Should You Be Holding Kogi Iron Limited (ASX:KFE) Right Now?

For Kogi Iron Limited’s (ASX:KFE) shareholders, and also potential investors in the stock, understanding how the stock’s risk and return characteristics can impact your portfolio is important. KFE is exposed to market-wide risk, which arises from investing in the stock market. This risk reflects changes in economic and political factors that affects all stocks, and is measured by its beta. Not every stock is exposed to the same level of market risk, and the broad market index represents a beta value of one. A stock with a beta greater than one is considered more sensitive to market-wide shocks compared to a stock that trades below the value of one.

See our latest analysis for Kogi Iron

What is KFE’s market risk?

With a five-year beta of 0.35, Kogi Iron appears to be a less volatile company compared to the rest of the market. This means the stock is more defensive against the ups and downs of a stock market, moving by less than the entire market index in times of change. Based on this beta value, KFE appears to be a stock that an investor with a high-beta portfolio would look for to reduce risk exposure to the market.

Could KFE’s size and industry cause it to be more volatile?

A market capitalisation of AU$105.66M puts KFE in the category of small-cap stocks, which tends to possess higher beta than larger companies. Moreover, KFE’s industry, metals and mining, is considered to be cyclical, which means it is more volatile than the market over the economic cycle. Therefore, investors may expect high beta associated with small companies, as well as those operating in the metals and mining industry, relative to those more well-established firms in a more defensive industry. It seems as though there is an inconsistency in risks portrayed by KFE’s size and industry relative to its actual beta value. There may be a more fundamental driver which can explain this inconsistency, which we will examine below.

How KFE’s assets could affect its beta

During times of economic downturn, low demand may cause companies to readjust production of their goods and services. It is more difficult for companies to lower their cost, if the majority of these costs are generated by fixed assets. Therefore, this is a type of risk which is associated with higher beta. I examine KFE’s ratio of fixed assets to total assets to see whether the company is highly exposed to the risk of this type of constraint. Considering fixed assets account for less than a third of the company’s overall assets, KFE seems to have a smaller dependency on fixed costs to generate revenue. Thus, we can expect KFE to be more stable in the face of market movements, relative to its peers of similar size but with a higher portion of fixed assets on their books. This is consistent with is current beta value which also indicates low volatility.

What this means for you:

You may reap the benefit of muted movements during times of economic decline by holding onto KFE. Its low fixed cost also means that, in terms of operating leverage, its costs are relatively malleable to preserve margins. What I have not mentioned in my article here are important company-specific fundamentals such as Kogi Iron’s financial health and performance track record. I urge you to complete your research by taking a look at the following:

Financial Health: Is KFE’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

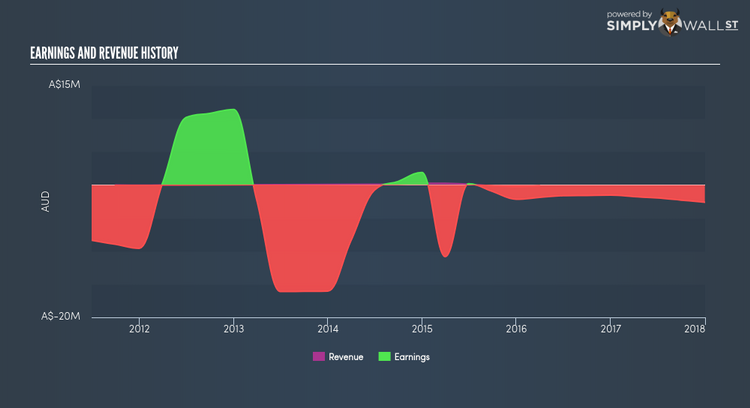

Past Track Record: Has KFE been consistently performing well irrespective of the ups and downs in the market? Go into more detail in the past performance analysis and take a look at the free visual representations of KFE’s historicals for more clarity.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance