Hilton (HLT) Expands Luxury Portfolio With Sydell Group Buyout

Hilton Worldwide Holdings Inc. HLT has announced its acquisition of a majority controlling interest in Sydell Group to bolster its luxury lifestyle hotel market presence. This move marks HLT's strategic entry into the flourishing luxury hospitality segment, leveraging Sydell Group's acclaimed NoMad brand. Sydell Group, led by Andrew Zobler, has crafted several successful lifestyle brands, including NoMad, known for its exceptional design and culinary experiences.

With Sydell Group overseeing design and branding while Hilton drives development, the partnership aims to expand the NoMad brand globally. Approximately 100 NoMad properties are projected to be developed, with discussions for around 10 properties already at an advanced stage. This expansion aligns with Hilton's commitment to catering to evolving guest preferences and offering unique luxury experiences in sought-after locations.

The addition of NoMad to Hilton's portfolio complements its existing luxury brands such as Waldorf Astoria, Conrad and LXR Hotels. By integrating NoMad into its commercial platforms, including Hilton Honors, management aims to provide guests with seamless access to exclusive benefits and experiences. This acquisition further strengthens HLT's position as a leader in the luxury hospitality market, with plans to expand its luxury inventory to 600-700 properties in the coming years.

Financial terms of the acquisition were not disclosed, but the strategic move underscores Hilton's focus on accelerating growth and catering to diverse customer needs. With NoMad's expansion, Hilton reinforces its commitment to offering unparalleled luxury experiences, positioning itself for sustained success in the global hospitality industry.

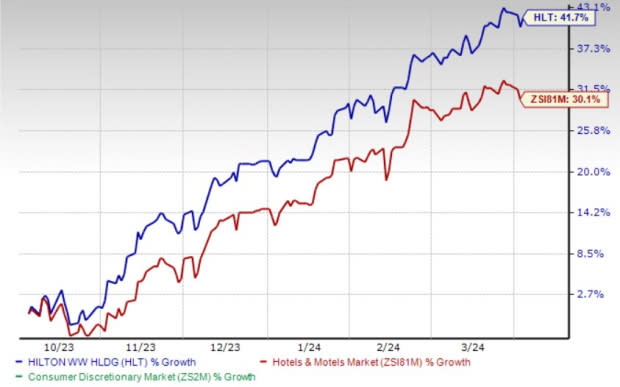

Shares of the Zacks Rank #3 (Hold) company have gained 41.7% in the past six months compared with the industry’s growth of 30.1%.

Image Source: Zacks Investment Research

Key Picks

Some better-ranked stocks in the Zacks Consumer Discretionary sector are as follows:

Trip.com Group Limited TCOM sports a Zacks Rank #1 (Strong Buy). TCOM has a trailing four-quarter earnings surprise of 53.1%, on average. Shares of TCOM have gained 34.4% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TCOM’s 2024 sales and earnings per share (EPS) indicates a rise of 18.2% and 1.8%, respectively, from the year-ago levels.

Royal Caribbean Cruises Ltd. RCL flaunts a Zacks Rank #1. RCL has a trailing four-quarter earnings surprise of 26.4%, on average. Shares of RCL have surged 123.4% in the past year.

The Zacks Consensus Estimate for RCL’s 2024 sales and EPS indicates a rise of 14.7% and 47.9%, respectively, from the year-ago levels.

Hyatt Hotels Corporation H carries a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 17.8%, on average. Shares of H have increased 46.3% in the past year.

The Zacks Consensus Estimate for H’s 2024 sales and EPS indicates a rise of 3.5% and 25%, respectively, from the year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

Trip.com Group Limited Sponsored ADR (TCOM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance