House prices in these two cities are set for double-digit growth

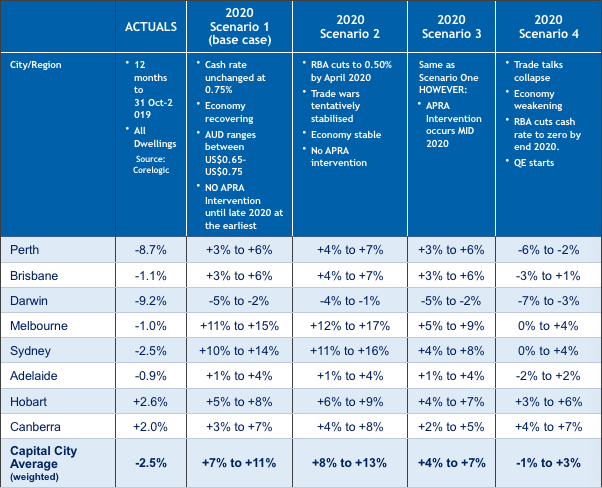

Sydney and Melbourne are set for double-digit property price growth, with prices rising anywhere between 10 to 14 per cent in Sydney, and 11 to 15 per cent in Melbourne.

Property prices have been on the decline for the better part of 2019, but recent interest rate cuts and looser credit conditions will see house prices in all Australian capitals rise next year.

Also read: Here’s where Australian property prices are going in 2020

Also read: Housing market sprints ahead as buyers urged to get in now

Also read: What if interest rate cuts fuel house prices but nothing else?

The base forecast is that all house prices will rise between 7 and 11 per cent, SQM’s 2020 Housing Boom and Bust Report reveals, which is a strong bounce-back from the price falls over the past few years.

But while every capital is set to benefit, Sydney and Melbourne will lead the pack.

“The Sydney and Melbourne housing markets have recorded a sharp turnaround in the second half of 2019 following on from the surprise result of the Federal Election, interest rate cuts, the loosening of credit restrictions and ongoing strong population growth rates,” said SQM’s managing director Louis Christopher.

“These factors are expected to drive the national housing market into 2020. In a close call, [banking regulator] APRA is expected to not immediately intervene despite the strong price rises.”

But Christopher said the sustainability of the price recovery is still in question.

“Sydney and Melbourne are rising from an overvalued point,” said Christopher.

“Long term, our two largest housing markets look vulnerable and forever reliant on cheap credit. Housing debt, while falling compared to GDP over 2019, is still very high. Better value can definitely found elsewhere such as Perth and Brisbane.”

The only city expected to record price declines is Darwin, where prices are set for anywhere between -2 and -5 per cent falls.

The base forecast assumes no changes in interest rates, and no intervention by APRA.

It also assumes the Australian economy will respond to the 2019 rate cuts and recover.

SQM’s research is in line with Moody's and CoreLogic data, which stated the trough in the national housing market had well and truly passed, and improved activity in Sydney and Melbourne markets showed the market was set to perk up.

“Improved auction clearance rates in these cities, alongside the return of monthly dwelling value growth, according to CoreLogic data, support the outlook for ongoing improvement,” Moody’s said.

Buyers urged to get in quickly

With property prices set to grow across the nation, it’s only going to get more difficult for first home-buyers to enter the market.

Property expert Michael Yardney said buyers in Melbourne and Sydney were already taking advantage of rates and rushing to purchase before property values exceeding their capacity to save a deposit.

But, CoreLogic head of research Tim Lawless said there’s still some time.

“Although housing values are now consistently tracking higher, at least at a macro-level, the national index remains 6.8 per cent below the October 2017 peak, indicating that buyers still have some time to take advantage of improved housing affordability before values return to record highs,” he said.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance