies and Ross Stores is their exposure to Target’s big box stores (as detailed below), which are heavily trafficked on the weekends. The discounter has also led traditional supermarkets in offering curbside pickup and other online ordering capabilities during the pandemic — raising the potential for a prolonged period of strong traffic for itself, and spillover for Ulta, Ross Stores and TJX Companies.

Attractive store positioning in life after COVID-19 is not being lost on some in retail.

“With the vast majority of our stores located in strip centers and many in close proximity to grocery stores, our store locations are a convenient shopping visit for people making fewer trips from home,” pointed out TJX Companies CEO Eddie Herrman on the company’s latest earnings call.

Brian Sozzi is an editor-at-large and co-anchor of The First Trade at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.

Read the latest financial and business news from Yahoo Finance

Levi's reports solid quarterly earnings, CEO says jeans maker will come out of coronavirus stronger

Yum! Brands CEO on how his 50,000 restaurants are doing amidst the coronavirus pandemic

Grubhub founder: our sign-ups are surging during the coronavirus

HP CEO: here’s how we are helping coronavirus relief efforts

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance