How much Aussies your age are saving each month

The coronavirus pandemic has severely hamstrung Australians’ ability to put cash away, with one-third struggling to save $100 a month.

Related story: How much do you need to live comfortably in each Aussie capital?

Related story: How much in savings do I need to buy a house in each capital city?

Related story: How much do Aussies your age have in savings?

New research from Money.com.au has revealed that prior to the pandemic, two-thirds of Australians weren’t saving at all. And as the Covid-19 crisis continues, only 28 per cent said they would be regularly saving in 2020. Money.com.au considers putting funds into an offset account as saving.

This percentage is higher for younger Australians, although across all age groups many Australians said they were focusing on paying off debt over saving.

But it’s not just financial constraints stopping Australians from saving: low interest rates are also discouraging more than a quarter of respondents.

Are low interest rates discouraging you from saving?

This is particularly true for younger savers. Across all age groups, 49 per cent said they would need more than $10,000 in savings for interest rates to matter. As it stands, the average savings rate across the big four banks is 0.9 per cent.

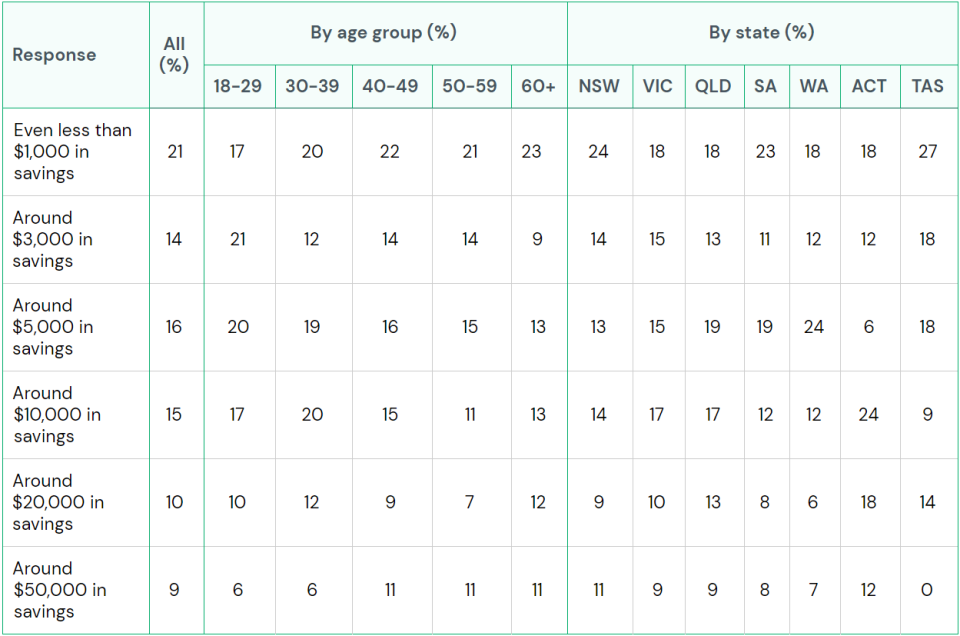

What level of savings would you need to get to for savings account interest rates to matter to you?

“The data reveals a worrying insight into our savings behaviours, even more so now that we’re facing worsening economic conditions and thousands of Aussies are on reduced income,” said financial adviser and Money.com.au spokesperson Helen Baker.

“Between the rising costs of living, stagnant wage growth, and reduction in government benefits in the near future, it leaves little wiggle room if people’s circumstances were to get worse. However, now is the time that Aussies should be proactively saving, while there are less opportunities for discretionary spending.”

She said Australians shouldn’t be put off by low interest rates, given how long it will likely be before rates improve.

“Instead, Aussies should continue to slowly build up their emergency fund if they can, by saving regularly and looking at the long-term picture.”

How much are we saving?

One third (32 per cent) of Australians believe they can only save less than $100 a month. This percentage increases by age, with Australians aged 60 and older the most likely to fall into this category.

On the other end of the spectrum, only 10 per cent believe they can save more than $1,000 a month. Again, younger Australians aged 18-29 have the most faith in their ability to save more cash (14 per cent) than older generations (7 per cent).

How much money do Aussies believe they can save each month?

Most Australians (34 per cent) describe themselves as having been proactively saving in 2019, with 28 per cent also saying they will save in 2020.

Another 20 per cent are focusing their energy on debt and 19 per cent don’t fit into any of those categories.

Younger Australians aged 18 - 29 were among those most likely to be saving in 2019 with 42 per cent putting cash away, and they were also the most likely to be saving in 2020.

Australians 60 and over were the least likely to be saving in 2019 and 2020.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance