Hotels, Resorts and Cruise Lines Stocks Q1 In Review: Hilton (NYSE:HLT) Vs Peers

Wrapping up Q1 earnings, we look at the numbers and key takeaways for the hotels, resorts and cruise lines stocks, including Hilton (NYSE:HLT) and its peers.

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

The 15 hotels, resorts and cruise lines stocks we track reported an ok Q1; on average, revenues beat analyst consensus estimates by 1.4%. while next quarter's revenue guidance was 0.8% below consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and while some of the hotels, resorts and cruise lines stocks have fared somewhat better than others, they collectively declined, with share prices falling 4.3% on average since the previous earnings results.

Hilton (NYSE:HLT)

Founded in 1919, Hilton Worldwide (NYSE:HLT) is a global hospitality company with a portfolio of hotel brands.

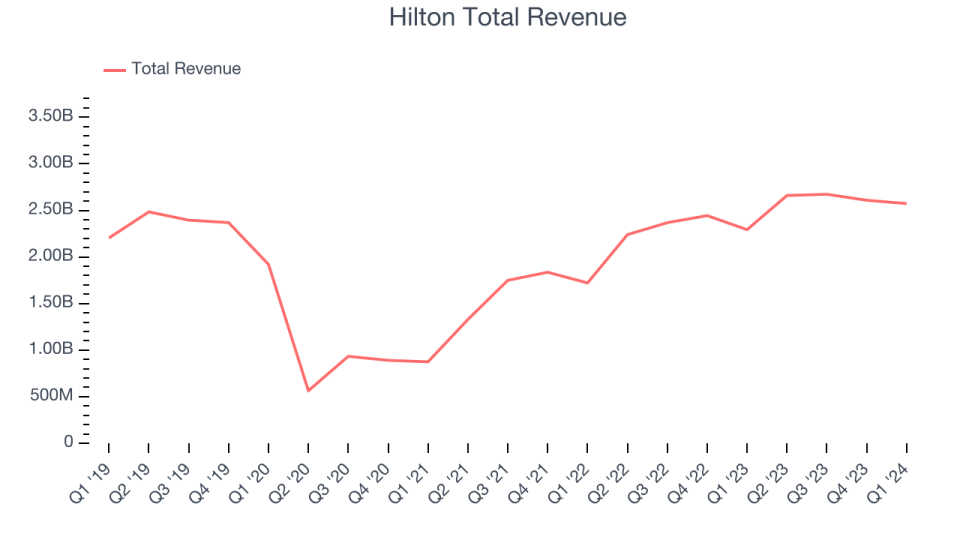

Hilton reported revenues of $2.57 billion, up 12.2% year on year, topping analysts' expectations by 1.7%. It was a solid quarter for the company: Hilton beat analysts' revenue and EPS expectations. Additionally, adjusted EBITDA guidance for the full year 2024 was raised and came in above expectations.

Christopher J. Nassetta, President & Chief Executive Officer of Hilton, said, "We are pleased to report a strong first quarter with bottom line results meaningfully exceeding our expectations, further demonstrating the power of our resilient, fee-based business model and strong development story. During the first quarter, system-wide RevPAR increased 2.0 percent as renovations, inclement weather and unfavorable holiday shifts weighed on performance more than anticipated. On the development side, we continued to see great momentum across signings, starts and openings. As a result of our record pipeline and the growth pace we've seen to-date, we expect net unit growth of 6.0 percent to 6.5 percent for the full year, excluding the planned acquisition of the Graduate Hotels brand."

The stock is up 9% since the results and currently trades at $214.95.

Is now the time to buy Hilton? Access our full analysis of the earnings results here, it's free.

Best Q1: Playa Hotels & Resorts (NASDAQ:PLYA)

Sporting a roster of beachfront properties, Playa Hotels & Resorts (NASDAQ:PLYA) is an owner, operator, and developer of all-inclusive resorts in prime vacation destinations.

Playa Hotels & Resorts reported revenues of $300.6 million, up 9.8% year on year, outperforming analysts' expectations by 6.3%. It was a stunning quarter for the company, with an impressive beat of analysts' earnings estimates.

Playa Hotels & Resorts achieved the biggest analyst estimates beat among its peers. The stock is down 11.7% since the results and currently trades at $8.34.

Is now the time to buy Playa Hotels & Resorts? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Choice Hotels (NYSE:CHH)

With almost 100% of its properties under franchise agreements, Choice Hotels (NYSE:CHH) is a hotel franchisor known for its diverse brand portfolio including Comfort Inn, Quality Inn, and Clarion.

Choice Hotels reported revenues of $331.9 million, down 0.3% year on year, falling short of analysts' expectations by 3.2%. It was a weak quarter for the company, with a miss of analysts' operating margin estimates and underwhelming earnings guidance for the full year.

Choice Hotels had the weakest performance against analyst estimates in the group. The stock is down 5.6% since the results and currently trades at $115.34.

Read our full analysis of Choice Hotels's results here.

Sabre (NASDAQ:SABR)

Originally a division of American Airlines, Sabre (NASDAQ:SABR) is a technology provider for the global travel and tourism industry.

Sabre reported revenues of $782.9 million, up 5.4% year on year, surpassing analysts' expectations by 3.9%. It was a mixed quarter for the company, with a miss of analysts' earnings estimates.

The stock is down 9% since the results and currently trades at $2.64.

Read our full, actionable report on Sabre here, it's free.

Marriott (NASDAQ:MAR)

Founded by J. Willard Marriott in 1927, Marriott International (NASDAQ:MAR) is a global hospitality company with a portfolio of over 7,000 properties and 30 brands, spanning 130+ countries and territories.

Marriott reported revenues of $5.98 billion, up 6.4% year on year, in line with analysts' expectations. It was a slower quarter for the company, with a miss of analysts' operating margin and earnings estimates.

The stock is up 3.7% since the results and currently trades at $244.75.

Read our full, actionable report on Marriott here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance