How to invest with all this recession fear

One of the great imponderable questions is: when will this stock market do what all markets do - crash?

In recent times, Donald Trump’s poking of China with a trade war (driven by tariffs) has spooked the bond market, so a warning sign that a recession might be coming is flashing red.

Also read: 5 places to put your money when share markets tank

Also read: Investing in shares for your kids is a no-brainer: Here’s how to do it

Also read: Stocks plummet, AUD falls: Is Australia headed for recession?

A recession is a trigger for a stock market crash.

However, at the moment, the stock market’s key influencers are still positive about a trade deal.

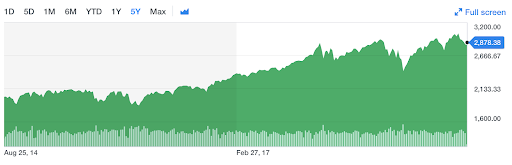

That’s why the US stock market has continued to climb over the past couple of years, despite trade war fears. This chart of the S&P 500 Index, which tracks the share prices of the USA’s top 500 listed companies, proves that point.

But lately the chart shows that the gains are giving way to ups and downs, as doubts creep in about a trade deal.

The recent trade spat that saw China impose tariffs on $US75 billion worth of US goods, including autos, led the US President to go into a tweeting tirade, where he ‘ordered’ US companies to stop producing in China and come on home.

This was over-the-top stuff even for Trump, but it has spooked Citi’s US economics team: they now think there’s a 60 per cent chance of a ‘no trade deal’ before the November 2020 election.

If that’s the case, how should you invest?

I’m telling my financial planning clients that I’m betting there will be a trade deal and the stock market will go up.

This could excite stocks over the Christmas/holiday period and stocks do tend to rise over November to March. This chart from CNBC shows that this period is historically good for stocks.

Also, the third year of a US President’s term is the best for stocks, while the fourth year is second best.

If my trade deal and market surge theory work out, I’ll be encouraging my financial planning clients to buy stocks/funds that are great for paying dividends, so they’ll be an income paying, defensive play, in case stocks sell off between May 2020 and the election in November.

If Trump can get a deal and see another leg up for stocks as well as avoiding a recession, then there’s a good chance he will be re-elected, which would be good for stocks.

The alternative scenario might be “no trade deal”, which I think would hurt stocks and could lead to a big sell off, which could be the straw that breaks the backs of the world and US economies.

If you think this is the case, you should be going to cash, buying gold or at least have a heavy holding of reliable income-paying stocks or funds.

As someone who has a listed income fund on the stock market called the Switzer Dividend Growth Fund (with the ticker code of SWTZ that produced a yield of 7.9 per cent before franking and 11.2 per cent gross), I think it’s a product whose time has come. And that’s especially so with term deposits around only 2 per cent.

Economists have predicted that interest rates could be low for 10 or even 20 years, which I think will prove to be too negative. But one thing’s for sure, these low interest rates will push wealth builders more towards stocks.

And the ones that pay high levels of income will be chased by non-thrill seeking investors, when markets get into volatile and Trump-threatening waters.

By Peter Switzer.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance