House prices are still dropping, but the bottom is in sight

It is difficult to think of a bigger issue that gets Australians fired up than house prices.

Regular readers will know that back in September 2018, I made a bet on house prices with Tony Locantro, a fired-up Investment Manager with Alto Capital in Perth.

Tony wont mind me saying this, but he is what is called an ‘uber bear’ on house prices – he reckons prices are grossly inflated and are overdue to collapse. On the other hand, I reckon there is a cycle and that after the surge up to 2017, house price falls were inevitable, but that the decline would last only a couple of years and would not be too severe.

Related article: Should I choose a variable or fixed interest rate home loan?

Related article: Bad news for parents: Sydney property too expensive, granny flat trend booms

Related article: The statistic that could make you think twice about buying in a high-rise

The bet was framed around a peak-to-trough fall in prices of 35.0 per cent in either Sydney, Melbourne or the 8 capital cities measure used by the Australian Bureau of Statistics.

If prices fell by more than 35 per cent at any stage from the peak until the end of 2021, Tony would win, if the fall was less than 35 per cent, I would win.

Simple.

That background is important because the ABS just released the official dwelling price data for the March quarter 2019.

In the quarter, dwelling prices fell 3.0 per cent in the 8 capital cities and dropped 3.9 per cent in Sydney and 3.8 per cent in Melbourne.

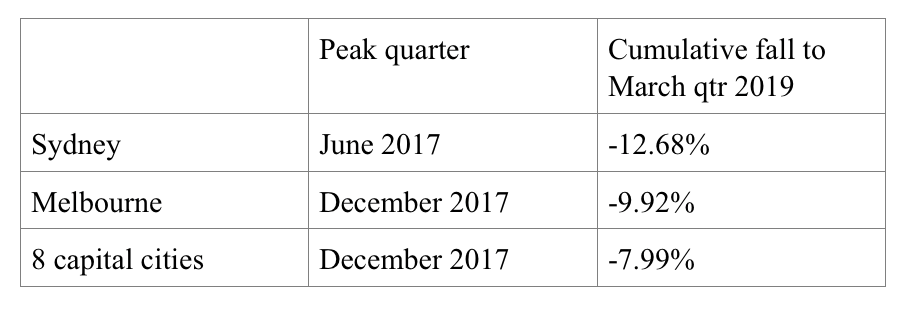

The table shows that so far in the house price slump, of the three markets in question, the largest fall has been recorded in Sydney – which is down 12.7 per cent, with Melbourne down 9.9 per cent. The 8 capital cities fall is a more moderate 8.0 per cent.

Quite clearly, this is well short of the 35 per cent threshold which framed the bet although there are still 2 and three-quarter years to go until the bet is closed.

That said, the more up-to-date house price data from Corelogic points to small price falls for the June quarter, including a potential bottoming in prices in the month of June.

It should be noted that the recent interest rate reductions from the banks, the relaxation of credit restrictions and the probable lift in housing demand from investors who may have been more cautious prior to the Federal election are all factors that are likely to have a positive effect on prices over the more medium term.

While there appears to be a good case to suggest house prices are near a bottom for the cycle, there are still risks around the macro economy and therefore prices.

If the global economy stalls in the wake of trade wars or there some other shock, the Australian economy and the housing market would be adversely impacted.

Concerns also come from the weakening in an already weak labour market. If the unemployment rate keeps rising and gets close to 6 per cent, loan arrears and pockets of ‘forced selling’ could emerge to drive dwelling prices sharply lower.

But for now, I am very happy with the way my bet with Tony is panning out. Happy not only for my own sake, but happy for the economy too, because if Tony is to win the bet and prices drop more than 35 per cent, it will mean a nasty recession, sky-high unemployment and pain for many businesses and in the community more generally.

Stephen Koukoulas is no nonsense economist who calls it without fear or favour. He is currently Managing Director of Market Economics as well as being a Research Fellow, Per Capita. Stephen is also a keynote speaker at Ode Management.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance