Honeywell (HON) Q3 Earnings Surpass Estimates, Revenues Miss

Honeywell International Inc. HON reported mixed third-quarter 2019 results with earnings beating estimates but revenues lagging the same. Adjusted earnings were $2.08 per share, surpassing the Zacks Consensus Estimate of $2.01. The bottom line also jumped 9.5% year over year driven by organic sales growth.

Honeywell’s third-quarter revenues came in at $9,086 million, missing the consensus estimate of $9,155 million. Also, the top line declined 15.6% year over year. The fall was primarily attributable to the impact of spin-offs of some of the company’s businesses in 2018. However, revenues increased 3% organically on the back of solid demand for commercial fire products, strength in its aerospace business, and broad-based growth in process solutions business.

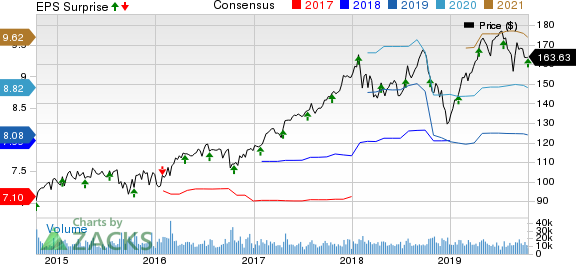

Honeywell International Inc. Price, Consensus and EPS Surprise

Honeywell International Inc. price-consensus-eps-surprise-chart | Honeywell International Inc. Quote

Segmental Breakup

Revenues for Aerospace were $3,544 million, down 12% year over year. Honeywell Building Technologies revenues declined 44% to $1,415 million. Performance Materials and Technologies generated $2,670 million, up 1%, while Safety and Productivity Solutions revenues declined 7% to $1,457 million.

Costs/Margins

The company’s total cost of sales in the reported quarter was $6,038 million, down 20.1% year over year. Selling, general and administrative expenses declined 15% to $1,296 million. Interest expenses and other financial charges were $96 million compared with $99 million a year ago.

Operating income margin for the third quarter was 19.3%, up 370 basis points.

Balance Sheet/Cash Flow

Exiting the third quarter, Honeywell had cash and cash equivalents of $10,908 million compared with $9,287 million as of Dec 31, 2018. Long-term debt was $11,101 million, higher than $9,756 million recorded at the end of 2018.

During the third quarter, the company generated $1,471 million cash from operating activities, lower than $1,878 million a year ago. Capital expenditure was $192 million compared with $183 million incurred a year ago.

Adjusted free cash flow was $1,286 million, down 28.9%.

Outlook

Honeywell expects robust demand environment in commercial aerospace business to drive its revenues in the quarters ahead. It also expects greater operational excellence and stock buybacks to boost profitability.

Honeywell revised full-year guidance for 2019. The company anticipates earnings to be in the range of $8.10 to $8.15 per share compared with $7.95-$8.15 guided earlier. However, it has lowered revenue guidance for 2019 between $36.7 billion and $36.9 billion from $36.7-$37.2 billion predicted earlier.

Zacks Rank & Stocks to Consider

Honeywell currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the same space are Federal Signal Corporation FSS, HC2 Holdings, Inc. HCHC and KushCo Holdings Inc. KSHB. All these companies carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Federal Signal pulled off average positive earnings surprise of 16.48% in the trailing four quarters.

HC2 Holdings delivered average earnings surprise of 48.55% in the trailing four quarters.

KushCo’s earnings surprise in the last reported quarter was 14.29%.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.50% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Federal Signal Corporation (FSS) : Free Stock Analysis Report

Honeywell International Inc. (HON) : Free Stock Analysis Report

HC2 Holdings, Inc. (HCHC) : Free Stock Analysis Report

KUSHCO HOLDINGS, INC. (KSHB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance